We believe those who view the exceptional profit upgrades from domestic consumer-related stocks over the last few months as being extremely short-term should consider the current spending capacity – and options for spending – of the Australian consumer.

We believe there is a high level of spending capacity left in the domestic consumer sector which is supportive of consumer-related stocks outperforming for a longer period than is factored into current share prices.

The consumer has vastly higher savings, increased wealth via a buoyant real estate and share market, reduced spending options with the removal of international travel and relatively low unemployment on a global scale. Combined, we think these factors put consumers in a strong position for increased spending in 2021 and further into 2022. Couple this with a level of pent-up demand, and we see this as an excellent setup for domestic consumer stocks, either via retailers or domestic travel-related businesses.

Unprecedented retail spending

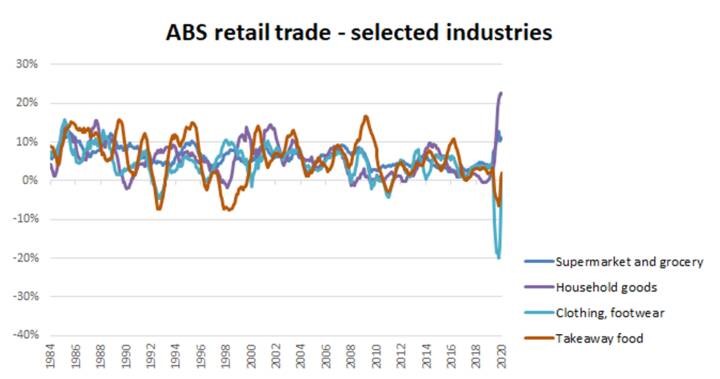

With increased time spent in lockdown, consumer spending patterns shifted at an unprecedented level, with an initial focus on pantry stocking, setting up the home office and turning to cooking and home improvement jobs. Key outperforming categories were liquor, food and household goods, with the services sector of restaurants and cafes hit the hardest, with many of these changes the largest seen on record.

The consumer was forced to reallocate spending during COVID-19 in a short time period, with many out-of-home spending options removed overnight. Emerging from COVID-19 with limited long-haul travel options, there has been a sustained increase in auto related spending largely related to driving holidays.

Source: ABS, AMP Capital

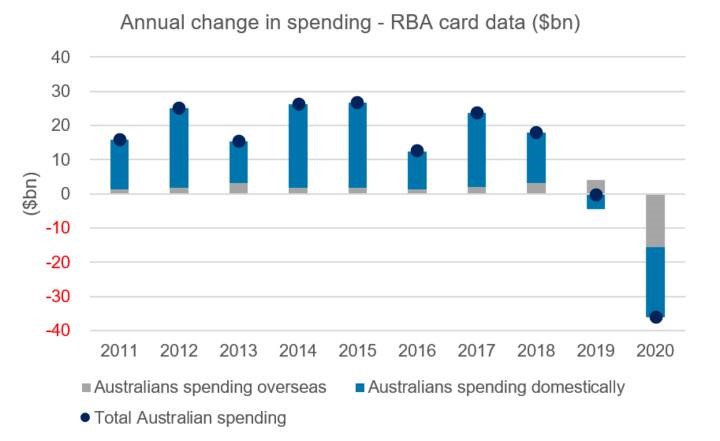

Limited spending options

Reduced spending options from COVID-19 via limited entertainment and travel – which also drove the unprecedented reallocation in retail spending – have resulted in Australians spending roughly $36 billion less in 2020, with $13 billion of the reduced spend coming from a lack of international travel. Note that international flights and accommodation booked through local travel agents or airlines are not captured in the $13 billion of international spend and therefore this number likely significantly understates the reduction in international travel spend.

Source: RBA, AMP Capital

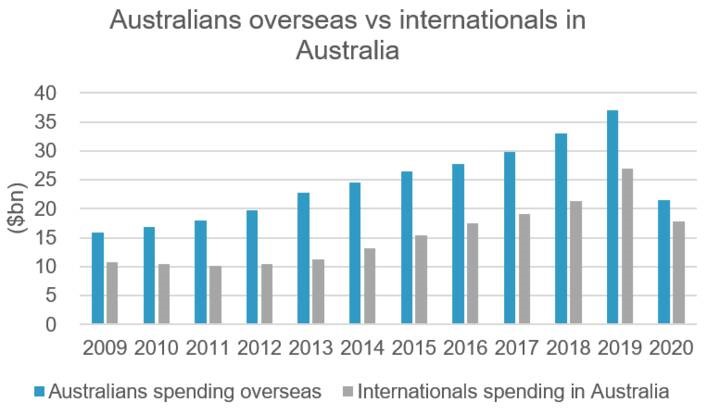

Additionally, Australians travelling overseas spend more than international visitors spend in Australia meaning there is a short-term net benefit to the domestic economy from the cessation of overseas trips.

Source: RBA, AMP Capital

There is a risk the return to international travel once borders re-open may be slow or more difficult than pre COVID-19 given the risk of unexpected border closures, increased or inconsistent documentation requirements across different countries, as well as a potential period of limited travel corridors providing consumers with reduced travel options. This suggests a longer reallocation of consumer spending than may likely be anticipated by the market.

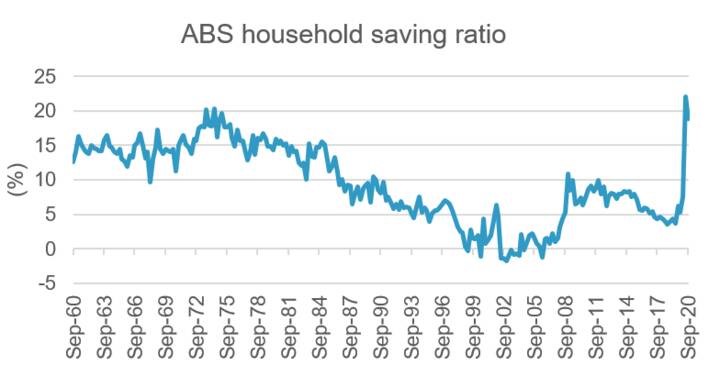

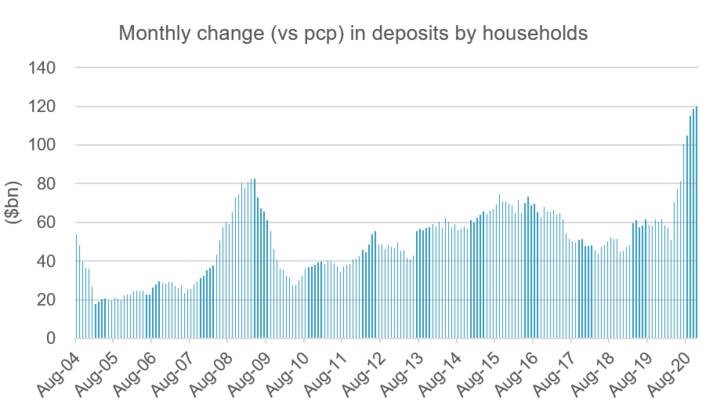

Record savings

The limited options for spending during the COVID-19 pandemic coupled with unprecedented government stimulus has resulted in consumers saving at record rates as evidenced by the household savings ratio which is at an all-time high.

Source: ABS, AMP Capital

Looking at savings in dollar terms using APRA data shows the huge spike in deposits, with the total level of household deposits increasing by $113 billion since end of 2019. For context, ABS retail trade data showed total retail trade spending in 2020 of ~$343 billion, meaning consumers have roughly one third of the total annual national retail spend sitting in additional bank deposits.

Source: APRA, AMP Capital

Concluding thoughts

In summary, while there are always risks to consider during a pandemic, we believe there are important investment themes this year in Australia:

- Consumer savings are at record highs and the economic environment is strong.

- There is pent-up demand from the consumer.

- Australia’s management of the virus is world leading, but international travel is unlikely for some time.

Kent Williams is a Small Caps Analyst at AMP Capital, a sponsor of Firstlinks. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. For a list of sources and important disclaimer information, see the original article here.

For more articles and papers from AMP Capital, click here.