It has always been an anomaly of the Australian financial system that retail investors have not had ready access to high quality corporate bonds. In most developed markets, and particularly in Europe, bonds have long been the mainstay of retail portfolios. At last in Australia, 17 corporate names are available through Exchange-Traded Bonds or XTBs listed on the ASX, to be purchased in the same way as any listed security.

In a prior life, I spent many years doing roadshows around Europe marketing bonds destined for retail investors. It was great fun. For the first ever transaction exceeding $A100 million in the Euromarket denominated in Australian dollars, we flew around Switzerland (with the light plane banking around the snow-capped Matterhorn!) visiting private banks who gobbled up the generous coupons for their Belgian dentist customers. It was wood-panelled meeting rooms inside splendid granite buildings, with polite Swiss bankers taking generous fees for keeping their clients happy.

But none of the bonds we issued in Australia were intended for retail distribution. The banks had the term deposit market sewn up.

Investors taking equity risk to achieve returns

Australian retail investors looking for secure yield have never been significant buyers of government bonds, except indirectly through bond funds, and now, ETFs based on bonds. Until recently, when fixed interest specialists like FIIG Securities started bringing corporate names to the market, retail investors were limited to bank term deposits and a few bonds listed on the ASX.

This might have been acceptable when interest rates were higher (Westpac issued a five-year term deposit paying 8% as recently at 2010), but the current bank rate for a five-year term deposit is only about 3%, barely covering inflation. Investors have turned to the much higher risk of shares, where the volatility of the All Ords index at about 15% is over three times the bond index. This is not a satisfactory solution to the problem of capital stability, as many investors have realised with the shock of bank shares like CBA falling from $96 to below $80 in a few months. That’s three years of dividends gone.

Need to open corporate bond market

Little wonder that the Financial System Inquiry Final Report argued that: “Less onerous disclosure requirements for listed securities would make retail issuance simpler and more cost effective” (page 263) and called for regulations to change to improve access to the bond market for retail investors.

As a sign of the need for secure alternatives, the latest ATO data for March 2015 shows 26.5% ($157.4 billion) of SMSF investments sitting in cash or term deposits, at a time when the cash rate is only 2%. Not many retirement goals are being met at that rate. Only $5 billion is listed under ‘debt securities’, although this ignores bond funds. Institutional super funds hold between 10% and 30% of their balanced options in fixed interest.

Australian Corporate Bond Fund (ACBC) has found a solution to the structural problem by placing individual senior, unsecured wholesale bonds into a trust, which issues ASX-listed securities called XTBs, similar to managed funds or Exchange Traded Funds. Each XTB reflects the maturity and coupon of the underlying corporate bond, best illustrated with an example:

- ASX code YTMLLC gives exposure to a Lend Lease Corporation (LLC) senior bond

- Final maturity is 13 November 2018

- Coupon is 5.5% pa paid semi-annually

- As at 19 August 2015, offered on the ASX at a price of $107.83.

Australian investors think in terms of yield, not price, and the XTB website has a useful calculator. Plugging in these numbers gives a yield to maturity of 3.39% at the time of writing (19 August 2015).

On the current range of XTBs, a fee of 0.4% per year to maturity is charged in the price by the manager, meaning the XTB investor receives 0.4% lower yield than wholesale. ASIC is in process of approving 16 more XTBs including five using floating rate senior bonds. It is expected that the fee structure for the floaters will be materially lower, to offer investors a more competitive option to cash or rolling short term deposits.

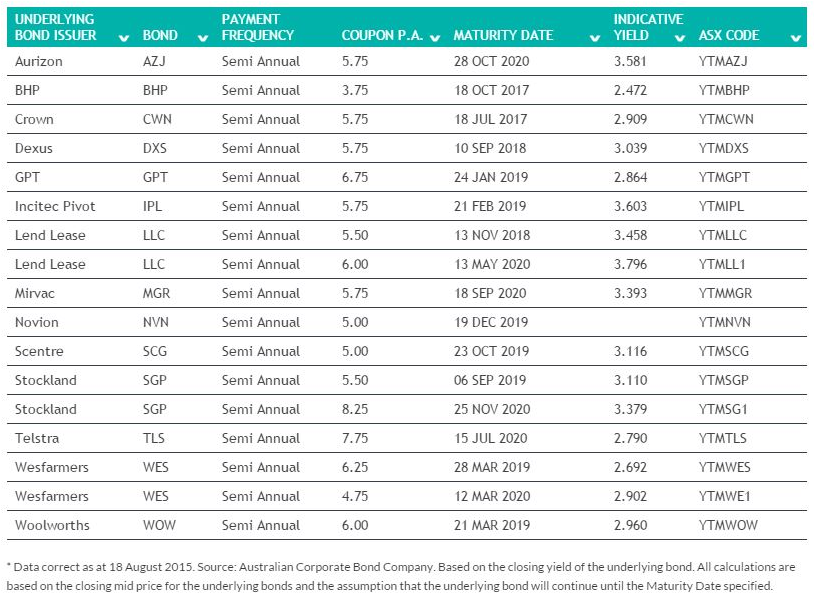

Table 1 shows the range of 17 bonds available at the moment.

Table 1: Corporate bonds available through XTB as at 19 August 2015

What are the issues to consider for retail investors?

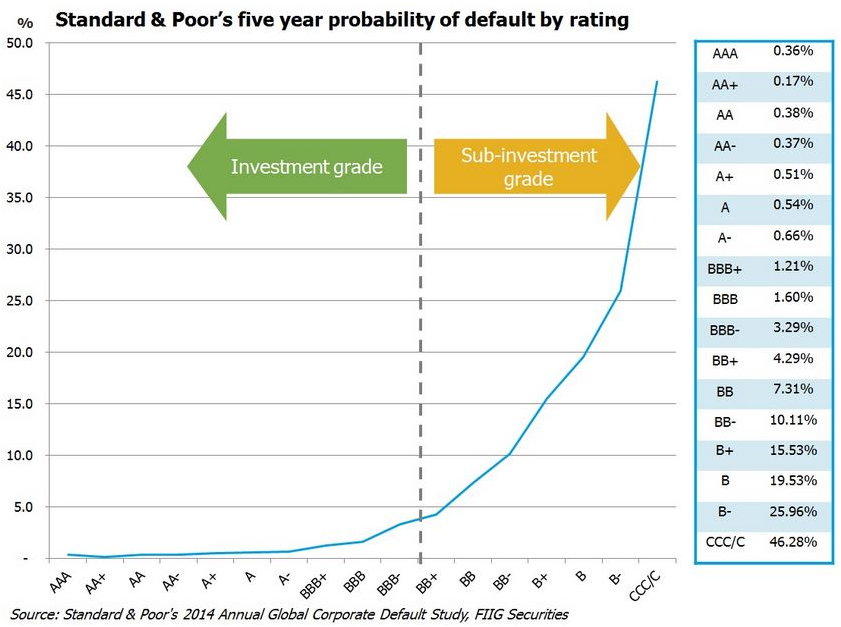

The most obvious point is that these names are all high quality, investment grade issuers, so none of the indicative yields are above 4%. Many of the bond transactions brought to the market by FIIG are unrated and sub-investment grade, but this is what is required to achieve the higher yields of over 6.5%. Retail investors chasing these returns need to carefully consider whether unrated issuers are worth the extra risk, and ensure a wide diversity without a large exposure to any one name. Companies with ratings below the investment grade of BBB+ have an exponential risk/return trade off, as shown in Figure 1.

Figure 1: Five-year probability of default by credit rating.

While XTB is in the ideal space for investors looking for better security and uncomfortable with equity risk, demand would have been much higher five years ago when rates were higher. Investor appetite for Telstra at 2.79%, Wesfarmers at 2.9% and Woolworths at 3% will be subdued while the major bank deposits are at or around 3%. This is despite the banks calling off their ‘term deposit war’ which created attractive rates when they were intent on building their retail funding bases. While there’s an argument for diversifying away from bank risk for hybrids and shares, bank deposits carry a government guarantee up to $250,000 and the familiarity of the term deposit structure.

However, for the conservative investor looking for senior debt of quality corporate names, who is not keen on bond funds and the riskier hybrids, it’s worth considering a bond such as Lend Lease at 3.8% for five years. All bonds must be ‘seasoned’ for at least a year in the wholesale market for ASIC to allow the product to be offered as an XTB, which ensures there has been good price discovery.

Another advantage of XTBs is their access point via the ASX. Along with developments such as mFunds, over 100 ETFs, actively-managed listed funds and even private equity funds, investors such as SMSFs can implement a diversified portfolio directly on the exchange through their broker, without the need for a separate platform.

What are the downsides? Clearly, as with any bond, XTBs are tied to the performance of the underlying bond. Investors should consider Figure 1 and recognise that although these bonds are senior debt, they are not immune from the vicissitudes of corporate fortune.

The market-making role at the moment is carried out by Deutsche Bank, and liquidity has not been tested in the new structure. Although ACBC was established in 2013 and is the only company currently using this structure for bonds, its executives have significant fixed interest experience.

In summary, XTBs are a welcome addition to the supply of corporate bonds for the retail investor, and worth considering for those who want far less volatility in the value of their capital, while giving a reasonable income flow in the current low rate environment. Unlike a bond fund, the investor knows exactly what they own and when it matures.

Graham Hand is Editor of Cuffelinks. This article is for general education purposes and does not consider the circumstances of any investor.