With inflation accelerating well beyond initial expectations and proving persistently elevated, central banks embarked on an aggressive tightening cycle through 2022, driving global rates upwards.

Markets are now caught between still hawkish central bank rhetoric and perceptions that economic data is starting to meaningfully soften. After experiencing the first bond bear market in a generation, many investors are desperately seeking justification for a dovish shift at global central banks that will act as a catalyst for a rally in bond markets.

In the US, markets are so convinced of the Fed’s inability to maintain tighter monetary policy that rate cuts are being priced in for 2023. This contrasts with the Fed’s own forecasts that rates will not fall until 2024 (see Figure 1).

In our view, markets are likely to be disappointed. Although inflation has likely peaked in the short term, and could moderate rapidly in the months ahead, it is unlikely to return to the Fed’s target for a considerable period.

A similar situation can be found across Europe, with European Central Bank President Lagarde warning that “recession alone won’t tame inflation” and the Bank of England highlighting that professional forecasters still expect UK inflation to be above target in three years’ time.

TINA no more: there is a realistic alternative

A consequence of the upwards adjustment in interest rates is that investors now have a realistic alternative to generate returns without having to resort to higher risk assets or sacrificing liquidity to add incremental yield. The acronym TINA (there is no alternative), justifying a shift to riskier assets, became embedded in investor psychology following the global financial crisis and the low-yield environment that followed.

It may take time for markets to readjust to a world where lower-risk assets provide meaningful returns, but as they do, flows should follow. A gradual reallocation from higher risk to lower risk assets in the years ahead should help to counterbalance central bank sales and anchor longer-term yields.

Global Inflation peaking but likely to prove sticky

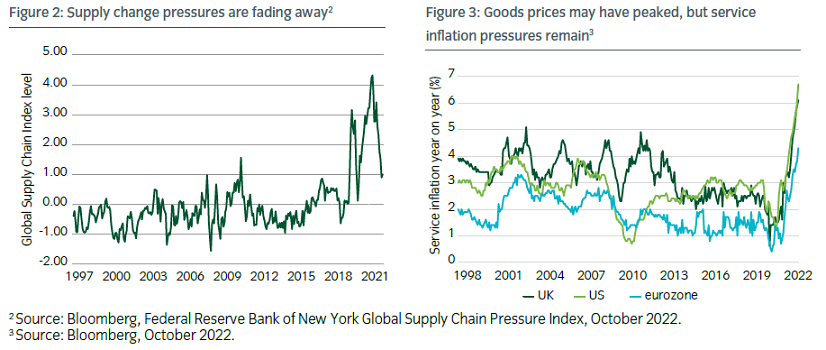

The elevated inflationary pressures that dominated 2022 should wane in 2023. Goods prices, which were key to the initial acceleration in prices, should lose momentum as supply chains normalise (see Figure 2). The global chip shortage, which caused huge problems for the auto industry and various high-tech industries, appears to have come to an end, with inventories rebuilding rapidly. Global shipping costs are also trending downwards, a relief for global supply chains reliant on cheap imports from Asia. Rising commodity prices could return as a future inflationary impulse, but further upside is likely to be tempered by growth concerns, and even a sideways trend in prices would have a significant impact on inflation due to base effects.

Although this should take some pressure off major central banks, the longer-term outlook remains concerning. Labour markets are tight, and wage pressures are unlikely to dissipate until workers have recovered real spending power. Economies now dominated by services are experiencing the highest levels of service inflation for decades (see Figure 3), and this may prove more difficult to tame. Globalisation, a structural force that has acted to keep inflation low for decades, is also unlikely to play such a significant role in the years ahead. The pandemic highlighted the vulnerabilities of global supply chains, and corporates are searching for ways to return production closer to home.

These factors make the medium-term outlook more challenging and, although the highest year-on-year rates of inflation may be behind us, inflation is likely to remain stubbornly sticky above central bank targets for a considerable period to come.

Asset allocation for the new environment

In some parts of the world (eurozone and the UK), a recession is all but inevitable, but growth dynamics in most countries are likely to be challenged in the pursuit of getting inflation closer to central bank targets. Our own assessment of the cycle considers a broad range of factors. We often refer to purchasing managers indices (PMIs) as they provide a timely set of comparable data points across countries and regions. Our assessment of them, and other forward-looking indicators, suggest we entered a phase where economic activity has been contracting from the summer of 2022.

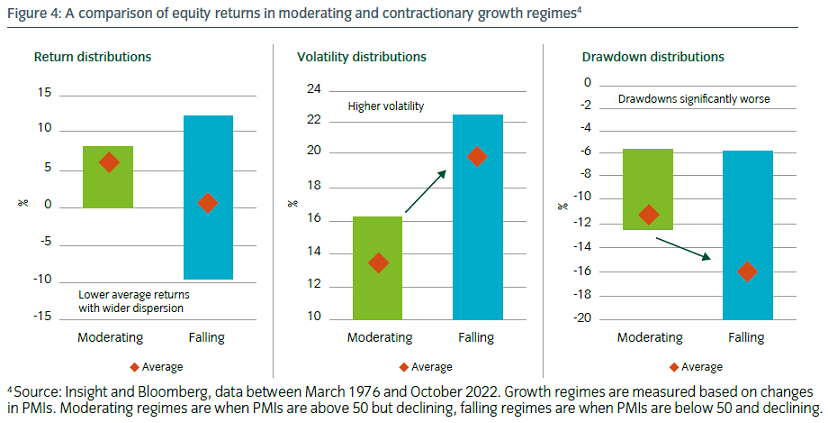

We have a rich set of data that allows us to look at historical asset class behaviour in various combinations of growth, inflation, and real interest rates. Using history as a guide, average asset class returns are not dissimilar whether we look at regimes where economic activity is moderating or contracting. However, volatility tends to be higher for risky assets in contractionary periods and draw-down risk is much more elevated (see Figure 4) and this was evident in Q3 2022.

Cautious for now, but with an eye on the turning point

A contractionary growth regime would indicate that a defensive bias is warranted as long as a combination of stubbornly high inflation and the increasing prospect of slower growth paints a challenging environment for most traditional assets. However, it is also notable that the outlook is now well known to most market participants and market sentiment is hovering at levels of extreme pessimism.

Such environments can see brutal upward corrections, and the ability to access a range of alternative investments such as option-based strategies can be helpful both from a risk mitigation and return generation perspective. At some point in 2023, conditions may become more constructive and when we consider the factors that normally correspond with bear market recoveries (see Figure 5) they remind us that we do not have to wait for growth (or corporate profits) to bottom before markets can look forward to recovery.

The return of attractive long-term income-based returns

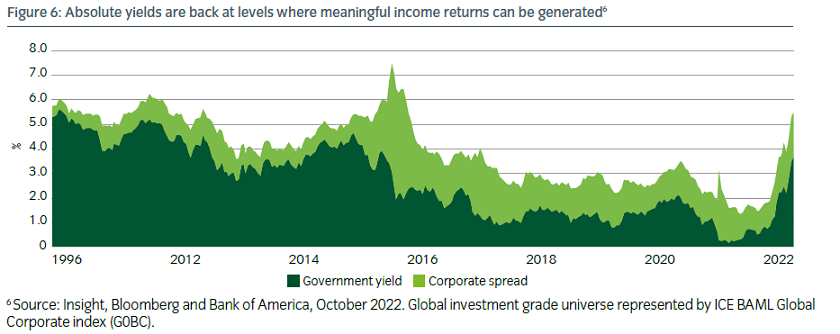

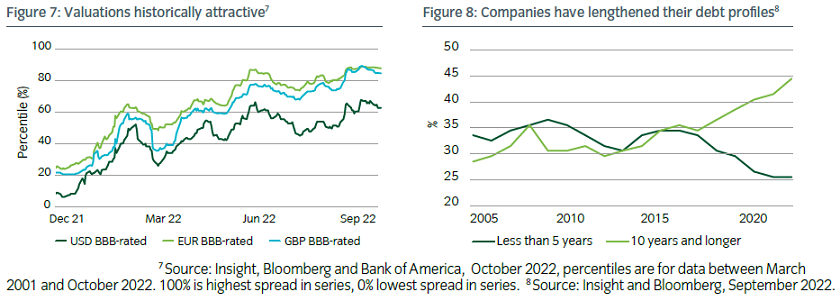

A combination of rising government bond yields and widening credit spreads created a perfect storm for credit investors over 2022, driving absolute yields back to levels like those seen before the global financial crisis (see Figure 6) and spreads to historically attractive levels (see Figure 7). Investment grade credit now potentially offers a way to achieve long-term return objectives via income alone, without the drawdown risk inherent in equity markets.

Despite the rise in yields, many corporate issuers are insulated from the interest rate shock. Through the period of low rates, corporates gradually extended their bond maturity profiles, taking advantage of buoyant market conditions to lock in low funding costs. As this debt gradually approaches maturity, funding costs will creep upwards, but for many issuers it will be years before this has a meaningful impact, with close to 45% of companies having an average debt maturity of 10-years or longer (see Figure 8).

For those best able to pass rising costs onto their customers, the combination of high inflation and long maturity fixed rate debt will potentially allow debts to be inflated away over time, effectively allowing some issuers to naturally deleverage. Until there is greater confidence that inflation is under control and that the growth outlook has stabilised, the risk of further volatility persists – making it hard to predict a rally in spreads. But, for those investors able to hold for the longer term, return objectives may now be achievable with income alone.

Bruce Murphy, Director, Australia and New Zealand, Insight Investment

Gareth Colesmith, Head of Global Rates and Macro Research, Insight Investment

Matthew Merritt, Head of Multi-Asset Strategy Group, Insight Investment

Adam Whiteley, Head of Global Credit, Insight Investment

Download the full report here.