Report on the inquiry into the implications of removing refundable franking credits

In September 2018, the Treasurer, Josh Frydenberg, asked the House of Representatives Standing Committee on Economics to inquire into the implications of Labor's proposal to remove refundable franking credits.

The Report was released last week.

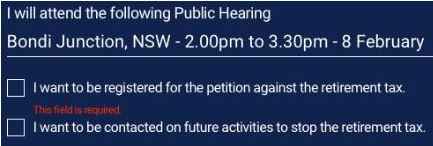

From the start, the Committee's work was controversial, and this is reflected in the strongly-worded Dissenting Report from the Labor members of the Committee (at the end of the full report). I already wrote an editorial on the ways the Government led by Tim Wilson used the parliamentary committee process to agitate against the policy. At one stage, the Committee required people attending the public hearings to register for a petition against the so-called 'retirement tax'. The Committee received 1,777 submissions, plus 1,108 'form letters', essentially as provided by Mr Wilson.

The Committee became a forum for hundreds of people to vent their anger at the loss of their franking credit refunds, usually retirees who were not wealthy and had planned for a self-funded retirement with the benefits of a full refund. For example, the Report records:

"Many affected retirees spoke of anxiety from the fear of losing a third of their income. There’s Karen’s story of ‘exhausting and soul destroying’ stress.

Others raised concern that abolishing refundable franking credits would compound the legacy of the gender pay gap. There’s Margaret’s story of historic sexism and how ‘too many people making decisions for us’ are ‘totally unaware of history and our lives’.

And then there are straight stories of financial hardship. There’s Michael’s story of medical challenges and how the removal of refundable franking credits will cause him ‘considerable hardship’."

Notwithstanding the genuine complaints that people had planned for their retirement legally under a prevailing set of rules, the Committee should be seen within a political context, especially in the month before a Federal Election.

There are only two recommendations: 1) not to remove refundable franking credits, and 2) any policy should be part of an equitable package of tax reform.

Highlights of the Report

Tim Wilson's summary rightly points out that wealthy people with large SMSFs are less likely to be affected by the loss of refunds.

"It also does not take account of the introduction of the transfer balance cap in the 2017/18 financial year that applied a 15 per cent tax rate on income earned on balances above $1.6 million. These funds will continue to enjoy the use of franking credits to fully offset their tax liability, while those under $1.6 million will not."

The Report highlights the impact on some lower income earners who currently receive a refund.

"Abolition of refundable franking credits is fundamentally regressive. Australia has a tax free threshold of $18,200 for workers, yet the abolition of refundable franking credits would apply an effective 30 per cent tax from the first dollar earned."

There is also a problem with the data, as the Report uses 2014/15 numbers which do not reflect the introduction of the $1.6 million transfer balance cap on 1 July 2017. There is far less in the pension phase of super than the Report suggests. Nevertheless, the Report quotes the Alliance for a Fairer Tax System data which stated that in 2014-15, over half of those receiving cash refunds had incomes below $18,201, and 96% had taxable incomes of less than $87,000.

Much of the Report quotes individuals who will be adversely affected, and financial services groups defending their members.

The revenue implications are huge. The independent Parliamentary Budget Office (PBO) estimates the policy will collect $5.2 billion in 2020-21 and $48.6 billion by 2027-28.

For the record, in its conclusion, the Committee:

" .. is of the view the policy is inequitable, deeply flawed and the timeline is rushed ... the ALP’s policy will unfairly hit people of modest incomes who have already retired, and who are unlikely to be able to return to the workforce to make up for the income they will lose."

The Dissenting Report

The three Labor members of the Committee produced a long Dissenting Report, with their main argument being the inequitable nature of franking refunds. Their comments particularly target SMSFs:

"This analysis from the PBO shows that 92% of taxpayers in Australia did not receive any cash refunds for excess imputation credits in 2014-15. 90% of all cash refunds to superannuation funds accrued to SMSFs (just 10% went to APRA regulated funds). Labor understands that this is despite SMSFs accounting for less than 10% of all superannuation members in Australia.

The PBO analysis indicates that of all excess imputation credits refunded to SMSFs in 2014-15, 50% of the total benefits accrued to the wealthiest 10% of SMSFs by fund balances (which had balances in excess of $2.4 million). The top 1% of SMSFs by fund balance received a cash refund of $83,000 (on average). Labor's analysis shows that this is an amount greater than the average full time salary."

Where does that leave us, other than with two sets of political statements?

Shadow Treasurer Chris Bowen shows every sign of toughing it out with the policy and taking it to the next election and beyond, but if Labor wins the Lower House, it is unlikely to control the Senate. Bowen will argue he has a mandate but he will probably need to relax parts of the policy to gain the numbers to pass the required legislation. Changes such as allowing the first $5,000 of excess refunds would still allow him to claim he has targetted the wealthy.

Footnote on the election campaign

Scott Morrison kicked off the Governments campaign by quoting a $387 billion number for for 10 years of higher taxes under Labor. This is the break up:

- $230 billion in personal income tax by not adopting the Coalition's new tax thresholds in 2022 and 2024.

- $57 billion in stopping refunds for excess franking credits.

- $34 billion for reducing the threshold to $200,000 for the superannuation surcharge and lowering the non-concessional contributions cap to $75,000.

- $31 billion to stop new negative gearing arrangements for existing dwellings, plus reducing capital gains tax concessions from 50% to 25% from 1 January 2020.

- $27 billion for taxing trusts

- $6 billion for the 2% deficit levy on high income earners

- $2 billion from capping fees at $3,000 for managing tax affairs.

Graham Hand is Managing Editor of Cuffelinks.