Recently the Australian Shareholders Association (ASA) invited The Perth Mint to host a webinar for ASA members entitled 'Gold - Where to next?'. The webinar looked at recent performance trends in gold, the outlook for investment demand, the potential short-term headwinds and tailwinds driving the gold price, and the key reasons investors, including SMSF trustees, are including a gold allocation in their portfolios.

During the course of the webinar, we asked trustees two questions relating to the outlook for investment markets.

In the first question on the potential for further equity market volatility, more than 90% of respondents stated they were concerned.

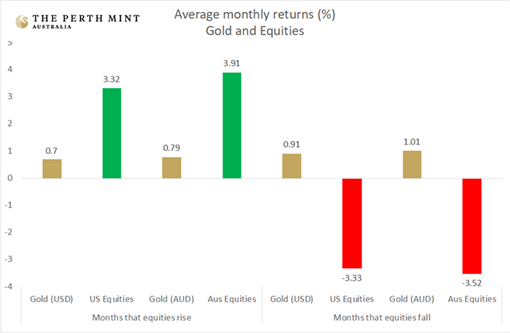

This is relevant for future gold demand, as market data from 1971 to 2019 reveals that gold has typically been the highest-performing asset in the months, quarters and years that equities suffered declines in value. It also happens to be positively correlated to rising equity markets.

The chart below shows the average returns for gold and equities in the months where equities rise, and the months where equities fall (1971-2019).

Source: The Perth Mint, Reuters

In the second question on the current cash rate of 0.25% and the outlook for rates with Australian 10-year government bond yields below 1%, more than 60% stated that this was a concern.

The anxiety regarding low interest rates will likely help drive gold demand in the future. Market history tells us that gold has been an outperformer in periods of low real interest rates, delivering annual average gains of more than 20% in nominal terms between 1971 and 2019 in the years when real interest rates were 2% or less.

Here are some of the questions from the webinar.

1. Is gold supply growing faster than demand?

Over the 10 years to the end of 2019, gold demand averaged just over 4,400 tonnes. Gold mine production averaged just over 3,200 tonnes over the same period — so gold mine supply is not outstripping demand.

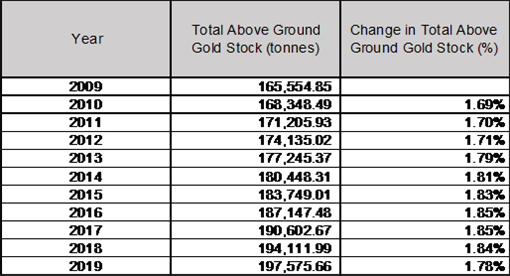

While gold production changes each year (it rose by 24% between 2010 and 2019), this newly-mined gold is only a small fraction of the existing stockpile.

This stockpile has been built over thousands of years as humans have found gold, mined gold, refined gold, and then either worn it as a display of wealth or held it (in the form of bars or coins) as an investment.

The table below illustrates the small impact annual mine production has on the total gold stock.

It shows the total above-ground gold stock on a yearly basis over the last decade and the percentage increase in the total gold stock on a yearly basis over this time.

Source: The Perth Mint, World Gold Council

The total supply of gold increases at a stable rate over time. Given that the price of any asset is determined by its supply and its demand, this understanding of gold’s stable total supply should make it clear to investors that the gold price is almost exclusively demand-driven.

2. How much gold should your portfolio hold?

As with all asset classes, the size of any allocation is a personal decision. This is affected by multiple factors including age, employment status, income requirements, existing asset allocation and tolerance for short-term volatility.

Some investors will have zero allocation. Others, including diversified managed funds, will have up to 25% of their portfolio in gold. Investors with allocations of this size view the metal as an essential element of a portfolio, due to the fact gold has delivered strong returns over the long-term, acts as a diversifier in a portfolio, and can hedge inflation risk.

While the Perth Mint can’t provide financial advice, many of our SMSF trustee customers allocate between 5% and 10% of their portfolio to precious metals.

3. How should investors buy gold, and what are the storage costs?

Much like equity investors have multiple vehicles through which they can gain their exposure (direct shares, managed funds, ETFs or LICs for example), there is no one-size-fits-all approach to investing in gold.

Physical bars and coins are the traditional method, and remain popular, especially for those who like to feel tangible wealth in their hands. These products typically come with higher trading fees due to the fabrication costs of manufacturing them.

Some SMSF trustees use a Perth Mint depository account, which allows trading any time of the day or night and also includes custody. Trading costs are typically 0.95% for trades between $10,000 and $100,000, and this fee declines for higher value trading.

Storage costs for depository accounts are 1% per annum for allocated bars (those bars you have direct legal title to). Unallocated gold, where you don't own the title to a specific bar but a portion of the physical gold held by The Perth Mint, has no associated storage costs.

The third option is an exchange traded product. There are three ASX-listed gold products, including Perth Mint Gold (ASX:PMGOLD).

4. Why hasn’t silver performed as well as gold recently?

While gold is often considered a safe-haven asset and monetary commodity, silver is seen as a quasi-industrial commodity. Almost 60% of the demand for silver comes from industrial use including photography and silverware.

As such, silver often tends to sell off during periods of heightened concern about global growth. The economic fallout from coronavirus saw the Goldman Sachs Commodity Index fall 40% in the first three months of 2020. As part of this, the price of silver dropped 20% over the same period.

5. Should Australian investors invest in gold hedged in US dollars rather than unhedged in local currency?

Investing in gold unhedged in Australian currency gives investors exposure to two factors:

- the movement in the US-dollar gold price, and

- the movement in the Australian-to-US dollar foreign exchange rate.

This introduces another risk factor for Australian investors, but also adds a potential source of return. Any fall in the Australia dollar relative to the US dollar will boost the local price of gold.

Many Australian investors are happy to have their exposure to gold unhedged in local currency. This is because they see it as currency diversification for their overall wealth, and typically earn their income in Australian currency and have exposure to Australian real estate, shares and cash in their portfolio.

Ultimately though, this is an individual choice.

6. Are gold miners a better investment than gold?

Just like buying shares in Australia’s big banks is not the same as buying an investment property (even though the majority of bank lending is directed toward residential property), gold and gold miners are different investments.

Physical gold is an exceptionally liquid asset (turnover in the gold market is typically more than US$150 billion per day), has zero credit risk, and has a long track record of protecting wealth in periods where equity markets sell off. However, gold does not provide an income stream.

Gold miners on the other hand can pay dividends, and can see their profits grow substantially in periods of rising gold prices, depending on a handful of factors including their ability to:

- maintain or grow production.

- maintain or grow the margins they make on their production.

Movements in gold mining company share prices are typically more volatile than movements in the gold price itself.

The market tends to treat gold as a defensive asset, while gold equities are typically considered to be growth assets. Gold companies fit within the equity component of a portfolio, due to the higher risk and higher return characteristics they typically display.

Jordan Eliseo is a Senior Investment Manager at The Perth Mint, a sponsor of Firstlinks. The information in this article is for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here. The Perth Mint offers a gold Exchange Traded Product (ASX:PMGOLD) which has a management fee of 0.15%.