Here’s the edge for individual investors: fund managers have clients, individual investors don’t.

Fund managers sometimes consciously and subconsciously cater to their perceptions of client needs. If they don’t, they won’t receive money to set up a fund or keep money invested in the fund. Examples include:

1. Clients can be impatient and want returns now, not in three years’ time. That makes it difficult for funds to pursue a long-term strategy.

2. Clients can prefer less controversial portfolio holdings. For example, ESG-friendly companies are an easier sell than coal companies, yet it can come at the expense of returns.

3. Clients will generally prefer less volatile, diversified portfolios. That may mean owning a company that goes up 3x, but having to reduce the holding so a portfolio doesn’t become too concentrated in one stock, perhaps to the detriment of both the portfolio and the client.

Individual investors don’t have these constraints, and it can give opportunities to outperform the market.

Playing the long game

The pressure for funds to perform is constant, and much of that pressure comes from clients. Clients may be able to sit through 12 months of underperformance, but if it drags through to two years, serious questions are likely to be asked. It’s a rare client that will sit tight through three years or more of fund underperformance.

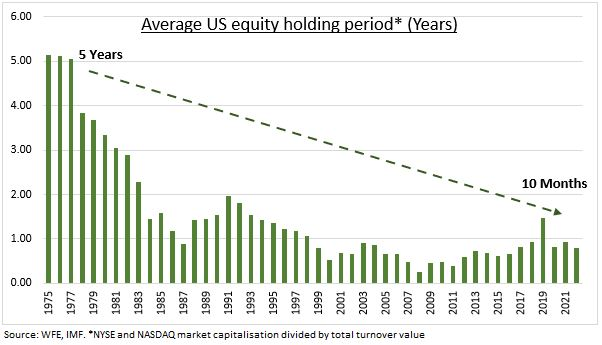

Inevitably, that can make funds focus on short-term performance, and the data supports this. The average holding period for stocks in the US is just 10 months.

This holding period is for all investors, retail and institutional. Though institutional fund managers aren’t much different. The average turnover rate for large-cap funds in the US is 73%. That means 73% of their portfolios are turned over each year. Or put another way, the average period that these funds will hold a stock is about 16 months. The focus on short-term performance means funds can sometimes chase momentum stocks, or those that are rising in price. This can lead to disastrous results.

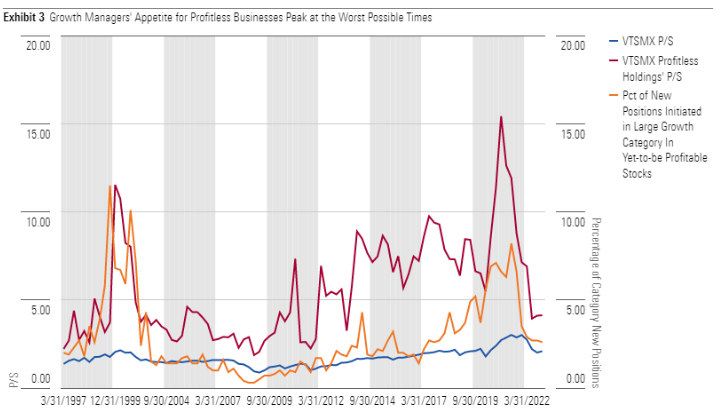

In a recent study, Morningstar found that US fund managers loaded up on high-flying companies, many of which were profitless, during the pandemic boom of 2020-2021. And many of these managers got wiped out in the market downturn of 2022.

The study suggests that by the end of 2020, the US stock market’s profitless companies were more expensive than at the tech bubble’s peak and more than 8x as pricey as their profitable peers.

Yet fund managers still bought these stocks. By June 2021, about one in every 12 new positions of funds in the ‘large-growth’ category (those investing in growth stocks) were in unprofitable stocks. Three months later, nearly 4.5% of large-growth category assets were invested in companies that had never turned a profit. That compared to the peak of the dot-com bubble, when 4.4% of category assets were in yet-to-be-profitable companies.

While time is often the enemy of the fund manager, it can a friend to the individual investor. In fact, it can be the individual investor’s edge in the market.

Going where funds won’t go

For equity funds to be marketable to clients, they’ll sometimes have to stay away from stocks that are controversial. A recent example is the push for fund managers to invest in ESG-friendly companies.

From 2017, there was growing pressure on funds to remove coal companies from their portfolios. That not only led to an initial downturn in the stock prices of coal companies but starved these companies of capital to invest in new and existing coalfields. It resulted in a downturn in coal supply at a time when coal demand was still growing. The supply shortage led to a spike in coal prices and an enormous run-up in coal stocks that only ended about six months ago.

Many fund managers were constrained from holding onto coal stocks, or from buying into them. Because of this, they missed out on the staggering out-performance of these stocks during 2019-2021.

Another example comes from highly indebted companies. Funds will often explicitly say that they don’t invest in companies that are highly leveraged. For instance, they may choose to not invest in stocks with a total debt to equity ratio of greater than 50%.

This can be a sensible strategy because indebted companies can bring more risk, especially during a rising interest rate environment. On the flip side, it also means that the strategy excludes a lot of companies, some of which may not be as risky as they first appear. And that can be an opportunity for savvy individual investors.

The well-known US-based investor Mohnish Pabrai gives a good example of this in his book, The Dhandho Investor. In 2000, Pabrai invested in a US funeral services business, Stewart Enterprises, whose stock had slumped more than 90% from its peak. The company had bought many other funeral services businesses (a roll-up business model) and taken on a huge amount of debt. The market was pricing the stock as if it was about to go bankrupt.

Pabrai saw that bankruptcy was possible, but also that the business was making good money, and had options to refinance its debt and sell-off some businesses to raise cash. He reasoned that the risks of bankruptcy were low, while the odds of the business getting through their bad patch were high. Soon after, the company announced that it was considering selling its businesses outside the US and the stock price took off. Pabrai doubled his money in under a year.

Where a fund manager can be constrained from investing in certain stocks and sectors, the individual investor isn’t, and that can provide compelling opportunities.

Letting your winners run

In product disclosure statements for funds, you’ll regularly see statements that they won’t have stock holdings exceed a certain percentage of total portfolio holdings. This is to reassure potential clients that they won’t take on too much risk with one stock and that they’ll be appropriately diversified.

There’s nothing wrong with this, though portfolio diversification isn’t a black and white topic in the world of finance. Some such as Charlie Munger think a handful of stocks is enough for a portfolio, while at the other extreme, some funds hold many hundreds of stocks.

One disadvantage of a fund having restrictions on how much of a stock they can hold is that it can mean not holding onto companies whose prices rise a lot.

For example, CSL Limited IPO’ed on the ASX at a price of $2.30 in 1994. Since then, it’s risen 6000% (including a 3:1 stock split).

Many funds bought into the CSL float yet how many have held into their original stake for the next 29 years? I don’t know the answer, but I’m fairly sure that it would be none. That’s because any stake in CSL from the float would have become too large within a portfolio for a fund to justify holding onto the stock.

For example, say a fund bought into CSL at the float, and the stock was 3% of the total portfolio. Given the subsequent share price rise, that 3% would have grown to perhaps 90% of the total portfolio today. What fund manager, even a successful one, could justify having CSL as 90% of their total portfolio? Invariably, clients would complain that they don’t need to invest in the fund as they can hold CSL directly themselves. Or they would point to the risks in having so much portfolio exposure to just one stock.

Yet, here’s a question: would have cutting back on a stake in CSL held from IPO been the right call at any time over the past 29 years? People will have different opinions on this and there’s no right answer. The point is that funds are limited in how much of a stock they can own in portfolios.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information.