Despite the intention to wind back the generosity of superannuation for large balances, Treasurer Scott Morrison has left open a wide window of opportunity to park money in this tax-advantaged system. Couples have a final chance to place up to $1.15 million into super in the next nine months, even if they are already each over the $1.6 million cap. Such a window might never open again.

The acclaim for the compromise on the super changes announced last week has been widespread. The Australian called it “Turnbull’s super week”, while The Australian Financial Review’s headline went as far as saying, “Morrison wins over everyone”, adding that the change was, “welcome across the industry as a fair and sensible compromise”. Such praise means votes in politics, and veteran journalist Paul Kelly, The Australian’s Editor-At-Large, wrote:

“Finally, on superannuation Morrison and Financial Services Minister Kelly O’Dwyer have achieved an astute, multifaceted compromise. They have won industry backing and party room endorsement, removed the main retrospectivity peg, replaced the $500,000 lifetime cap on after-tax contributions with a $100,000 annual cap, won the budget savings and set up a negotiation with the parliament that will see the super package become law.”

Apparently everyone’s a winner.

What about the lost personal income tax?

Wait a minute. Wasn’t the reason for the proposed change to stop superannuation becoming a store for the wealthy? And to fulfil the objective of providing an income in retirement, not intergenerational wealth transfer? And to stop the drain on revenue from assets being placed in a tax-favoured structure?

The removal of the retrospective elements and limitations of the proposed $500,000 non-concessional contribution (NCC) cap is welcome. However, it’s surprising that a couple under the age of 65 (who have not already triggered the bring-forward) can now put over a million dollars (two lots of $540,000) into super as an NCC by 30 June 2017. Adding a last stab of up to $70,000 in pre-tax concessionals gives $1.15 million, a supersized top up for anyone with access to enough money.

Sure, each person will have a limit of $1.6 million in pension mode where the income remains tax-free, but the balance will be taxed at 15% in an accumulation account. With franking, the average tax rate paid in superannuation outside pensions is about 9%, and higher-earning assets can remain in the pension fund. For those with multimillion-dollar super balances, their likely personal marginal income tax rate is 47% (excluding medical levy of 2%). They can reduce their marginal tax rate by 32%.

(People aged between 65 and 74 who meet the work test can make an annual $180,000 contribution but cannot use the bring-forward rule).

Assuming the $1,080,000 earns only 5%, or $54,000, the tax saving of 32% is $17,280 per couple per annum. Thousands of people will take this last chance - is this fully factored into the budget?

Does this sound familiar? Exactly 10 years ago …

The 2006/2007 Budget was wonderful for high income earners. I remember sitting at the ANZ Budget Dinner in the Westin Hotel ballroom with a thousand other financial market types as Peter Costello delivered the super goodies. The Reasonable Benefits Limits rules were abolished, payments received from a fund as either a lump sum or an income stream would be tax-free after the age of 60, and there was a $1 million top up each. The room was almost silent as executives imagined the dollar signs flipping through their minds. When Costello finished speaking, there was a hubbub as thoughts tumbled out. “Did you hear what I heard?” buzzed the tables as the waiters topped up the wine.

The coincidence in timing and content with the Morrison announcement is extraordinary, as it was almost exactly 10 years ago, on 5 September 2006, when Costello issued this statement:

“People will be able to make up to $1 million of post-tax contributions between 10 May 2006 and 30 June 2007 which will allow people who were planning a large contribution under the existing rules to do so. The $150,000 annual limit on post-tax contributions will commence from 1 July 2007. People aged less than 65 will be able to bring forward two years of contributions, enabling $450,000 to be contributed in one year, with no further contributions in the next two years.”

Wealthy Australians and their advisers set about accumulating as much in super as possible. It was the best tax management programme in town. Post-tax contribution $450,000 brought-forward. Tick. Annual pre-tax contribution $50,000. Tick. And the granddaddy of them all, the one-off $1 million. Big tick.

These were the good old days of mining booms, budget surpluses, reductions in marginal tax rates and even baby bonuses without a means test. And here was superannuation – not some dodgy and doubtful tax-minimisation scheme at the bottom-of-the-harbour – as a centrepiece of government policy, allowing millions to be parked tax-free.

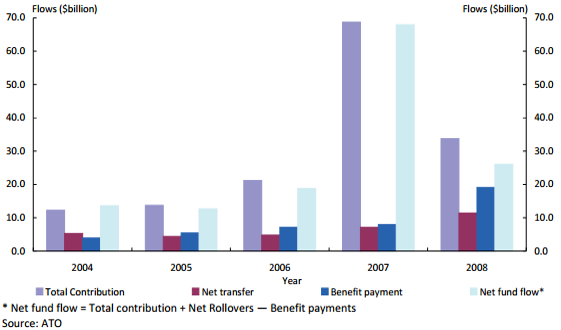

It was a godsend for the wealth management industry. As the chart below shows, there was a massive spike in contributions during 2007. Of the $70 billion in total SMSF contributions, member contributions comprised $57 billion or 80% of total SMSF contributions in that year, and retail and industry funds experienced billions more.

Breakdown of total SMSF fund flows, 2004 to 2008 (with $1 million allowed in 2007)

Largely as a result of these limits, 2.6% of the 550,000 SMSFs now have balances over $5 million, according to the Australian Taxation Office (ATO). That’s 14,300 funds representing about 28,000 members.

Massive inflows in the short term, then a drop off

The removal of the $500,000 NCC and its backdating is not only good news for those who can afford large contributions, but also for the wealth management industry – fund managers, platforms, industry and retail funds, planners, accountants, SMSF administrators and thousands of others – in the short term. The public awareness of superannuation is higher now than it was in 2007, and this window of opportunity is special because the door to NCCs closes for many on 1 July 2017. In 2007, Costello allowed ongoing after-tax contributions of $150,000 a year, so there was not as much need to rush.

Under Morrison, from 1 July next year, anyone with $1.6 million or more in super cannot make further NCCs. Even those with smaller balances have a lower annual cap of $100,000, with a bring-forward. Particular attention will focus on property. The next nine months might be the last time the limits allow a lumpy asset like a property to be placed into super.

There may be some tempering of enthusiasm due to the ongoing tinkering with the superannuation system ensuring there is no certainty of the tax treatment.

In following financial years, the new limits will bite, as the wealthy make no more NCCs and the concessional limit drops to $25,000. With an ageing population drawing pensions approaching $70 billion a year and asset earning rates low, it’s possible that super assets might peak for all time in the June 2017 quarter.

If this plays out, and given the stock market’s usual myopic focus, wealth management businesses will be a good buy into 2017 as strong inflow and funds under management announcements are made to the market, followed by disappointments into 2018 and beyond.

Is the work test really such a stretch?

What about the reintroduction of the work test for people aged between 65 and 74, who cannot make NCCs unless they pass the test of being ‘gainfully employed’, contained in the SIS regulations 7.01 (3):

“A person is gainfully employed on a part-time basis during a financial year if the person was gainfully employed for at least 40 hours in a period of not more than 30 consecutive days in that financial year.”

I have a friend who is over 65 and he took some part-time work (babysitting? gardening? acting?) for a few weeks. Is 40 hours within 30 days or 10 hours a week difficult to organise? A financial adviser told me, “I have a few clients that step in when local businesses need to replace a receptionist or clerical employee for holiday leave.” Arrangements should be checked with the ATO but might be worth it for a last shot at a decent NCC.

What could Morrison have done?

There were two major issues where the politics forced Morrison and Turnbull to negotiate a compromise to the budget proposals: the retrospective treatment of NCCs to 2007, and the $500,000 limit. However, there was widespread (not universal) acceptance that the $1.6 million cap on tax-free income was a decent number.

Given all the ‘budget repair’ arguments, I'm surprised he did not simply remove the $500,000 limit and the 1 July 2017 start date for the new rules, and leave in place the requirement that anyone already over $1.6 million could not contribute more NCCs. It would have achieved most of the desired political outcome without the potential drag on future income tax caused by opening the NCC to everyone.

Not everyone should stick more into super

Of course, the vast majority do not have a cool million lying around. For many, super may not be the best place to lock up their money, especially above the $1.6 million cap where the tax rate becomes 15%. They can take advantage of the tax-free threshold of $18,200 on income earned outside super, and perhaps the Seniors and Pensioners Tax Offset, which allows tax-free earnings of up to $32,200 for singles or $57,800 for couples. If earnings rates are low with franking credits, it’s worth calculating how much is better held outside super in individual circumstances.

These proposals are not yet legislated, although given the political wins for the Government last week, and the previous hammering it took with a public and backbench revolt, they may be reluctant to revisit the rules any time soon. Longer term, governments cannot resist fiddling.

Watch what happened in 2007

The timing of allowing $1 million into superannuation in 2006/2007 was unfortunate for some, as it was during a major bull run on the stock market, and thousands ploughed the money into shares. The GFC then hit and wiped out far more than the gains from the tax savings. The point to note is not to confuse the investment vehicle (superannuation) with the investment market (such as shares, cash, bonds, property, etc).

Every financial adviser (as soon as the changes are legislated) will be telling their better-off clients to ship as much into super as possible this financial year. Ever since Australians realised the mining boom and the good times were over, many have blamed Howard and Costello for frittering away the large surpluses, and the $1 million super allowance is often cited as an example of generous policy. Is Morrison creating a similar legacy?

(Editor's Note: We have received feedback on a different interpretation of the non-concessional contributions limits. We have checked with superannuation experts who confirm the content above. For example, Liam Shorte says, "Graham your article is correct. As long as they have not triggered the bring forward in the last two years then they can use the full $540,000 before 30 June 2017. The new $1.6m balance limit for contributions does not apply to contributions made before 1 July 2017." )

Graham Hand is Editor of Cuffelinks. This article is based on a current understanding of the proposals but these may change and individuals should seek financial advice based on individual circumstances.