Physical gold has been one of the best-performing assets this year, rising 20% and currently sitting at about $1,750 per troy ounce. This continues a strong run dating back to the turn of the century, with the precious metal appreciating close to 9% per annum over this period.

Yet despite these solid returns, gold is still barely on the radar of most investors: less than 0.5% of total global pension fund assets are held in gold. In Australia, demand from SMSF trustees is rising, though it’s coming off a very low base. According to ATO data and recent asset allocation statistics from SuperConcepts, less than 1% of SMSF funds hold ‘other’ assets, of which physical gold is a small component.

With prices near their highs, some investors feel they’ve missed the opportunity to profit from this cycle, though banks like UBS are upgrading price forecasts and JP Morgan stated that gold had entered ‘a new bull market’ earlier this year. No one can be sure how long it will last, though the average bull market lasts for just over five years, recording gains of 385%, according to the World Gold Council.

Trading and storage

Physical gold can be bought and sold 24 hours a day, with trading premiums of less than 1% of the value of the metal, depending on which products, volumes, and bullion dealers you choose.

For SMSF trustees, it is best practice to stick to investment grade cast bars, rather than coins and tablets, which come with higher trading costs.

Gold can be stored in three different ways:

- Pool allocated metal: investors buy a claim on a pool of physical gold managed by a bullion dealer on behalf of all investors. There are no storage costs associated with this method.

- Secure storage: investors buy an actual physical bar (or bars) that they own. Annual costs for this range from 0.75% to 1% of the metal’s value.

- Private vaulting: physical bars are stored in the investor’s own vault. This can be done for as little as $252 per year, which works out at just 0.25% on a $100,000 investment.

Volatility and income

Price volatility and lack of income are legitimate concerns that any gold investor must be comfortable with. The volatility of annual returns for Australian dollar gold over the past 15 years has been around 12%, higher than that of traditional defensive assets like bonds, though lower than the volatility that equity market investors have endured over the same time period.

While it is true that gold will never provide income, traditional investments like term deposits also provide little income at the moment, and frustration with record low interest rates is forcing investors to look at alternative assets.

There are no guarantees, but if history is any guide, gold is one of those alternatives where prices tend to rise fastest in low ‘real’ interest rate environments, like the one we are in today.

The ‘real’ rate of interest is calculated by subtracting the inflation rate from the official overnight cash rate set by the RBA, and is currently sitting at just 0.5% in Australia (1.5% RBA rate minus a 1% CPI rate as at the end of June 2016). Since 1971 (when gold prices became free floating), the yellow metal has recorded average annual price gains in excess of 20% in years when the ‘real’ rate of interest was below 2%, outperforming both stocks and bonds in the process.

Hedge against equities

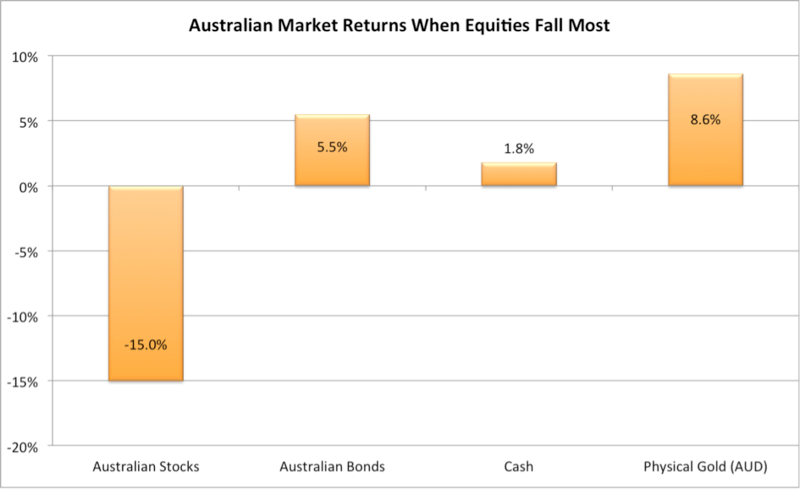

Gold historically performs strongly whenever the ASX is falling. In our book, Gold for Australian Investors, we analysed market returns for a variety of asset classes over a more than 40-year period, again starting in 1971. That study (inspired by a Q3 2015 research piece from AQR Capital Management, titled Good Strategies for Tough Times) found that physical gold was the best performing liquid asset in the 10 worst performing quarters for global equity markets.

This is captured in the chart below, which highlights the average performance for gold, as well as the average performance of Australian stocks, bonds and cash in those calendar quarters where global equity markets fell most.

Australian market returns when global equities fall most (calendar quarters since 1971)

Source: Gold for Australian Investors, Global Financial Data.

Obviously no one wants their shares to fall, but it does makes sense to have insurance against it happening, especially in an uncertain economic environment. Whether gold is still the highest-performing ‘risk off’ asset in years to come remains to be seen.

Central banks and emerging markets

SMSF trustees should be aware that the gold story is not all about rising demand from Western investors seeking a hedge against equities, or a cash alternative due to low interest rates. Gold prices will also benefit if consumers in emerging markets continue buying, with demand from these regions highly correlated to rising disposable incomes.

Central banks are now buying more than 500 tonnes a year, yet developing market central banks still hold less than 5% of their foreign exchange reserves in gold, versus a nearly 20% average for their advanced market counterparts.

No one can be sure what central banks will do next, but with over US$13 trillion in negative yielding sovereign debt, gold could become more attractive to emerging market central banks. Ken Rogoff, ex Chief Economist for the International Monetary Fund, stated in May this year that emerging market nations should increase their pace of gold accumulation, as the metal is both ‘highly liquid’ and ‘low risk’, both key criteria for reserve asset managers.

Jordan Eliseo is Chief Economist at ABC Bullion. This article is general information and does not consider the circumstances of any individual. Editor's note: This article focusses on physical gold, but gold Exchange Traded Funds are also available.