COVID-19 has put the spotlight on all asset classes, and commercial property is no exception. David Harrison, Charter Hall’s CEO & Managing Director, recently spoke at the Morningstar Individual Investor Conference and explained why quality office buildings are still an attractive investment. Here is a summary of the reasons David is still optimistic on the outlook for the office sector.

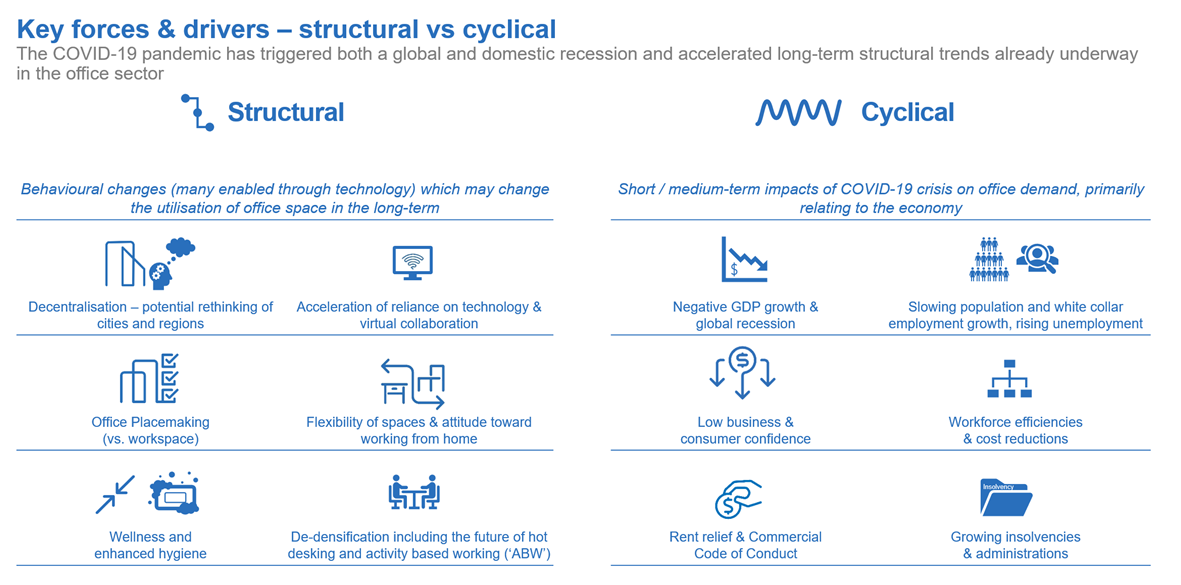

Structural vs cyclical change

There is a lot of media hype on the office sector. The million-dollar question is whether COVID-19 will create a structural change or a cyclical change, as we have witnessed with other past economic downturns.

Charter Hall’s view is that this is another example of a cyclical correction. While there will be a short-term reduction in demand and vacancy factors will go up, we entered this crisis with some of the lowest vacancy rates we have seen in both the Sydney (3.9%) and Melbourne (3.2%) CBD markets. Compare this to cities like Chicago (16.2%), LA (13.0%) and New York (7.7%). This will buffer any short-term reduction in demand.

Clearly, we are already seeing companies announcing cutbacks in headcount in response to the economic downturn. But an offsetting trend is an increase in the amount of space per person in occupying in a building. Go back 30 years, it was 25sqm per person but pre-COVID, it went as low as 10sqm per person. The pendulum had swung too far - you cannot have that sort of density and operate efficiently.

The end of 'activity-based working' extremes

The concept of 'activity-based working', where two or three people might occupy one seat on a particular day, and as people went to a meeting or left the office, their seat was occupied by some else, is unlikely to be the predominate workplace system in future. There will be a move back to fixed seats with some clustering in neighbourhoods and there might be some movement in those neighbourhoods on a weekly basis but not on an hourly or daily basis.

With the emphasis on workplace health, the densification of workplaces will return towards 14-16sqm per person. As a result, businesses will need more space for the same amount of people in our offices and this will help offset the cyclical change in demand.

CEO and business leaders need to deal with productivity and risk management. One of the problems that has arisen out of COVID-19 and working from home is that risk goes up. It is difficult to have a detached workforce no matter what the business. There will be a desire, particularly over the medium term, for staff to return into an office environment. Yes, there will be flexible arrangements, and in some industries, like call centres, they may be able to work efficiently from home 100% of the time. Most people will spend more time in the office and it is unlikely that we are going to see a long-term structural change in mass working from home.

Health and wellness in the office

In response to concerns about the workplace environment, there will be more focus on technology in buildings and a flight to quality by tenants. New buildings that provide the latest in health and hygiene facilities (such as ultraviolet hand rail sanitiser on building escalators and in air handling units, touch-free technology for doors and lifts and temperature scanners in the entrance) will be in demand. Buildings that fall short will not be able to compete.

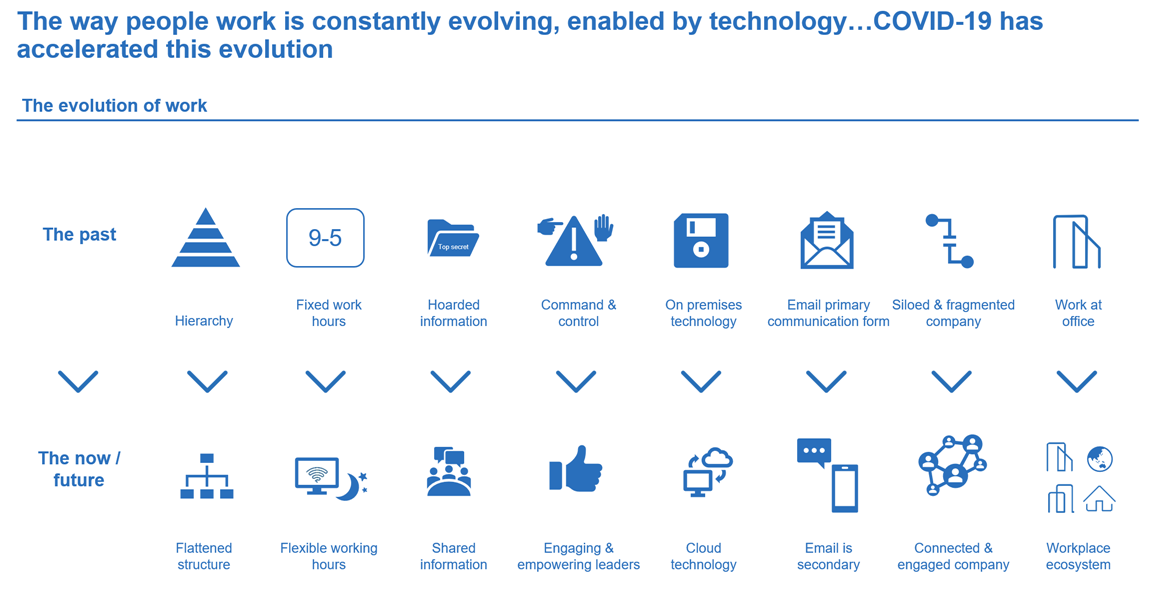

We’ve seen a lot of change over the past 30 years. The office will continue to evolve and adapt. We’ll see more flexible working hours, more shared information, and more innovative technology. But at the same time, there will be a greater focus on collaboration and empowerment. Whether in the CBD or the suburbs, a well-designed, productive, connected workplace environment will allow a company to attract and retain talent at the same time helping to foster the company’s identity and culture.

CBD vs the suburbs: It’s not one or the other

Another refrain is the death of the CBD and the rise of suburban office markets. We are believers in both CBD and metropolitan markets. Charter Hall is one of the largest owners of office property in Parramatta. We recently bought a 34,947 sqm office property in Macquarie Park in suburban Sydney that is leased to the NSW Government for 12 years.

The CBD is, and will continue to be, the dominant office market. Across Australia, there is 11 million sqm of quality (Premium and Grade A) CBD space and circa 3 million sqm in non-CBD areas.

To meet the needs of staff, businesses want a quality retail amenity and good public transport. It is difficult to have a suburban location in any state that has the convenience and centralised public transport system of a CBD. Apart from Parramatta and North Sydney in Sydney, most states have little in the way of mature suburban markets. There are some exceptions, but there will not be a massive structural change in office demand moving from the CBD to the suburban market.

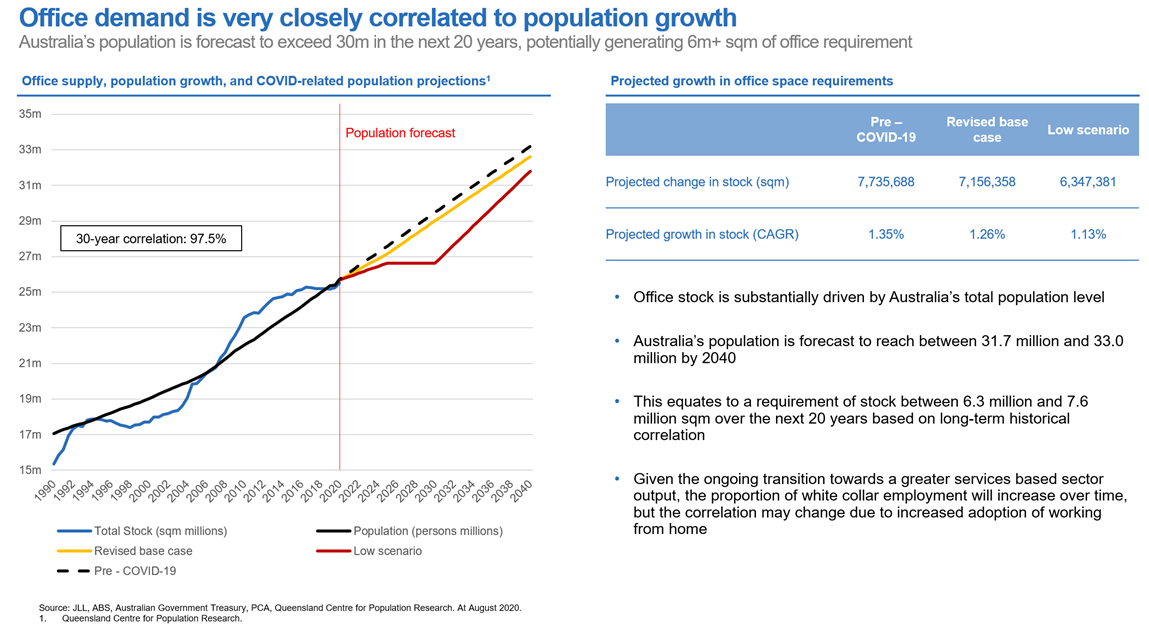

Population growth drives demand and it will again

There is a strong correlation between office demand and population growth. Obviously, COVID-19 has driven a short-term reduction in net migration. Hopefully, after the health crisis, we will see a return to pre-COVID net migration levels, which in turn will drive office demand. Population growth is essential if Australia is to continue above average economic growth compared with Europe and North America and many other parts of the world.

Capital continues to chase office assets

Some of the largest global institutional investors are investing in Australian office buildings and this will continue. Two recent examples include Peakstone, a Singaporean investor, acquiring a Sydney CBD office building in June 2020 for $530 million while in October 2020, Deka Immobilien, a German investor, paid $452 million for a Melbourne CBD office building.

One of the key reasons they are choosing Australia is because of the lease structures that allow 3.5% to 3.75% annual fixed rental growth. Investors want a growing distribution yield in a low inflation, low interest rate environment. Australian commercial real estate offers an attractive relative investment return compared with other major global markets. We expect office transaction pricing to remain firm and reflect the large gap between office yields and the 10-year bond rate.

Winners and losers

We are not as concerned about the office market as some. Clearly, industrial and logistics will be the stand-out performer for the next five years driven by the explosion in e-commerce while the supermarket and convenience end of the retail market will be more stable.

While there will be winners and losers in the office market, modern buildings with long leases to quality tenants will perform well. Older buildings with shorter leases will underperform.

Adrian Harrington is Head of Capital and Product Development at Charter Hall, a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any investor.

For more articles and papers from Charter Hall, please click here.