Since January 2013, there have been 30 new listed investment companies (LICs) join the ASX. Each of these LICs issued investors with options as part of the initial public offer (IPO). In most cases, investors received one 'free' option for each share, although there were some offers where the ratio was less than one-for-one. Why do LICs include options as part of their IPO structure and why are they seemingly popular with investors?

LIC options often expire valueless

Due to the expenses associated with an IPO, the initial Net Tangible Assets (NTA) of a new LIC will be below the issue price of its shares, so a new LIC with an offer price of $1.00 will have a starting NTA below $1.00. The discount to offer price will vary, but generally costs equate to 2-3% of the amount raised. By offering investors a ‘free’ option there is the perception of providing value to compensate for the IPO costs. The option initially has some ‘time value’ in that it allows the investor to subscribe for additional shares in the LIC at some time in the future, normally at the IPO issue price.

Most LIC options have expiry dates between 12 to 24 months after the IPO date. Theoretically, the market value of the option on listing will offset the reduced NTA arising from the IPO costs. In time, the option may also gain some intrinsic value if the price of the underlying shares rises above the offer price, driven by increases in NTA due to portfolio performance.

However, our analysis shows that options often expire without delivering any real value to LIC investors. Of the 30 LICs in our study, options for 15 of these LICs have already reached expiry. Nine experienced take up rates of less than 50%, with seven achieving take up rates of 15% or less. So, a significant number of investors who acquired shares in these LICs received no value for their options. Generally, options will not be exercised if the underlying shares are trading below the exercise price, as it makes no sense to acquire new shares at a higher price through an options exercise when they can be bought cheaper on-market. For Wealth Defender Equities (ASX:WDE), PM Capital Asian Opportunities Fund (ASX:PAF), Perpetual Investment Company (ASX:PIC) and CBG Capital (ASX:CBC) almost all their options lapsed at expiry. Investors who sold their options in these LICs on-market would have been in a better position than those who let the options lapse at expiry.

Dilutive effect for existing shareholders

Another issue for investors is that options exercised at a price below NTA will be dilutive to existing shareholders. There were six LICs in our study that achieved option take up rates above 50%. In each case, the new shares were issued at a discount to NTA. For investors who acquired shares in the IPO and exercised their options, this is not such an issue, as they would have received new shares at a discount to NTA. However, investors who did not exercise their options would have seen value transferred to those that did.

Investors who acquired shares on-market in the period post-IPO would also have experienced dilution via a drop in NTA without receiving new shares at a discount as compensation. Two LICs in our study achieved higher option take up rates due to underwritten options shortfall arrangements, which effectively resulted in a transfer of value from those investors that did not take up their options to the new investors that took up shares as a result of the underwriting arrangements. Bailador Technology Investments (ASX:BTI) had 24.5 million of its 31 March 2016 options underwritten, or 39% of the total options issue. The arrangement resulted in Washington Soul H. Pattinson becoming a 20% shareholder in BTI. The shares were issued at a large discount to NTA and we estimate the total dilutive impact of the options to be about 8%. Glennon Small Companies Fund (ASX:GC1) had 57% of its 18 August 2016 options underwritten with the new shares issued at a 16% discount to its prior month pre-tax NTA. We estimate the dilutive impact of these options to be about 6%.

Another reason LICs issue options is that it provides a potential opportunity for the manager to increase the size of the LIC if the options are exercised. In the case of a one-for-one option issue, the LIC size will double if all options are exercised, resulting in a higher fee base for the manager. Managers argue that a larger share base is also beneficial for LIC investors as it increases the market liquidity of the stock and reduces the potential for the LIC to trade at a discount to NTA.

Conclusion: the 'free' option may not be a free lunch

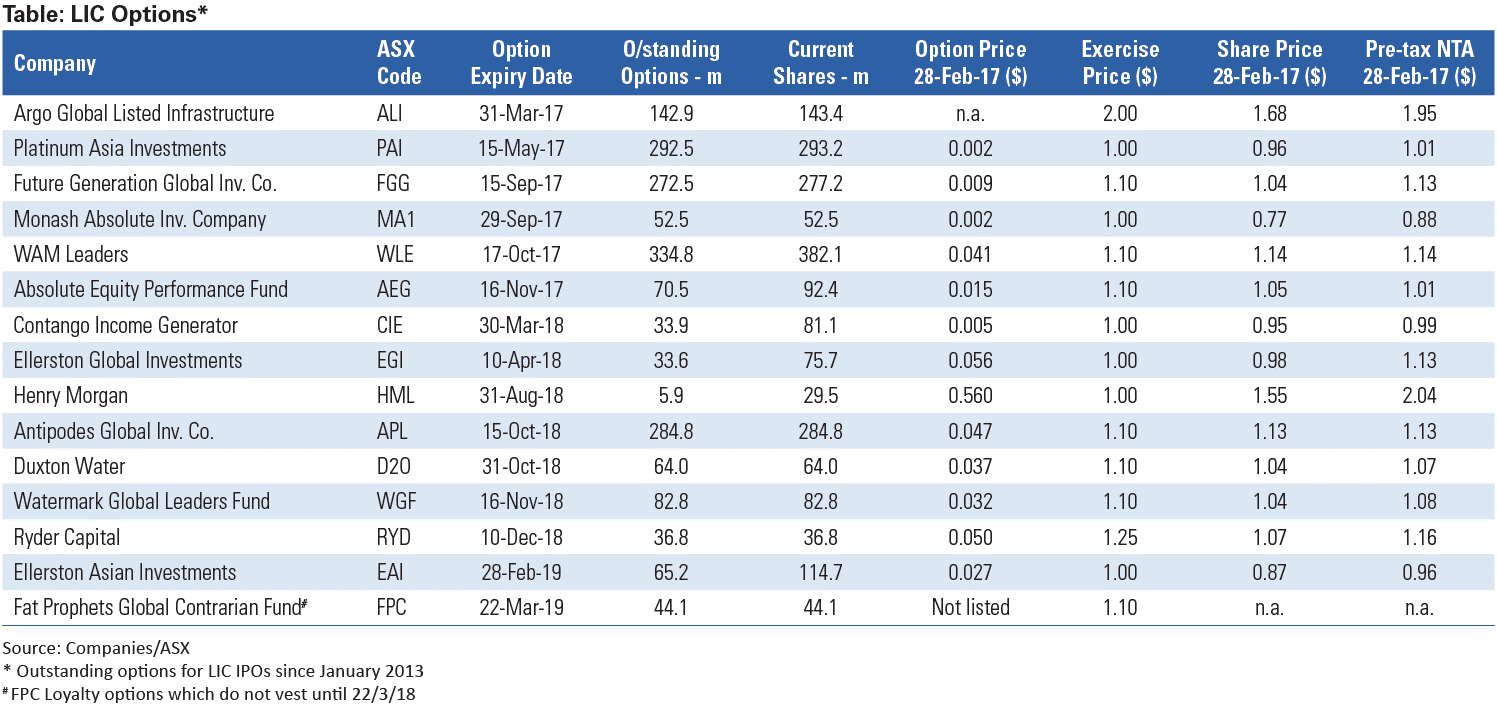

LIC investors need to understand that so called 'free' options may not necessarily end up delivering them with any value as the historical experience has shown many options expire worthless. Investors who sell IPO options on listing may lock in a gain that helps offset IPO costs, however, they forgo any potential upside if the LIC succeeds in growing NTA before the option expiry date. When buying LIC shares on-market, check to see if there are any options on issue and whether the exercise price is at a discount to NTA. If so, this will result in dilution when the options are exercised. The market price of LICs with large option overhangs can tend to trade at a discount to NTA until the options are exercised or lapse. The table above shows options outstanding for all new LICs listed since January 2013. This is not a comprehensive list of all LIC options outstanding as some existing LICs, including WAM Active (ASX:WAA) and Westoz Investment Company (ASX:WIC) have issued shareholders with bonus options.

The final word goes to Gareth Brown of Forager Funds Management. Forager listed its Australian Shares Fund (ASX:FOR) on the ASX in December 2016. As a listed investment trust, we have not included it in our study above. However, we note that it did not issue options to its investors. In response to investor questions as to whether it would be issuing options, Gareth wrote an article highlighting the key issues surrounding options and reminded investors that, “There is, after all, no such thing as a free lunch.”

Peter Rae is Supervisory Analyst at Independent Investment Research. This article is general information and does not consider the circumstances of any individual.