(This introduction is an edited extract from the longer research book attached at the end of the article).

How did 2017 stack up?

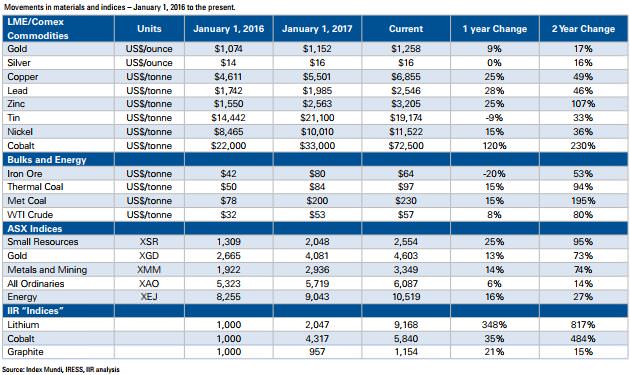

How times have changed since the end of the resources bust. The market began to turn at the beginning of 2016, and we have seen significant gains in all sectors and metals, as shown in the following table. The figures show strong performance across most market sectors and individual commodities over the last two years.

The resurgence is largely in response to an improving global economy, which fared better than expected in 2017, and is expected by some to carry into 2018. However, given that the Chinese economy is maturing, it is unlikely to repeat the rapid growth that characterised the early to late 2000s which led to the previous 'super cycle'.

2017 was an excellent year for the resources sector, building on the solid foundations achieved in 2016. I recall my first 121 Conference in London in early 2016 where a panel discussion suggested that, given the prevailing environment, some junior explorers should be privatised, much to the disgust of at least one managing director of a listed junior miner.

The headline story of the 2017 year was the battery metals, particularly lithium and cobalt. These have been driven by the expected growth in demand for rechargeable batteries, particularly for electric vehicles. Although it has not performed as well, graphite has held its own. We would expect interest in these commodities to continue, but with some flattening and consolidation.

We have noticed in the current cycle that most companies seem to be better quality than in the exuberance of the last boom. This is largely due to shareholders (many who were burnt in the bust) demanding more cost and project management discipline from company management. Many companies have a good product to sell and are run by quality personnel.

Due to the rejuvenation in the junior miner sector, quality smaller companies are once again able to raise funding for exploration, appraisal and development activities, markets are reacting positively to favourable company news, and share prices are continuing to move in the right direction.

Smaller companies, in contrast to the majors, boast management with significant ‘hurt money’ invested, meaning they are often run on the smell of an oily rag. Smaller independent resource companies are also much more leveraged to the strongly-performing commodities of 2016/2017.

What’s in store for 2018?

The resource space in 2018 will be volatile, but amid an overall improving tone in demand and supply fundamentals. One of the biggest drivers in sentiment early in 2017 was ‘The Trump Effect’. There was a lot of near-term enthusiasm in commodity markets as speculators gambled on an infrastructure-led spending spree, but it was largely overblown. The biggest factor in the resource sector remains China, easily the largest consumer of commodities in the world economy.

Our view is that the key mainstream commodities are the base metals, and in particular nickel, which is showing signs of life, with the battery resources also in the mix. Interestingly, the world’s major mining houses have relatively little exposure to the minor metals and are still heavily reliant on iron ore, coal and copper for the bulk of their earnings. We expect the gains in bulk commodities like iron ore and coal to subside, as supply is abundant and there have been temporary factors within China that have sucked in imports and supported price increases.

Australian miners should continue to benefit from strong commodity prices in A$ terms. Overall, we expect the strength in the sector to continue into 2018 due to our forecasts for strong metals prices, driven by a relatively healthy global economy.

Mark Gordon is Senior Analyst at Independent Investment Research. Gavin Wendt is the Founder of MineLife and the Senior Resource Analyst. These comments are general in nature and do not consider the circumstances of any investor.

The full Independent Investment Research - Small and Mid-Cap Resources January 2018 Review (including specific comments on many junior resource companies) can be accessed by clicking the image below. The purpose of this research book is to present a diverse group of resource companies worthy of further consideration.