Australia’s major banks make up a large chunk of the ASX and are a key component of most investors’ portfolios. Following the Big Four reporting half-yearly or quarterly results, it is an opportune time to reflect on the sector and some of the key trends.

Main takeaways from the Big Four banks’ results

Bad debts were less of a factor than we expected on the back of a positive economic outlook thanks to the amount of money that’s been thrown at the economy by the central bank and the Federal Government. The large chunk of loans that went into deferral have now rolled off deferral and borrowers are back into the habit of paying down their debt. About 10% of mortgage holders were not paying anything, not paying down the debt or paying their mortgage for about four to six months.

From an asset quality perspective, the market was expecting a good outcome and it came through better than expected. On the operational part, the market seems to be shifting back to analysing the top line on revenues and credit growth, which is not growing as quickly as analysts thought. On a net basis we are still seeing anaemic credit growth from households and while business lending has shown some signs of improvement, we still need to see how that flows through over the next three to six months.

Those are the broad trends. Some banks are spending smartly because they know how to and some banks are hoping that they are on the right track to reach a sustainable level in the next three to five years.

Resilience of the banking sector

The COVID pandemic and associated business disruption was a massive stress test of the Australian banking system. Thankfully, the Australian banks were already in decent shape going into COVID-19. Regulators in both Australia and New Zealand were proactive from the start and have been conservative, relative to global peers, in the way they calculate capital.

Commentators may argue that the major banks benefitted versus the non-major banks because of low risk weights for mortgage books, but there was undoubtedly a considerable amount of capital in the system before COVID. It helped that this occurred after the Royal Commission where the issue of ‘unquestionably strong’ levels of capital was front and centre.

APRA had set the tone and the phenomenal Federal Government and RBA response was also extremely helpful to the banks, which reciprocated with deferral programs, so it’s been a team effort. Assuming we stay on top of COVID (and the latest Sydney outbreak is a threat), we may be better off than we expected 12 to 18 months ago.

By our estimates, each of the major banks is sitting on between $7 and $10 billion worth of capital that can be distributed back to shareholders. So far, the banks in general have behaved rationally and have managed margins and returns. We expect capital return and capital distribution to be the key narrative over the next six to nine months.

The impact of neobanks and insurtechs

Pre-COVID, one of the big themes for the banks was digital disruption in the form of tech-savvy competitors moving into the financial services sector or overseas neobanks appealing to tech-savvy consumers in Australia.

I’m more sceptical of the neobanks and insurtechs than some of the other participants in the market. They need to get scale quickly. They need to reduce the cost of acquisition of a customer and they need a steady-state capacity level, which can drive operating leverage.

It is great that disruptors are offering a seamless customer experience but it’s very generic and it is a commoditised offering on savings. Having said that, we’ve seen some interesting offerings like Bendigo and Adelaide Bank’s digital bank, UP, and the user experience from Athena. We’ve seen 86,400 Ltd (now part of NAB) which also had a strong offering but they could not reach scale. Xinja was another big hope that went out hard with their rate offering to entice new customers, but they were unable to sustain their push into the market.

The theory of neobanks is good and they keep the incumbents honest and there are some incumbents who just will not spend money on technology. Westpac is spending on the front end but needs its back end in order. ANZ was lagging in technology and their app experience but now they’re spending money. Bank of Queensland will hopefully have a contemporary banking app soon. I think it’s fair to say that the incumbents tend to get lazy.

I agree with CBA’s CEO Matt Comyn’s comments at the recent Senate hearings that a number of technology providers are deliberately trying to build capability without an ability to scale or with a viable business model, but they may accelerate innovation if it were scaled. A lot of disruptor business models are predicated on getting taken out by the big players.

My investment logic for holding Big Four bank shares

Analysing large companies can be a joy and a pain but it is rarely boring. Narratives are increasingly important for the markets and with large companies it is critical to get ahead of some of potential shifts in narratives. There was a point when the Big Four were really cheap in the midst of COVID. It doesn’t mean that they were riskless, but on a risk reward basis, with all the support offered by governments, the probability of banks struggling was low.

While the four majors have different strengths and operating divisions, all of them except Westpac are now a lot simpler than they used to be. Westpac still has specialist businesses that it needs to get rid of. CBA has sold its insurance businesses. ANZ doesn’t have a wealth or a life business anymore. NAB’s a pure bank now, it doesn’t have a UK bank and it doesn’t have MLC or a life business.

They’re much cleaner, core banking businesses but they are still large and complex. And it’s not just loans, they’re dealing with people and their lives and their assets and their businesses. More than ever, franchise value is tied to how the market and how consumers perceive these brands.

Current take on the Big Four

NAB and CBA exhibit strong core themes that I want to see in a bank to capitalise on an improving environment. They exhibit the best franchise momentum for revenues and for volumes. NAB has managed its costs quite well while CBA, historically, has not cared as much about costs because it always grew its top line faster than costs. But this also offers CBA the biggest opportunity if it gets serious about taking costs out.

Both banks are sitting on extremely healthy levels of capital, so if they see the opportunity to drive hard for growth, they don’t have to worry about a lack of capital. So franchise momentum is critical at this juncture.

ANZ has seen its mortgage loan momentum slow, but it's also a much simpler bank under Shayne Elliott than it was six or seven years ago. I believe that ANZ has shown the most consistent discipline on costs compared to its local peers. The key is top-line momentum and that is a watching brief to see if ANZ can stabilise and turn that around.

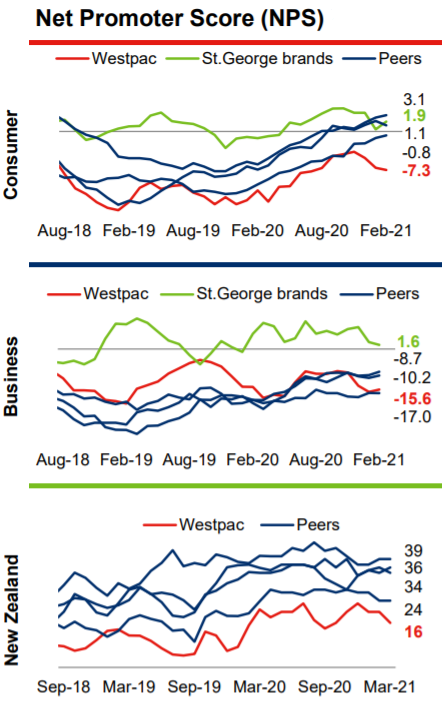

Westpac is the one that scares me, and I don’t use those words lightly. There’s a really important chart in Westpac’s most recent result presentation. It shows Net Promoter Score momentum for Westpac and the St George brands versus the major peers in the market. It is extremely poor and, for me, that’s a key issue at this point of time.

Source: Westpac 2021 Interim Financial Results Presentation

Westpac’s cost strategy means it needs to get leaner quickly, because its competitors are not standing still. It must take costs out at a core level by about 16% over the next three-and-a-half years, while at the same time stabilising the overall business. A multi-year 16% cost reduction doesn’t come without cutting people.

So, how does Westpac manage the internal dynamics? Few companies can expect to cut people or rationalise costs while maintaining a motivated workforce to drive top-line growth. Westpac has shown some encouraging signs that their mortgage book is stabilising, but there are issues with the business bank. It is a complex business with many moving parts.

I think about the banks as a cohort in terms of the portfolio. Do I want to own banks at this point in the cycle? Yes. The banks I want to own depend on their franchise momentum, at least for the near term.

Tariq Chotani is an Equities Analyst at Perpetual Investment Management, a sponsor of Firstlinks. This article contains general information only and is not intended to provide you with financial advice or consider your objectives, financial situation or needs.

For more articles and papers from Perpetual, please click here.