The bank hybrid party rolls on, although not in the heady issuing volumes of 2012. Regardless of the added risk of investing down the capital structure, retail investors facing term deposits of 3% cannot resist hybrids paying 5.7% issued by Australian banks. This week, it was Westpac’s turn to announce a new deal. Despite the equity-like characteristics of no fixed maturity date, no security, subordination, convertible to shares and non-cumulative payments (missed distributions are not recovered), the book build at 3.05% to 3.2% over the Bank Bill Rate (adjusted for franking) will drag in as much as Westpac wants. It is, after all, Westpac, and investors love the major banks.

It is a beautiful meeting of demand from retail investors for yield and the desire to raise cheap capital by banks, encouraged by a regulator who wants risk reduced in the banking system, and distribution agents who collect millions of dollars in fees. The only losers will be the investors if we have GFC-like conditions again, and even then, nobody who has held Australian bank paper to maturity has lost money. So the party music keeps playing and everyone is joining the dance.

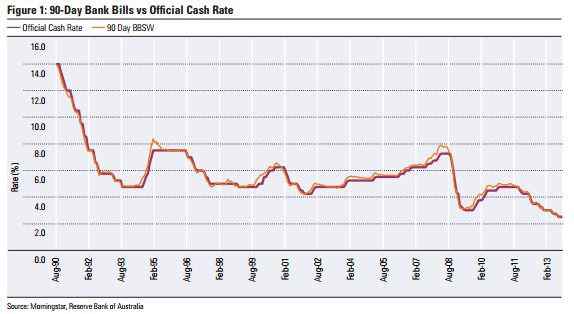

Although issuing volumes are down from levels of recent years, the margin is holding at a little above the 3% level. Morningstar’s April 2014 Monthly Review of Australian Debt and Hybrids shows the fall in the Bank Bill Rate against which the returns are set. The current 90 day Bank Bill Rate is about 2.7%.

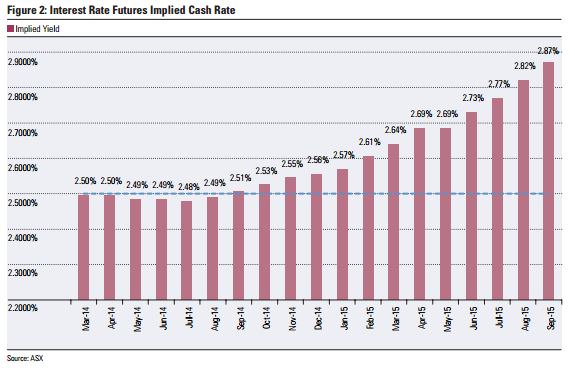

The Morningstar Review also looks at the futures market and implied rates until the end of 2015. No material increase in returns from hybrids can be expected soon.

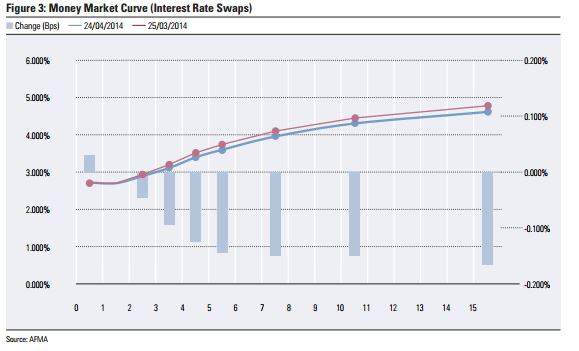

Looking further along the yield curve using long term interest rate swaps to 15 years, there’s little cause for celebration for investors relying on debt securities to live on. The current long rates are fluctuating around 4.5%.

In the absence of a ‘black swan’ event that pushes up rates unexpectedly, the search for yield will continue, and with it, support for bank hybrids and buying of solid dividend-paying shares including the banks.