Investment volatility is the talk of the town in the wake of the Brexit vote, nervousness about future US leadership and slowdowns in key sectors (commodities) and countries (China). Volatility is a challenge for anyone managing a portfolio. For example, large superannuation funds must manage their members’ capital in a way that helps their members answer questions like: When can I retire? How much can I expect to have to live on during retirement? How much investment risk do I need to accept in my portfolio to meet my retirement goals?

The investment journey

Discussions about the damage volatility can do to an equity portfolio tend to focus on the investor’s journey and how to smooth ups and downs to increase the investor’s confidence and reduce fear of loss, or serious diminution of capital. This is described as the ‘journey problem’ and a number of solutions are emerging to address this.

Simple responses include moving to risk-adjusted investments and favouring equity portfolios with innate defensive characteristics (e.g. investments with counter-cyclical or inflation-hedging qualities).

Sophisticated investors are increasingly considering more complex, targeted solutions like purchasing downside, tail risk protection, or volatility dampening. This can entail investing in derivatives that pay off during market downturn events or running a volatility strategy where the value moves in the opposite direction to the underlying equity portfolio.

What these responses are missing is the fact that volatility creates not just a journey problem for the investor but also what we might call a ‘destination problem’, where volatility creates a phenomenon called the ‘variance drain’.

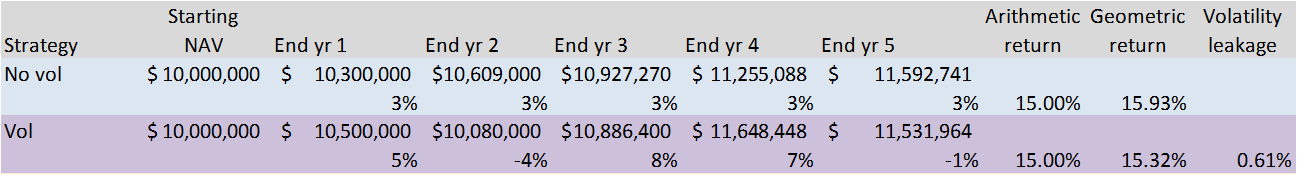

Variance drain is a drag on returns. It can be illustrated in the following example where we compare two hypothetical $10 million equity strategies. The two strategies have delivered the same arithmetic return at the end of a five-year period of 15%. One has experienced no volatility (‘No vol’ in the table), while the other has experienced volatility (‘Vol’) over this time period.

Click to enlarge.

Source: A Wide-Angle Lens View of Volatility: Managing the Journey and the Destination, Parametric Research, July 2016.

We see here that relative to the No vol portfolio, on a geometric (compounding, linked) return basis, there is a return drag from volatility (in our example) of 61 basis points, or $60,777, over the five-year period. Larger portfolios, higher returns, higher volatility or longer time periods can all potentially increase this ‘leakage’. The return drag from volatility is akin to other hidden leakages in implementation like fees, taxes and transaction costs that can furtively and assiduously eat away at an equity portfolio’s value over time.

Watch the journey and the destination

The principle of variance drain should remind superannuation funds and other sophisticated investors seeking to address volatility that it is a two-dimensional problem. A solution which simply removes some risks on the downside may indeed solve the journey problem but the costs associated with this solution can mean that the investor’s destination (in a superannuation fund’s case, member retirement balances) is compromised.

Portfolio managers need to avoid the return drag from either living with volatility or addressing it in a costly way, as well as smoothing the journey. While solutions which look to solve both problems are few and far between, they do exist and are generally constructed to reduce volatility in a cost-sensitive way; for example, by using out-of-the-money rather than in-the-money derivatives. They also seek to find a replacement source of returns to continue the important task of building the overall value of the portfolio. Such strategies take a ‘wide-angle lens’ view of volatility and can be found in the hands of a specialist implementation manager.

Raewyn Williams is Director of Research & After-Tax Solutions at Parametric, a US-based investment advisor. Parametric is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act 2001 (Cth) in respect of the provision of financial services to wholesale clients as defined in the Act and is regulated by the SEC under US laws, which may differ from Australian laws. This information is not intended for retail clients, as defined in the Act. Parametric is not a licensed tax agent or advisor in Australia and this does not represent tax advice. Additional information is available at www.parametricportfolio.com/au.