Each year, Mary Meeker of venture capital firm Kleiner Perkins Caulfield Byers produces a report on global internet trends and technology. It has become the 'must-read' for technology and business, and the 2017 Report fills 355 slides (up from 213 last year).

There is so much in it, including global macro trends, it’s almost impossible to summarise unless a single topic is chosen. It was delivered by Meeker at the Code Conference in a rapid-fire 33 minute presentation but she says the material is meant to be read, not presented.

It’s worth flicking through the 2017 Internet Trends Report in full, but here are the 'focus topics':

- Online Ads and Commerce: A review of current advertising trends shows an increased focus on the measurability of online ads and the interconnectedness of ads and commerce (slides 10-79).

- Interactive Games: Evolving and driving innovation, becoming leading spectator sports with growing use of games for education, learning and driving the consumer and tech landscape (slides 80-150).

- Media Distribution Disruption: Digital streaming businesses have changed the media game through scale and personalisation. Consumers want choice but are concerned about privacy (slides 151-177).

- Healthcare: Digitisation of patient data, pharmaceutical testing and medical records lead to more accurate diagnosis (slides 288-319).

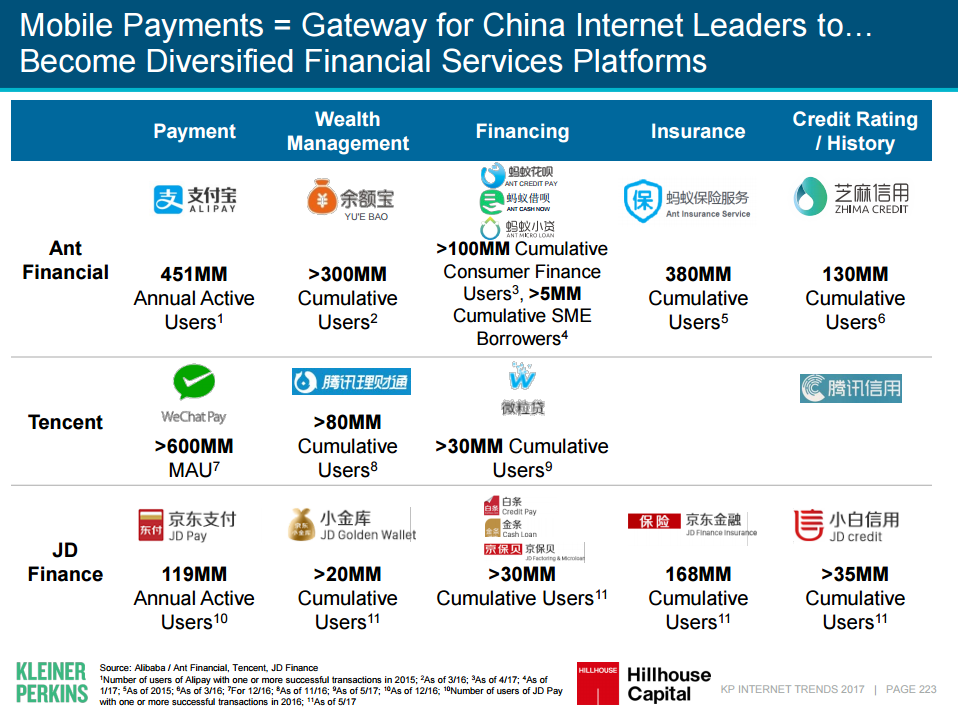

- China: Mobile user engagement is creating an evolution in mobile-centric entertainment and financial technology, plus leading on-demand transportation (slides 193-231).

- India: Behind China, but leapfrogging to new technologies and 1.2 billion people with digital identity profiles (slides 232-287).

Almost every business is affected in some way by the changes Meeker describes. There are now 3.4 billion internet users worldwide, growing at 10% a year. Online advertising is rapidly increasingly, with mobile gaining share over desktops. Internet advertising exceeded television advertising for the first time in 2017, with an incredible 85% of ad growth going to Facebook or Google. Meeker describes the type of ads that work on different platforms.

The future will be about pictures rather than words, with algorithms interpreting content. Machine learning is improving rapidly, and real-time online customer conversations are rising.

There’s an incredible rise of global interactive gaming, which Meeker describes as the 'motherlode' of tech product evolution and learning. There are now an unbelievable 2.6 billion gamers in the world versus 100 million in 1995. It is now mainstream, and the average age of gamers is 35 years. The games are not all trivial, as many involve planning workflows, resource efficiency, social connections, interactive learning, personal finance, esports and even surgery.

Other sections in the presentation are on media, music, health, video, augmented reality, retailing, China and India. Phew … it’s hard not to be overloaded with data.

And what about financial services? Try slide 223 for rapid take-up of payments, wealth management, financing and insurance and hundreds of millions of online users.

If you don’t have time to scan the 355 slides because you’re too busy in the present or worrying about the past, at least look to the future for half an hour by locking yourself in a room with a laptop and watch her presentation. It may reframe how you think about the coming years.

Graham Hand is Managing Editor of Cuffelinks.