Over the last three years, there has been a significant shift towards the adoption of new and emerging technologies leading to a widening mix of advice, administration and investment practices among wealth managers.

In the face of competitive market pressures, constant regulatory change and escalating data volumes, it is critical for wealth management firms to leverage technology and the underlying data creatively to improve service quality, personalise customer experiences and create platforms for smart processing.

How mature are your digital operations capability?

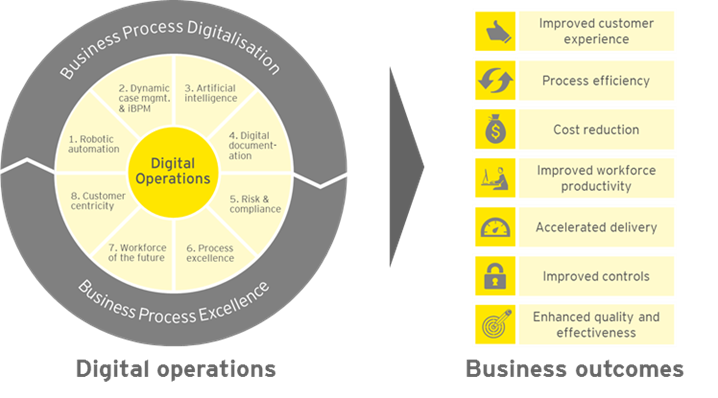

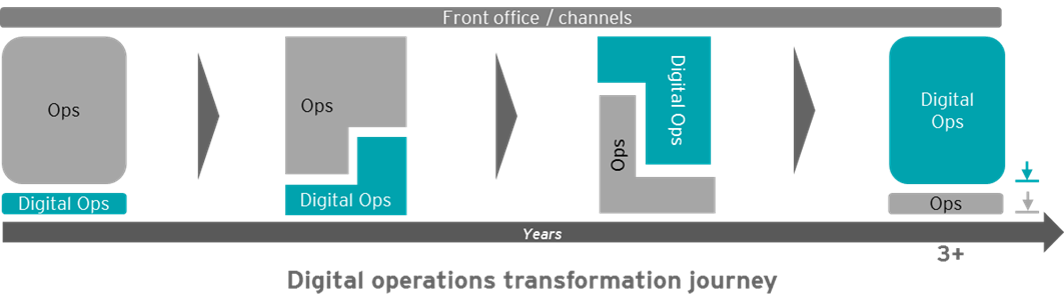

Wealth managers need to define and firmly establish digital operations as a capability within their businesses. EY’s assessment framework of digital operations measures nine key dimensions that drive business benefits and outcomes.

One of the key drivers to the speed and adoption of digital operations is the maturity of the Robotic Automation solutions. There are two types of solutions in this marketplace: Unassisted Automation and Assisted Automation.

Both types of Robotic Automation can deliver significant time, processing and error reduction and service quality benefits to many areas of the wealth and asset management value chain.

For instance, Assisted Automation (often called Robotic Desktop Automation or RDA) could be used to augment workforce productivity. Unassisted Automation (often called Robotic Process Automation or RPA) could be used to reduce operational processing windows, operating costs and high-cost, low-value tasks.

Robotic Automation can also drive digital operations functionality, for example, by acting as a keystroke surveillance agent, enabling workforce intelligence and improved employee performance via data-driven coaching. Or it could be used as an engine to work alongside or supplement front-end robo-advice platform offerings.

How can software robotics provide assisted advice with front-end robo-advice?

Keeping a customer’s best interests at the centre of an advice model is essential to wealth management success. Risk management in advice is also under increasing scrutiny from regulators. In the superannuation space for example, this message was highlighted recently by the Productivity Commission.

ASIC also published a review earlier this year, as part of its Wealth Management Project, identifying areas for improvement in how advisers are overseen within large organisations:

- “Failure to notify ASIC about serious non-compliance concerns regarding adviser conduct

- Significant delays between the institution first becoming aware of the misconduct and reporting it to ASIC

- Inadequate background and reference-checking processes, and

- Inadequate audit processes to assess whether the advice complied with the ‘best interest’ duty and other obligations”.

Robotic Automation can help regardless of whether a robo-advice platform already exists within the organisation. One example of this is the data analysis and data crunching work used to prepare a Statement of Advice with a risk management overlay. Robotic Automation solutions can automate a number of these steps, such as dealing with data points, drawing information out of multiple legacy systems, stitching it together and providing an end to end audit trail.

EY’s recent report, Robotics and its role in the future of work, found that the gains from automation can be considerable, but that even more is possible when robotics and digital are brought together. Robotic Automation can tap into shadow or legacy IT systems where it may otherwise be hard to create a new integration point, to feed a greater number of services or data points into the robo-advice channel.

What about investments and administration?

Non-indexed and unstructured investment instructions from different sources can lead to inefficiencies, errors and service quality reductions as data is reassembled into a variety of models to understand exposures, risks, performance and attribution.

Many organisations face the challenge of managing critical information across a mix of core and secondary systems, requiring highly-skilled staff to undertake repetitive activities. Robotic Process Automation could be used to operate around the clock, managing data collection, augmentation, and analytics and reporting. This model would result in only exceptions needing to be escalated to skilled staff as required.

It’s an especially good candidate where a set of steps occur each every day which is highly repetitive, rules-based, digitally triggered and based on structured data.

Where will your robotics journey take you?

Driving a Robotic Automation agenda into advice, administration and investments functions can help improve costs and significantly relieve pricing and margin pressure. The benefits, such as moving towards 100% paperless, can also be greatly accelerated through the use of a range of other capture and workflow tools.

Competing in the digital age means doing things differently. Wealth managers need to be laser-focused on data management and analytical strategies, using a data-driven approach to derive key outcomes and measure the maturity of their digital operations capabilities.

Jason McLean is the EY Oceania Wealth and Asset Management Advisory leader. Andy Gillard is the EY Asia-Pacific Digital Operations Leader. The views expressed in this article are the views of the author, not Ernst & Young. The article provides general information, does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Liability limited by a scheme approved under Professional Standards Legislation.