The global landscape for retirement investing is changing. Previously the focus was on investing for retirement – accumulating assets for future use – but as Western and Asian populations age, post-retirement investing is becoming more important.

However, the economic backdrop has shifted considerably. The huge economic shock from the COVID-19 outbreak means that interest rates are likely to stay even lower for longer; sources of income previously seen as reliable, such as dividend income from banks and property rentals, have turned out to be vulnerable. Dividend cuts have impacted income funds, while some property funds have been gated, leaving investors unable to access their money.

These factors could have a significant impact on the willingness of retirees to take on investment risk. Amidst such uncertainties, there has never been a greater need for high quality, affordable investment advice to support investors and guide them to suitable portfolios.

Investor needs differ post-retirement

Investor needs in the post-retirement phase are quite different from the accumulation stage. At Capital Group we have a saying, 'Retirement changes everything'. Saving for retirement usually means investing regularly, typically monthly through payroll, into a defined contribution plan. For most people it is of little relevance to their day-to-day life, just something out there in the future.

But in retirement an individual’s savings and the income that can be generated from them are crucial. Without a salary coming in, your retirement income pot is in many cases the focus of your finances. In the accumulation phase most individuals have the straightforward objective of capital appreciation. But in the decumulation phase, investors will typically look to draw an income from their assets but at the same time preserve capital, and if possible, enjoy some continuing growth in capital.

How they organise their investments after retirement will depend on several factors.

Firstly, what other income and assets they have. Do they have secure income from the state and from defined benefit plans? Do they have non-secure income from any remaining employment earnings? and from non-retirement investments including property rentals, for example? The extent of these additional income flows will vary enormously from individual to individual.

Secondly, what is the pattern of expenditure in retirement? Do they have outstanding mortgages or other debts to pay off? What is their lifestyle expectation for retirement?

Investing in retirement needs to account for more unknowns. Investors will ask themselves questions such as “How long will I live? Is there a risk I will outlive my savings? Do I need to set aside funds for emergency expenditure such as a new roof for the house or even for nursing care in later life?”

Post-retirement, there are three principal risks: sequencing risk, longevity risk and inflation risk. Sequencing risk is a particular problem for retirees. If I make withdrawals from my retirement account in down markets, I run the risk of consuming my capital at an accelerated rate and running out of money sooner than expected. So, volatile assets carry more risk in retirement, yet at the same time I still need real assets, which can protect me against inflation and have the potential for growth in capital and income over maybe 20 years+ in retirement.

A framework to tackle the challenge

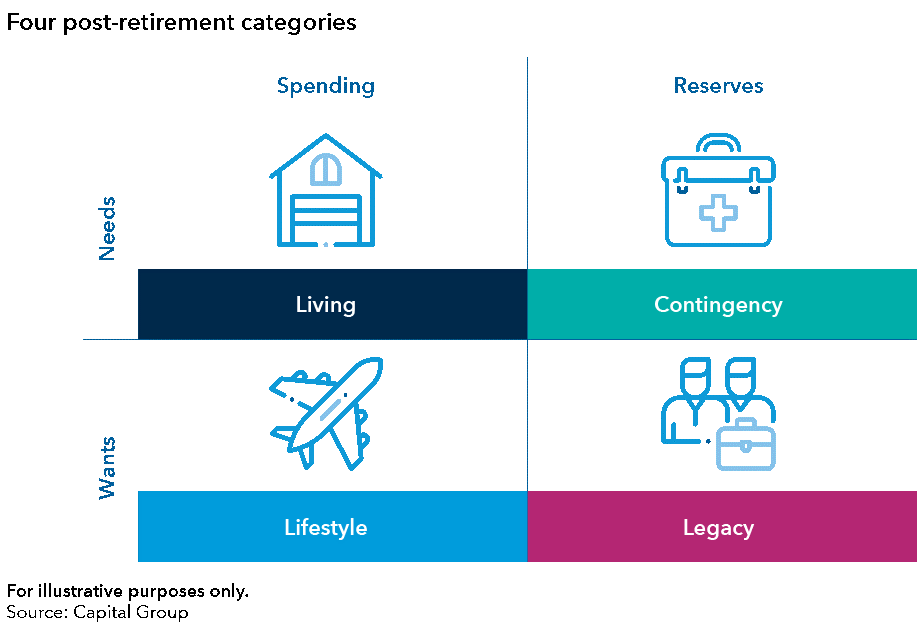

Capital Group has developed a framework for thinking about investing in retirement, which utilises a simple 'four-box' approach, shown below.

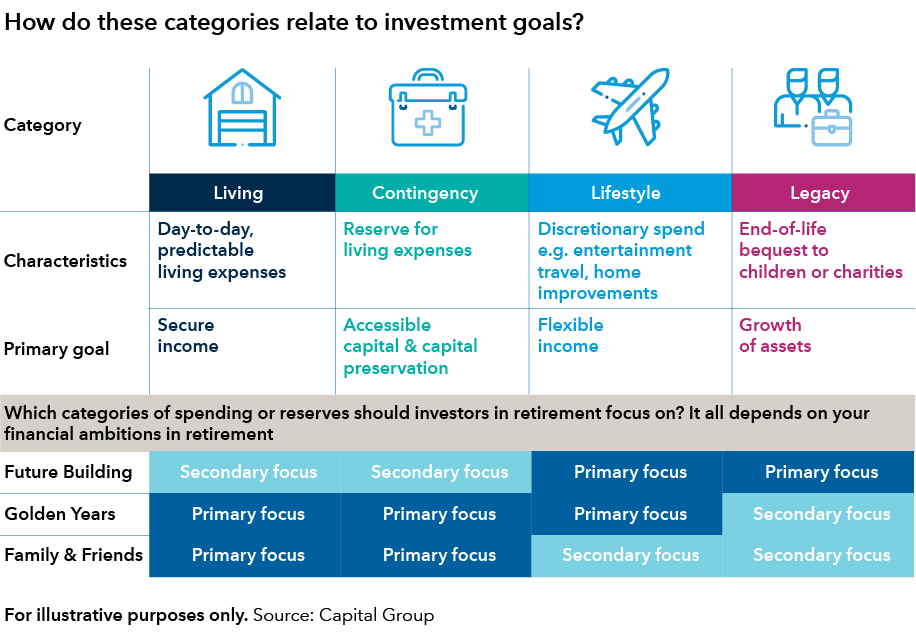

There are two categories of spending, living expenses (the basics) and lifestyle expenses (discretionary spend). And two categories of reserves – a contingency fund (rainy day money) – and a legacy pot for the next generation or charities.

Each of these spending or reserve categories can be matched up with an appropriate portfolio designed with retiree needs in mind. Portfolios designed to fund living expenses will tend to be fairly conservative reflecting the fixed nature of these outgoings, portfolios supporting lifestyle expenditure can be more balanced as expenditure in this category is more discretionary. Contingency reserves will be largely cash or short-term bonds whilst legacy reserves should be primarily assets that can protect against inflation over time.

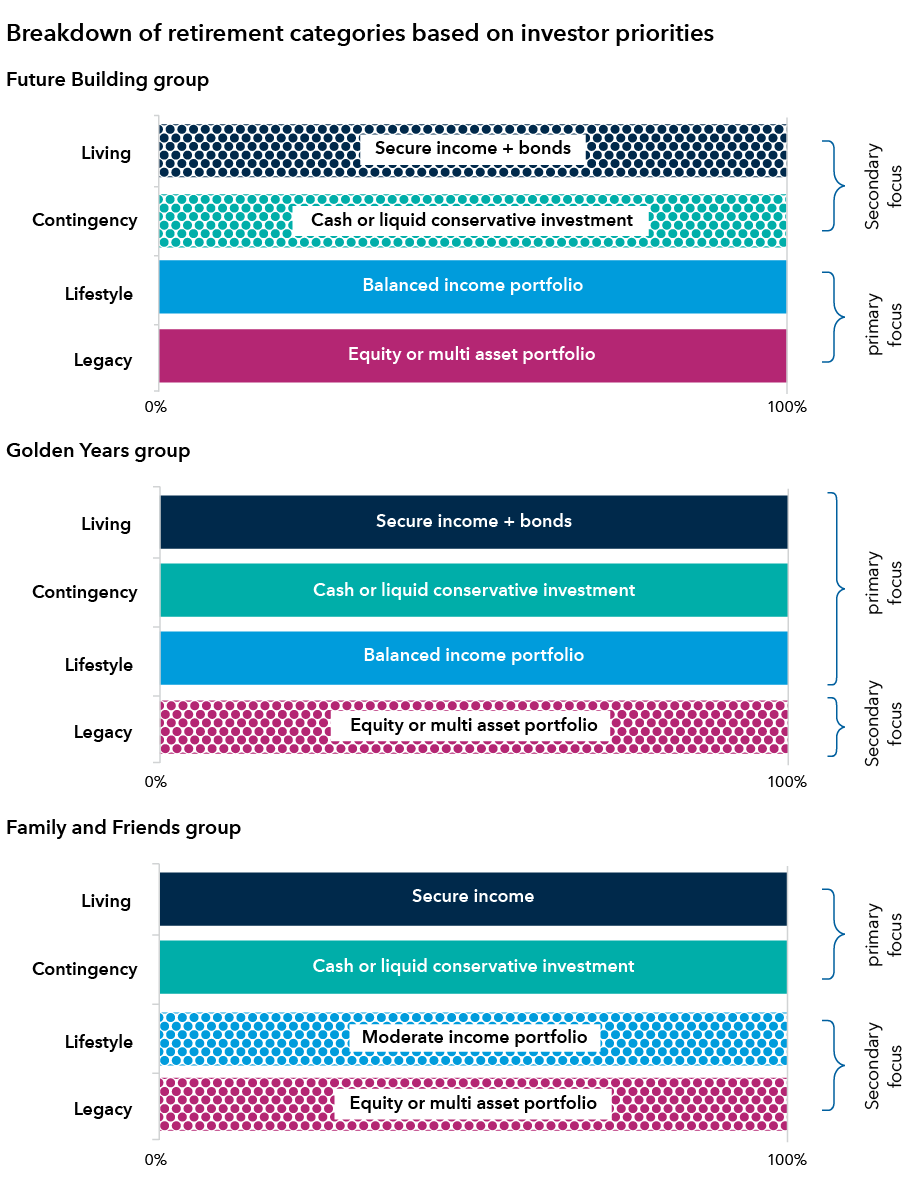

In retirement, investors tend to have divergent needs and wants. In the table above, these have been simplified into three broad groups of investors.

Future Building – this group of investors will consist of those looking to build a financial legacy for the next generation. Typically, they will have already secured their income streams for everyday expenses and have enough liquid reserves to deal with most emergencies.

Golden Years – this group of investors want to spend their retirement getting out and enjoying the world. They need to pay attention to funding their day-to-day expenses as well as lifestyle needs but are less focussed on leaving a legacy other than their main home.

Family and Friends – this group of investors is focused on enjoying retirement with family and friends. They will prioritise spending on everyday needs and putting money aside for a rainy day with less emphasis on lifestyle spending.

So, what steps should investors in each of these groups take, working with their advisers, to construct portfolios that are tailored to their individual needs?

Identify what investment types are appropriate for each category

Defining each category by its ultimate investor goal provides greater clarity in identifying the appropriate asset, whether to provide a secure income stream, capital growth, or capital preservation.

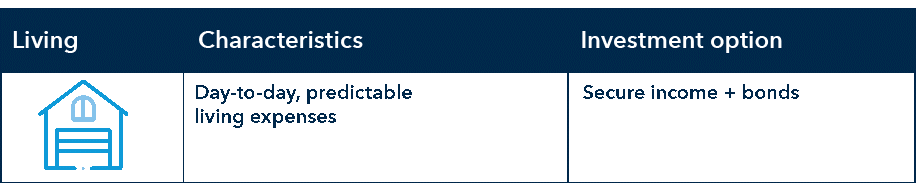

Living

Predictable, day-to-day living expenses need to be supported by a regular flow of secure income. For many investors, this could be covered by the state pension, an employer-sponsored defined benefit income stream or an annuity. These income streams are secure, consistent and are a good match for regular expenses that don’t tend to vary from month to month.

For investors looking to supplement these costs from their own pension account, their instinct may be to default to cash. However, returns on cash are unlikely to keep pace with inflation, and drawdowns from an asset class that has neither the potential to grow in value nor provide a significant income stream can deplete capital reserves aggressively.

A more appropriate investment option could be a supplementary allocation that is largely made up of bonds. Fixed income exposure may work best to achieve sustainable withdrawal rates with significant potential for capital preservation.

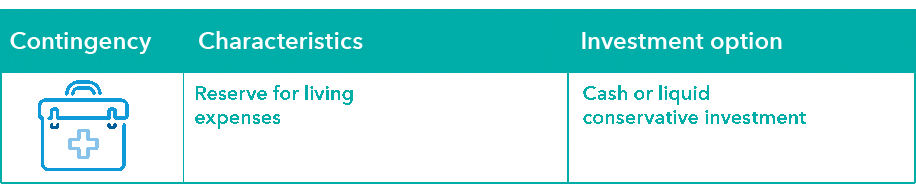

Contingency

Emergency funds are not intended to provide income flows to cover spending needs, therefore yield isn’t necessarily a consideration. However, to rise above today’s negligible interest rates, short-term, high-quality bonds, which offer good liquidity, may be a supplement to pure cash holdings.

Contingency funds can also be helpful to mitigate sequencing risk. The benefits of having a liquid source of funds have been made clear in the recent bout of market volatility. Investors with contingency funds could have used those in peak volatility periods to avoid making withdrawals when the market was at its most depressed.

Lifestyle

The discretionary spending covered in the lifestyle category doesn’t have the same need for secure, predictable income as day-to-day living expenses. Therefore, it lends itself to assets whose income flows and capital values are variable. Typically, this could be a mix of equities and bonds.

However, retirees may have different tolerance for volatility and capacity for loss. Generally, investors with greater financial flexibility tend to have greater tolerance for variability in returns and this can be reflected in the underlying asset mix.

Taking our investor groups at the top of this section those in the Future Building and Golden Years groups are more likely to be able to tolerate greater variability in returns, and therefore might prefer a higher proportion of their lifestyle assets in equities, with a smaller amount allocated to fixed income investments. A balanced income portfolio has the potential to provide income from both equity dividends and bonds, coupled with greater potential for capital growth.

For investors in the Family and Friends group, a more moderate allocation to equities might be appropriate as a higher allocation to bonds would help provide a greater level of consistency in returns, albeit this level of return may be lower over time.

Legacy

Investments intended for legacy purposes are mainly the preserve of those with greater wealth, although a broad range of retirees in many countries will seek to treat their homes as legacy assets. For individuals treating their primary residence as a legacy asset, an investment solution may not be necessary. However, for those looking to build a separate legacy investment portfolio, equities and multi-asset funds could be suitable candidates for this category.

Customisation without complexity

Having identified examples of appropriate investments for each of the four categories – living, lifestyle, legacy and contingency – we now have a clear framework to assemble post-retirement investment options.

The graphs that follow show what a standard asset framework might look like from the perspective of each of our investor groups. They show the different building blocks available for delivering appropriate solutions.

We believe the benefit of using this retirement investing framework is that:

- it provides a clear link to real-life investor needs and wants

- the suggested portfolios are specifically designed to support retirement investing goals

- the framework can allow for tailoring to specific individual needs by varying the proportions of an individual’s portfolio in each category, and

- where an investor uses an adviser the framework is straightforward and can be integrated into overall retirement planning.

The framework is intuitive and flexible enough to create investment options tailored to investor needs. By matching appropriate investments with specific spending categories, it becomes much clearer where investors could focus their attention and, with the help of their adviser, refine their approach to retirement.

Philip May is Director of Retirement Income Solutions at Capital Group, a sponsor of Firstlinks. This article is neither an offer nor a solicitation to buy or sell any securities or to provide any investment service. The information is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any of the information you should consider its appropriateness, having regard to your own objectives, financial situation and needs.

For more articles and papers from Capital Group, click here.