The 2017 Vanguard/Investment Trends SMSF Report provides a glimpse into the challenges and trends faced by SMSFs, the largest subset of super fund assets with $645 billion under management in the $2.3 trillion of super assets. The Report surveyed 3,000 SMSF trustees, 470 financial planners and 900 accountants.

Three issues stand out from the Report: coping with the increased complexity of the super rules, the growing number of SMSFs with unmet financial advice needs and the latest changes in asset allocation.

Concern over rule changes

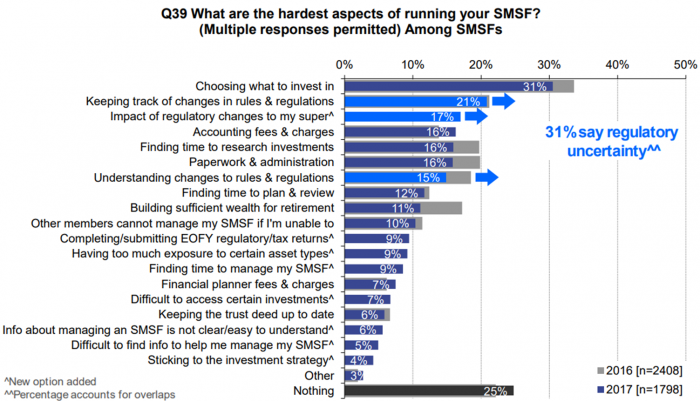

Choosing what to invest in remains the hardest aspect of running an SMSF, but keeping track of regulatory changes and how they impact investments are prominent worries.

Source: Vanguard/Investment Trends 2017 SMSF Report

More trustees are concerned about accounting fees and charges than financial advice fees, but the research also shows little concern about finding time to manage an SMSF, accessing investments or information, or sticking to an investment strategy.

SMSF appetite for financial advice

The use of financial advisers (defined to include ‘accountants for financial advice’ and ‘superannuation consultants’) by SMSF trustees has fallen steadily over the last 10 years, from 54% in 2008 to 38% in 2017, although this is up from 36% in 2015. These relatively low levels are surprising. The concern about regulatory changes highlights the need for expert advice as navigating the minefield of super regulations is not for the inexperienced or novice. The top barriers to seeking advice were lack of confidence in advisers' expertise (27%), cost (23%), limited range of advice (21%), previous poor experiences (21%) and lack of ethics (17%). Unmet advice needs was reported at record levels, and 52% of trustees say they are most likely to turn to a financial planner while 48% say an accountant. Among financial planners, 20% identify as SMSF specialists, 49% SMSF generalists and 31% as non-SMSF planners.

SMSF financial planners report their major challenges as compliance and demonstrating value (75%), competition from accountants (45%), working with accountant (40%) and legislative changes (27%). The relationship between the two professions is often strained, although a growing proportion of accountants have a relationship with a financial planner. While 56% of accounting firms report they employ an in-house planner, 30% say they refer clients to an external planner when necessary.

More SMSFs changing their asset allocations

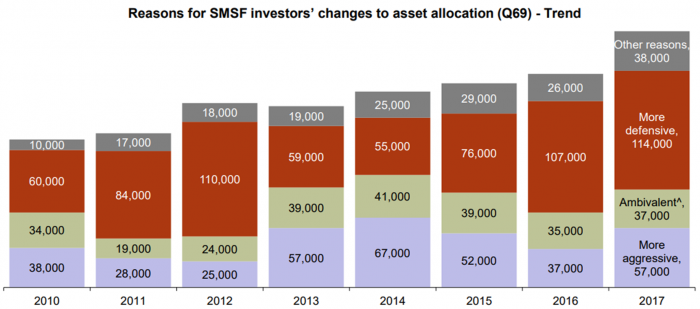

With historically low returns forecast for the next decade, SMSFs will be challenged in meeting their investment goals. More SMSF trustees than ever before are changing their asset allocations, with ‘more defensive’ outweighing ‘more aggressive’. SMSFs' stock market expectations for the next 12 months (excluding dividends) are not optimistic, at only 3.4% on average. As the table below shows, there is no SMSF consensus on whether portfolios should be more aggressive or more defensive.

Source: Vanguard/Investment Trends 2017 SMSF Report

Asset allocation by SMSFs

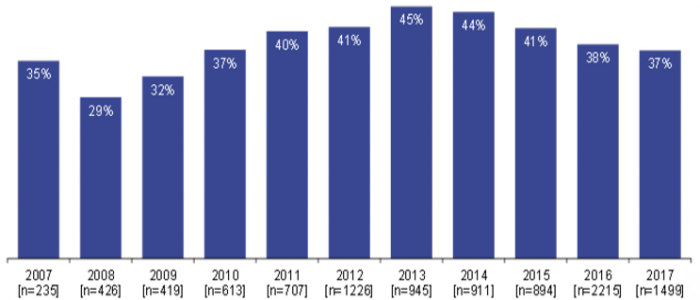

Cash retained a healthy share of allocations at 26% despite low rates. The table below shows direct shares (excluding managed funds and ETFs) continue to dominate allocations although down significantly in recent years. Residential property has remained steady at around 6-8% of SMSF portfolios for many years.

Proportion of SMSF portfolios in direct shares

Source: Vanguard/Investment Trends 2017 SMSF Report

Managed funds have risen over the years but still at a relatively low 10%, although the intention to use managed funds has risen from 35% to 45% in the last five years. The leading managed fund sub-category is international equities (actively managed), suggesting allocations will improve in future reports and SMSF trustees are finally hearing the message that they are underrepresented globally.

On the ‘intention to invest in the next 12 months’ measure, the leading category is ‘blue chip shares outside of managed funds’, followed by high-yielding shares. ETFs, small caps, infrastructure, bonds and A-REITS all rose over the last year, with term deposits falling away in recent years.

ETFs continue to attract new demand, with 38% of ETF investors holding ETFs via their SMSF. Again, international index and active ETFs top the ‘intention to invest’ score. While in a major growth phase, only 3% of SMSF assets are allocated to ETFs, with financial advisers the core drivers behind the growth.

The summary from the 2017 SMSF Report includes:

- Service providers have an opportunity to cover significant unmet needs, with investment selections and regulatory change the most prominent uncertainties. There is a large appetite for education and advice about strategy but not products.

- This need has not translated into increased use of financial planners, with trustees citing difficulties finding advisers who can meet all their needs.

- SMSF money is ‘on the move’, with asset allocation changes at the highest level observed, but both into more aggressive and more defensive categories.

SMSFs continue to grow with the net annual increase in numbers steady, although the number of new SMSFs established fell just below 30,000 in 2016 for the first time in five years.

If you're an SMSF trustee, how are your allocations changing, and have you outperformed the large funds which achieved 9.2% overall in FY2017?

Graham Hand is Managing Editor of Cuffelinks.