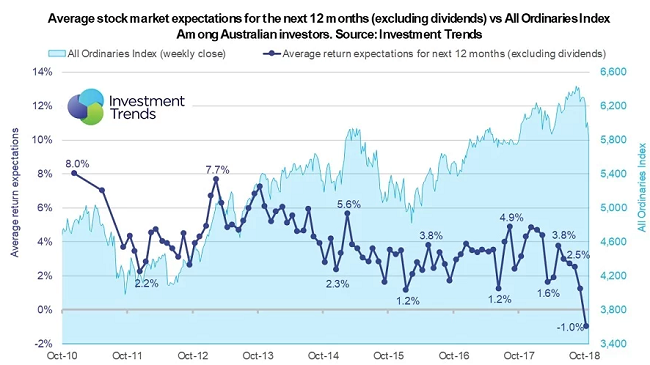

According to the Investment Trends October 2018 Investor Intentions Index, Australian retail investors’ stock market return expectations have slipped into negative territory for the first time since tracking began in 2009.

Each month, Investment Trends asks investors what return they expect from the Australian stock market, excluding dividends, over the coming 12 months. In October 2018, the average capital gain expectation of investors fell to -1%, down from +1.2% in September and +4.7% in January this year. For the first time, on average, investors expect domestic markets will be lower in 12 months’ time than where they are today.

Click to enlarge

Investors believe we’re in a bear market

By way of comparison, when asked to rate their level of concern with global financial markets, in February 2018 the average investor was the least concerned since the GFC. In fact, throughout 2017 investors became increasingly desensitised to both market volatility and global events.

Fast forward to October 2018 and the picture is very different with concern levels reaching a 22-month high. While recent volatility has played a hand in driving this pessimism, investors are now more concerned about major global issues.

Geopolitical events cast a darker shadow over investors’ outlook

When asked what they are most worried about, investors cite:

- the current White House administration (46%)

- tension between the world’s major economies (40%)

- global debt levels (33%)

- China slowdown (32%), and

- recent share market volatility (27%)

Whether directly or indirectly, Australians are concerned about the economic outcomes of the current White House administration and the trade policies being implemented both by the US and in response to them.

With capital gain expectations for the Australian stock market turning negative at the same time that the local property market has cooled, for financial services there’s a big job to be done to convince Australians to stay invested through the current cycle.

Recep Peker is Research Director at Investment Trends.