Large technology stocks such as Apple, Amazon and locally, Afterpay, are capturing the headlines as key beneficiaries of the COVID-19 disruptions. While valuations for these stocks are now high, investors don’t need to pay big prices on tech stocks if they are prepared to dig a little deeper.

Three examples in our portfolio that trade on reasonable valuations are News Corp, City Chic and Redbubble.

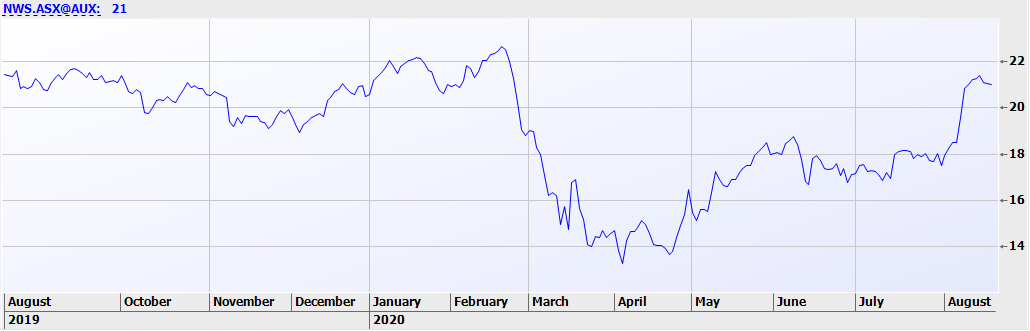

News Corp (ASX:NWS) owns a number of old-world, structurally-challenged assets such as newspapers and Pay TV. From a valuation sense these are ascribed a negative value based on the current share price. But also within NWS is a 62% holding in one of Australia’s best digital businesses, realestate.com.au, and Dow Jones which includes the Wall Street Journal.

For the first time recently, NWS disclosed Dow Jones earnings separately in its earnings result, illustrating a jewel in the crown. 71% of revenue is digital and earnings increased 13% in the fourth quarter despite COVID-19 disruptions. Its peer, The New York Times, trades on 25x EBITDA, implying Dow Jones could be worth up to US$6 billion (70% of NWS), yet there is little ascribed in the share price in our view. Another key upcoming catalyst to close this gap is a NWS Investor Day in September focused on Dow Jones where the quality of this business will be more apparent.

Source: Iress. Price as at 11 September 2020 was $20.47.

City Chic (ASX:CCX) is a plus-sized female apparel retailer. Revenues have been impacted by COVID-19 disruptions however many peers were impacted far more. CCX has used its strong balance sheet and access to capital markets to buy the online operations of a US competitor, with a further acquisition likely in October.

With little additional operating costs, we expect they will be far more profitable than consensus estimates. Online sales will account for 70% of total, making it a largely digital retailer. CCX will come out of this crisis with significantly higher earnings and a better-quality business.

Source: Iress. Price as at 11 September was $3.27.

Redbubble (ASX:RBL) is a global online marketplace with a variety of products featuring designs from over 500,000 independent artists. It is a clear beneficiary from COVID-19 driving work from home and increased online retailing. After some disappointments in previous years, FY21 looks like being a break-out year. Sales growth has accelerated to over 100% p.a., marketing spend is more efficient with lower AdWord pricing, and operating costs are being controlled with a focus on profitable growth.

This all leads to very strong operating leverage, which we believe is under-appreciated and will lead to meaningful consensus earnings upgrades in coming months. Redbubble still trades at multiples well below its peers and generates cash as it grows, highlighting the strong economics.

Source: Iress. Price as at 11 September was $3.92.

Each of these companies have digital assets that are under-appreciated in our view, providing the opportunity to invest in strong technology businesses at a reasonable valuation.

Richard Ivers is Portfolio Manager of the Prime Value Emerging Opportunities Fund, a concentrated fund investing in companies outside the S&P/ASX100. This article is general information and does not consider the circumstances of any investor. Prices are correct at time of writing but of course change regularly.