Longevity is among the more predictable of the major change agents affecting developed societies. Yet ignorance, perhaps a sense of complacency plus a reluctance to engage on a personal basis inhibit a holistic approach to dealing with this challenge – and its opportunities.

Life expectancies continue to increase more than forecast, but this is not new. The table below shows that longevity increases have been taking place for over two centuries in developed countries. Numbers from 1906 onwards are for Australia.

|

Year

|

Impact on longevity

|

Life expectancy at birth (average in years)

|

|

Pre 1800

|

Very little

|

35

|

|

1906

|

Reduced infections, disease transmission etc.

|

57

|

|

2001

|

Antibiotics and a focus on personal systemic problems (cancers, heart disease, strokes etc.)

|

80

|

|

2011

|

Continuing medical advances

|

82*

|

|

2100

|

Focus on brain?

|

Over 100? 120?

|

(* Males 80 years, Females 84 years. Source: Australian Bureau of Statistics, Gender Indicators, January 2013).

The increase over the last ten years suggests we still have some way to go. The last century saw a focus on helping babies survive early years, followed by the development of antibiotics and then progressively attacking mid-life problems, including the consequences of smoking. The century ended with an increasing ability to intervene in older age challenges, including mobility and support for independence. Success with DNA mapping underpins growing confidence in earlier diagnosis and treatment of illnesses.

The next big challenges will come from the brain. Building on remarkable developments over the past ten years or so, success in dealing with brain decline will make projections of life expectancy even more challenging. Could baby life expectancy reach 120 or more by the turn of this century? Too early to say but the straws in the wind are blowing that way.

What about you?

Understanding about the community at large is important, but what about you? In an increasingly complex world, is there any way you can plot your personal path with enough confidence to commit to your planning decisions?

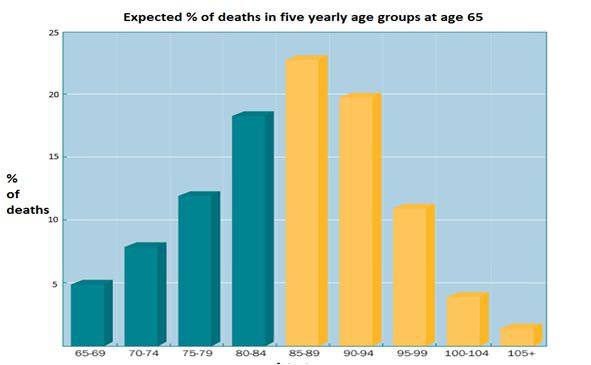

The following graph shows expected death rates in five-year intervals for a person aged 65 as predicted by the Australian life tables. For example, about 5% of 65-year-olds are expected to die before they reach the age of 69, while over 10% are expected to die between the ages of 95 and 99 and about 5% over 100.

Source: Australian Life Tables

Just over 20% of 65-year-olds are expected to die in the five-year group containing the current average, which means nearly 80% won’t. So for the majority, the life tables are not really helpful. We need to do better than this to give people more information about their own longevity.

The 1980’s saw the start of longitudinal studies looking to answer why some people live longer than others (and many other things about longevity). These studies follow the same people over many years. By the early 2000’s they were revealing much more about who died, who survived and what made the difference. Using this data in conjuction with the life tables can help individuals to position their own lifespan better within their age group.

As well as giving a sense of personal lifespan, this work helps to reveal why a person may be different from average. People can now make better informed decisions about what they might do to influence their own remaining time frame. It’s also becoming clear that the factors that influence longevity are also likely to influence quality of life.

People can already better understand and take more control over their remaining lives. The website at www.mylongevity.com.au has a free life expectancy calculator which helps people in taking this step. While there’s a long way to go, we can now begin to answer ‘what about me?’

Where is this leading us?

At the personal level, knowing more about your personal longevity has exciting implications for financial, medical and even career advice. Understanding your possible personal time frame invites stronger commitment to decisions about finance (how much money might you really need), health (you can target the things you need to live both well and longer) and career (how long will you seek to maintain the value of your capabilities and experience). Personal time frame considerations underpin all these dialogues.

At the community level, greater longevity awareness provides a context for dealing with the challenges an increasingly older community is creating. Increasing longevity is already changing Australian society. Greater personal longevity awareness will enable us collectively and individually to stay ahead of (and change the rules of) the game.

David Williams began longevity research in 1986 and was a Director with RetireInvest and CEO of Bridges. He chaired the Standards Australia Committee on Personal Financial Planning. David founded My Longevity Pty Limited in 2008, and his free website at www.mylongevity.com.au has provided more than 65,000 personal profiles online.