The financial advice landscape is influenced by the priorities of the government of the day, legislative changes, pressure from regulators, and the ever-increasing licensee and compliance standards. Most recently, following the release of the final recommendations to the Quality of Advice Review (QAR), the industry is waiting the Government’s response, long past the expected timing.

These influences have impacted the way advisers provide advice to Australians who are seeking to improve their financial position over the course of their life.

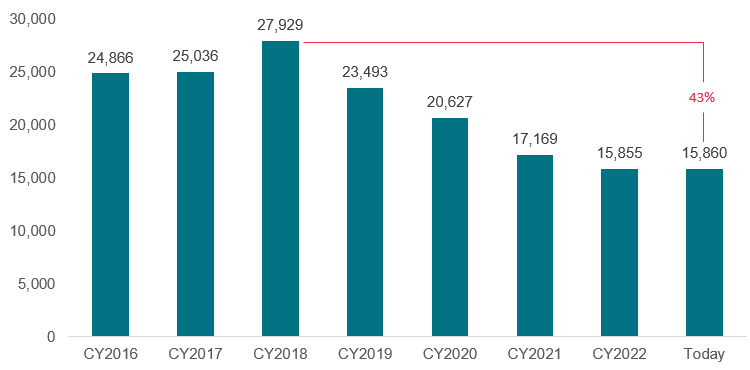

Adviser numbers down

Against this backdrop is a significant decrease in adviser numbers in Australia over the past few years. From a high of 27,929 in 2018, only 15,860 qualified, financial advisers are listed on the Australian Securities and Investment Commission (ASIC) register, a decrease of 43%.

Source: WealthData

In contrast to the decline in existing adviser numbers is the growth in provisional and new advisers joining the industry. This has contributed to the slight increase in adviser numbers between December 2022 and now.

The reasons for the decline are many and varied and include increasing education requirements, regulatory pressures and rising compliance burdens, and the difficulties of operating in an ever changing environment.

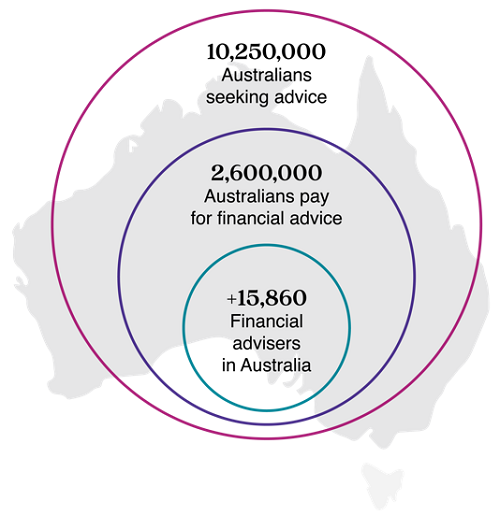

Australians need more advice

Despite this reduction in the number of financial advisers, Australians need advice more than ever and they are seeking financial advice in increasing numbers. A recent ASIC report noted that 2.6 million Australians are currently paying for financial advice however 10.25 million Australians would like to receive financial advice at some time in the future.

There are some barriers to Australians paying for and receiving financial advice including that the cost of advice is too high and that too few Australians trust financial advisers.

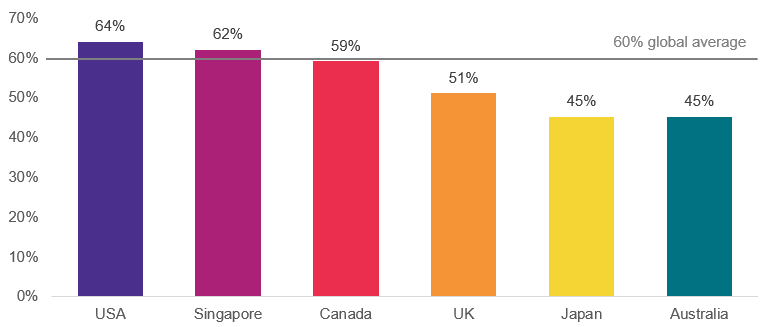

Thankfully for those of us working in the financial services industry, the level of trust has increased in recent years. In 2020, the CFA Institute’s Investor Trust Study showed that only 24% of Australians trusted the financial services industry. The latest report, released last year, shows that trust levels have risen to 45%. Although still below the global average of 60%, the significant increase is consistent with that experienced across the globe, with the report citing trust levels are at an all-time high.

The cost of advice?

How much does financial advice cost? Our data is sourced from our work producing thousands of advice documents (called Statements of Advice) each year, across multiple licensees and adviser practices. We can capture the upfront fees and ongoing fees charged by financial advisers.

Upfront fees are charged when a client initially receives advice and may include capturing the client’s existing situation, researching the potential options that may add value to the client’s position, determining the most appropriate strategy and product recommendations, the cost of producing the Statement of Advice document itself and the cost of implementing the advice.

Ongoing fees are quoted as an annual figure but are normally charged monthly over the course of a year. They can be paid directly by the client or deducted from the client’s portfolio as a flat dollar or percentage-based fee. Ongoing fees are charged by the adviser to provide continuous advice which includes reviewing the client’s portfolio and performance on a systematic basis, providing regular updates to the client, making small changes to the client's portfolio (e.g. rebalancing back to the client’s risk tolerance level), and maintaining the client’s records.

There are many different ways that advisers can charge fees, including:

1. A set annual fee based on the type of client and services required.

- A pre-negotiated fixed fee is the most common. Payment frequency varies but is often monthly. It can be deducted from a bank account or product, if the product allows. There may also be caps on how much can be deducted from a product.

- A pre-negotiated fee based on asset levels, which is less common. This is a rate that is usually collected via a product and is based on an average balance over a defined period, such as a month. Not all products facilitate this. Some product providers will exclude the cash hub balance when determining the fee and others will not.

- A combination of a fixed fee and an asset-based fee. With an asset-based fee, the adviser needs to provide a reasonable estimate of what the fee is likely to be and outline the assumptions used to work this out.

2. A percentage of Funds Under Management (FUM).

- Some advisers charge a percentage of FUM but care is needed to define what is included.

- It is possible to charge based on non-platform asset values, but it can be difficult to manage. For example, the family home is not in the mix as a financial adviser does not provide advice or service in relation to that asset, but what happens with an investment property?

3. An hourly rate.

- Some advisers charge by the hour. It creates transparency but there are challenges, for example, if an adviser has invested heavily in processes and technology to improve the efficiency of delivering the advice. It may take them less time to complete but the adviser still needs to receive a fair compensation for their time as well as the costs of building and maintaining their processes and systems.

Licensees may impose restrictions on minimum and maximum fees charged as may product providers. On the latter, such restrictions will not limit how much an adviser can charge, but it can limit how much can be deducted via the product.

The adviser must always charge what is fair and reasonable. This is a requirement under the Code of Ethics and the regulations. The adviser must be able to defend the charges, agree the amounts with the client in advance, and document them in the Statement of Advice to ensure there are no surprises for clients.

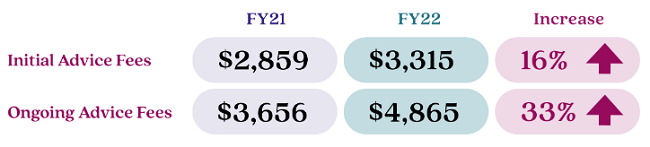

The following diagram captures the average upfront and ongoing fees that were charged by financial advisers using our software for the 2021 and 2022 financial years.

There has been a significant increase in advice fees charged by financial advisers over the past two years, particularly the level of ongoing fees. This trend is set to continue as we are seeing further increases in advice fees this financial year.

Financial advice fees have risen in line with the increasing costs of providing that advice. One of the main contributors is the regulatory burden on financial advisers which has increased exponentially, requiring them to devote more time to ensuring advice documentation adheres to compliance requirements.

The exodus of advisers from the financial advice industry has only exacerbated existing concerns around the cost and accessibility of advice for all Australians.

Other advice trends

Another trend in the advice documents is the increasing number of platforms and decreasing number of strategies that advisers are recommending.

With the abolition of tied distribution and the exit of the banks and large financial institutions from the financial advice space, advisers have more freedom to recommend a larger variety of super, pension and investment platforms.

Industry super funds are becoming more adviser friendly (e.g. allowing advice fees to be deducted from a client’s super balance), and hence are also increasingly being recommended. Although they are restricted somewhat by their licensee’s approved product list (APL), advisers are taking advantage of the myriad of platforms available in the market and according to our data, recommending multitudes. This suggests that advisers are genuinely seeking the most appropriate platform that suits the needs of their individual clients and not recommending platforms based on a financial or other benefit, as they have been accused of doing in past years.

Within the investment space, we have seen a move away from traditional managed funds and a significant move to the use of managed discretionary accounts (MDAs), separately managed accounts (SMAs) or individually managed accounts (IMAs). These types of accounts offer several benefits for clients including direct ownership of the securities by the account owner, full transparency of the underlying securities, and resulting tax optimisation on an individual account basis.

Despite this platform trend, the number of strategies that advisers are recommending is narrowing and limited. Of the 650 plus strategies and all their various permutations that are available to advisers to use, advisers for the most part are restricting their recommendations to those that they know and admire. Without the assistance of sophisticated technology, advisers cannot possibly be abreast of all the advice strategies available or be able to link to a client’s demographic to check eligibility.

Most common advice strategies

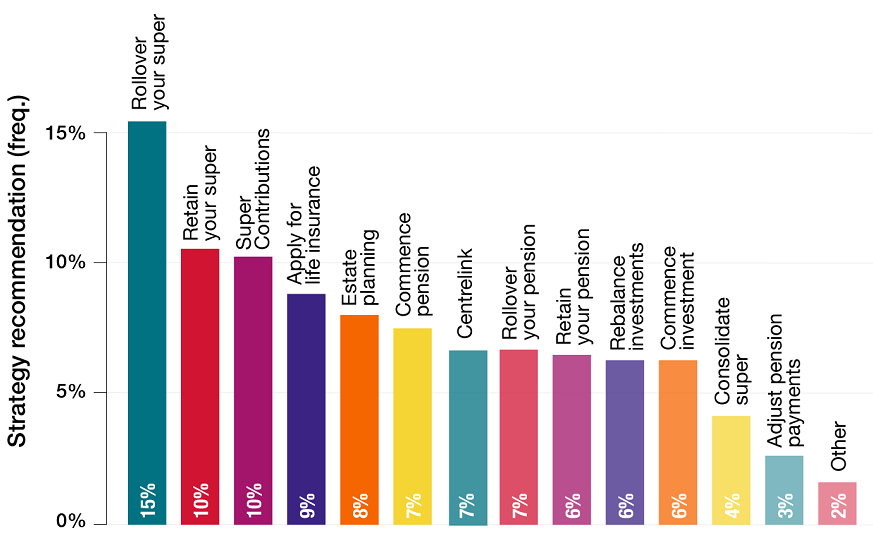

According to our data, ‘rollover your super’ is the most recommended strategy used by financial advisers. This is followed by ‘retain your super’, strategies that recommend insurances, ‘review your estate planning arrangements’, ‘commence an account-based pension’ and ‘review your Centrelink entitlements’.

Strategies that recommend rolling over your pension or retaining your pension are the next most popular advisers' recommendations. Recommendations to commence an SMSF have plateaued in recent years but are more highly recommended by financial advice firms that have a connection with an accounting entity (generally due to a joint ownership structure).

Opportunities for advisers

The financial advice industry is clearly in a state of flux, but with the demand for financial advice still strong among Australians and the Government’s response to the QAR due soon, there are good opportunities for financial planners. The move to use MDAs, SMAs and IMAs shows no sign of abating, and these structures will be key to the success of advisers. Combined this with the smart use of technology to develop advice strategies, this will ensure advisers can provide tailored, cost-effective advice for the benefit of their clients.

Anne-Marie Esler is Co-Founder and Co-CEO of fintech firm, Padua Solutions.