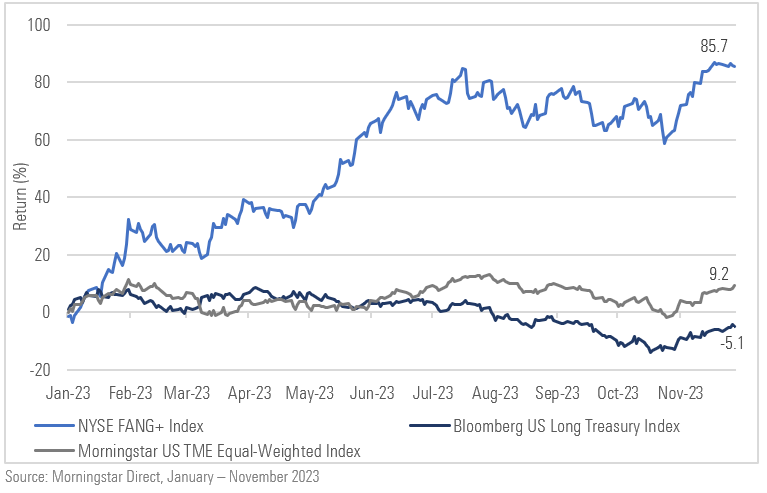

A look at 2023 in one chart.

Exhibit 1: YTD Returns for the Long Treasury Index, Big Tech, and the Equal-Weighted U.S. Stock Market

No one expected 2023 to play out quite like this. Most economists were forecasting a recession, quicky falling inflation, and a Fed pivot, while investors were bracing for equity losses and leaning toward fixed income, expecting higher yields to bolster bond returns after 2022’s historic losses.

Instead, we’ve seen a US economy that has continued to keep the start of a recession at arms’ length, a higher-for-longer rate policy, and stickier inflation than experts predicted. Meanwhile, fixed income has continued its losses and equities have outperformed expectations. In the case of AI-related stocks, returns have been stratospheric.

In a year of surprises like 2023, there are plenty of lessons for those willing to learn them. And the end of the year is the perfect time for reflection, just in time for New Year’s resolutions.

So, what are the top three lessons that spring to my mind as I reflect on the year? The folly of basing portfolio decisions solely on economic projections; the value of valuation at market extremes; and the easy confusion between valuation and falling prices. More on each one below.

The Head Fake of Economic Projections

I started my career as an economist at the U.S. Bureau of Labor Statistics, so I’m the last one to cast stones at economists. Predictions are often wrong, but a solid understanding of the prevailing economic conditions can be incredibly useful, allowing for investors to consider what potential economic outcomes are not fully appreciated by the market, thereby building more robust strategies. Today, for example, some of our portfolios are overweight U.S. regional banks, since the economic outcomes implied by bank stock prices are far more severe than the prevailing consensus for a soft landing.

The temptation, however, is to do more than compare consensus expectations to market prices. The temptation is to use economic projections as market-timing signals, swinging broad exposure according to the economic consensus.

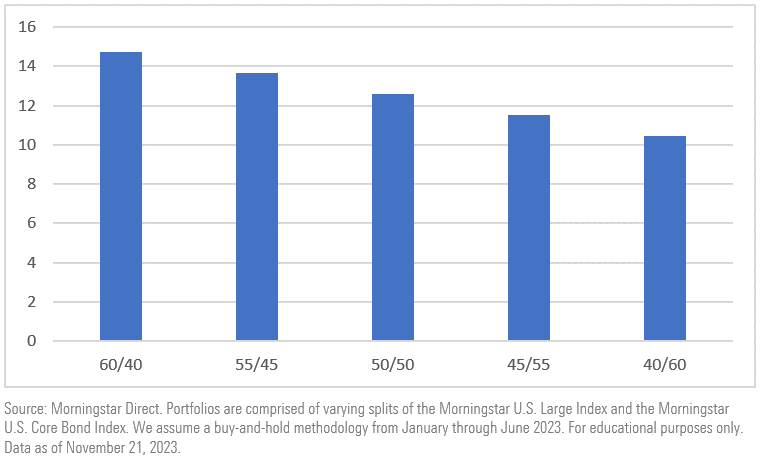

Of course, some years, there’s no cost to doing this, particularly if the economic conditions follow historic precedent. In surprise years like 2023, however, outcomes are less benign. Investors who piled into bonds for fear of an economic crash gave up return. Consider below: A 10% shift from U.S. large-cap stocks to the core U.S. bond market for a moderate $100,000 portfolio cost more than $2,000 in total return over the course of the first seven months of the year. (I assume the investor pivoted again at the end of July, when the soft-landing view began to dominate the economic consensus.) As you’d expect, more meaningful shifts into bonds proved more costly.

Exhibit 2: January through July 2023 Percentage Returns for Varying Stock/Bond Splits

I’ll say it again: We don’t ignore economic projections. However, we think the key is to use economic projections in conjunction with valuation. This is particularly critical at market extremes. Read on!

At market extremes, become a value investor

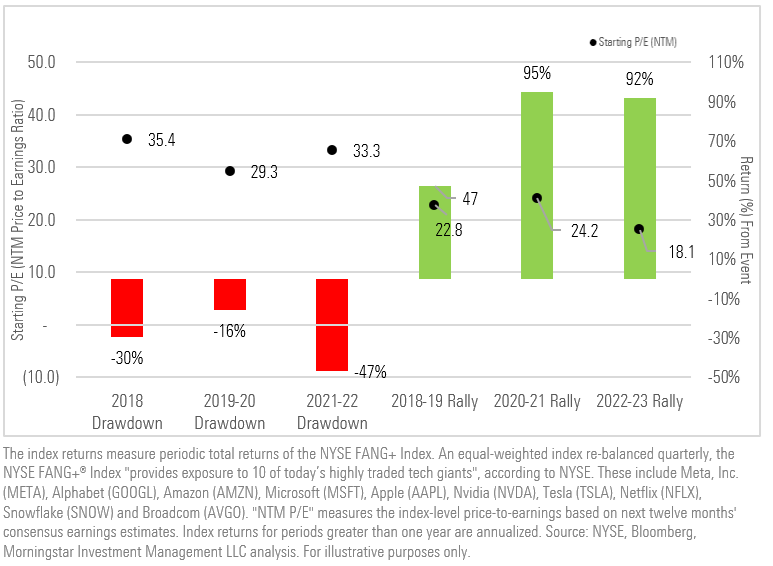

By the end of 2021, value investing felt like a relic of a bygone era. Growth stocks—particularly mega-cap growth stocks—had trounced the rest of the global equity market for so long that the soundest investment approach appeared to be not just a market-cap weighted passive index, but direct ownership of the largest five to seven stocks in the U.S. equity market, dropping the index structure altogether.

However, the late 2021 market reversal that continued long into 2022 rattled more than a few market participants. With Big Tech suddenly on the losing end of U.S. equity performance, investors began to look for fundamental explanations for the performance. Narratives abounded: Meta had lost its way, spending too much on the metaverse, while Alphabet was on the verge of becoming a has-been, laboring under a bloated employee base, facing increasing search competition from AI, and likely to suffer from waning dominance in global ads. Meanwhile, Amazon’s e-commerce business was showing signs of plateauing.

We didn’t share these views. We just thought the lot was way too expensive. And then, in our view, 2022’s losses made them far more attractive. So much so that despite market consensus around a recession, we started buying communication services—home to Meta, Alphabet, Disney, Netflix, and a host of cable companies—in the second half of 2022.

The rest is history. Communication services—along with information technology and consumer discretionary—have rallied hard from October 2022 through today. And not surprisingly, the fundamental explanations for performance have shifted again. Big Tech—now called the Magnificent Seven—is once again unassailable, this time because of the companies’ AI exposure.

Here’s the larger point: valuation isn’t a perfect market timing indicator—as value-oriented investors ourselves, we’ve had to learn this the hard way—but at market extremes, we find more often than not valuation rules the day. See below for more evidence of the relationship between extreme valuation and subsequent performance for Big Tech.

Exhibit 3: NYSE FANG+ Index: Analysis of Peak/Trough Valuations and Subsequent Return

But how do you know a market extreme is actually a market extreme? You don’t. That is why dollar cost averaging is so important. The downside of edging in is that you aren’t always able to build a full position size before the market turns. But I’ve found moderately less exposure than I’d like is far better than piling in and owning too much as something continues to nosedive.

There’s another risk to manage, too: the past isn’t prologue. This means that, at times, a market is collapsing because the market is changing—for good. With that in mind, let’s take a look at the final lesson that was reinforced for me in 2023.

The past isn’t prologue: Falling prices doesn’t always translate to greater value

Many of us have heard that, “This time is different” are the four most dangerous words in the investing dictionary. And that’s because they usually are. Until they aren’t.

While asset prices bounce around daily, the underlying drivers of returns—the actual cash flows that drive bond and stock prices—aren’t meaningfully changing. Thus, when a big disconnect arises between prices and fundamental value, investors usually consider it a buying opportunity.

Every now and again, though, that’s not the case. I learned this the hard way. In the wake of the Global Financial Crisis, as fracking emerged in the U.S. and natural gas prices plummeted, I assumed that investors were selling the asset too hard, too fast. I took a small position in a natural gas ETF and waited.

Seven years later, I sold my position at about an 85% loss. Harvesting the loss for the sake of my broader portfolio was nice but hardly the goal I had in mind years earlier.

The loss taught me two things: First, investing for the long term—in my case seven years—doesn’t ensure a good return if you are massively wrong on price. And second, using price movement as a shorthand or substitute for assessing underlying value can lead to costly mistakes.

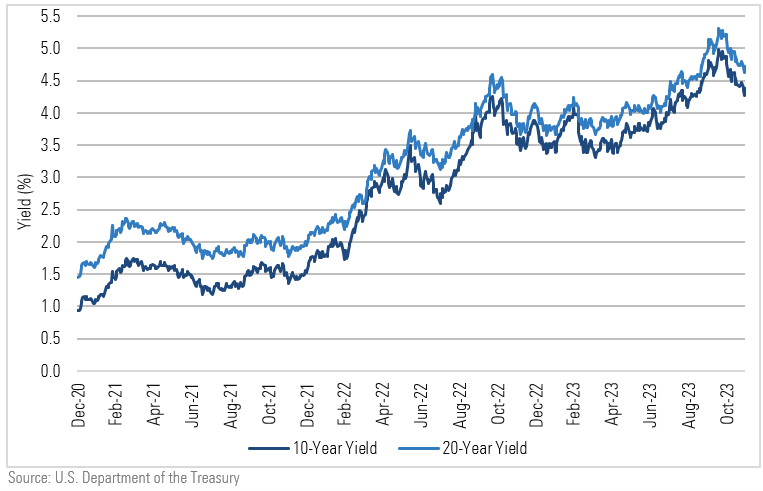

Investors who piled into intermediate- and long-term bonds at the end of 2022 learned a mild version of the same lesson in 2023. Sure, prices had sold off significantly in 2022, making bonds at the longer end of the curve a far better buy than the year prior. However, the conditions that led to quick snapbacks in bond prices over the past decade weren’t in place in 2023. The Fed was still geared toward tightening, and inflation, while rising at a slower pace than earlier in the year, was still a headwind. Finally, higher rates dragged fiscal deficits into the picture, muddying the fixed-income outlook even further.

Exhibit 4: 10- and 20-Year Treasury Yields, 2021 – November 2023

I’m not calling for a continued bond meltdown. In fact, the U.S. 10-Year Treasury is now—for the first time since we began running our fixed-income model in 2016—above fair value. As a result, our portfolio managers have been edging out the curve, taking advantage of the improved yields.

Still, the bond market duress of the past few years reminds me the importance of conducting actual fundamental analysis rather than using price movement alone to guide decision-making.

This fundamental rather technical (price following) orientation will minimize errors like my misguided foray into natural gas or an overzealous reaction to an overpriced asset class that has only just begun its journey back to fair value.

Marta Norton, CFA, is a chief investment manager with Morningstar Investment Management, a wholly owned subsidiary of Morningstar, Inc. This article is general information and does not consider the circumstances of any investor. It has been edited somewhat from the original US version for an Australian audience.

Register for a free trial of Morningstar Premium on the link below, including the portfolio management service, Sharesight.

Try Morningstar Premium for free