I’d like to suggest to readers that there’s more risk in those global large cap allocations in your portfolios than you might think. And yes, I’m the portfolio manager of a global microcap Fund. I have a vested interest, but bear with me.

I’m not saying dump your large cap exposure, I’m simply advocating for a little more diversity than most investors currently have. Here’s why.

The end of the cycle?

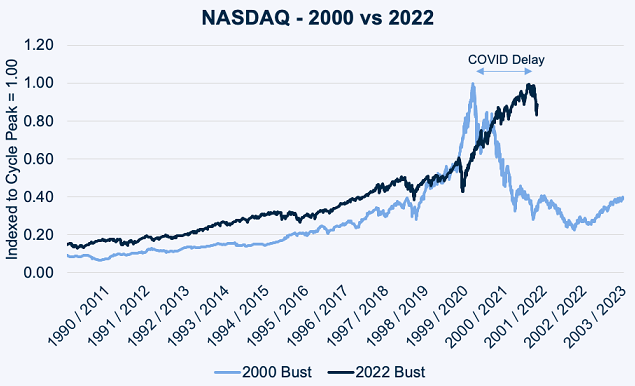

Right now, there are various data points that suggest we are approaching the end of a significant market cycle. One I believe in has been extended by COVID-19. In the chart below, I have taken the decade-long run-up of the NASDAQ during the dotcom era and compared it to the run-up of the NASDAQ in the current growth cycle (calling a November 2021 cycle peak).

The run-up is almost identical, but for a global pandemic pushing the peak back 12 months.

Source: Bloomberg, Spheria

People say dotcom was different. They say it was ridiculous. But there’s been many a ridiculous phenomenon during this cycle – profitless tech on nose-bleed multiples, cryptocurrencies, SPACs, war-time-like fiscal stimulus, negative real interest rates.

Now, with many large cap tech names selling off materially in recent months, it appears 'risk off' (that is, reducing risk in portfolios) is back - an awakening perhaps for many investors who’ve been enthralled by an enduring period of easy money.

Many remain asleep to concentration risk

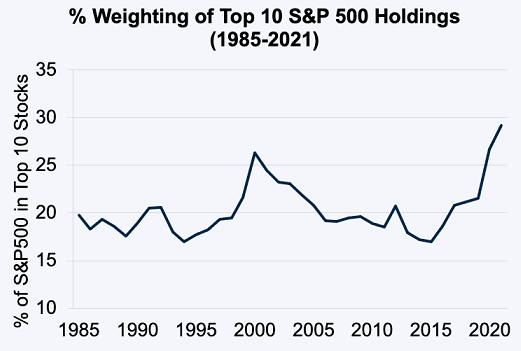

Concentration risk is often mentioned in Australian equities – “Too many Australian investors are overweight the big 4 banks, BHP and Telstra”. But less is spoken about the concentration risk investors are currently taking in global equities.

The impact of the proliferation of passive investing has been immense, with passive now around 55% of US equity funds. Throughout the 90s, it was 5%. In my view, there is no doubt that passive investments are the main conduit in which the tidal wave of Federal Reserve QE has entered the market. The result, as you can see below, is the most concentrated market in US history.

Source: Morningstar Direct, Spheria

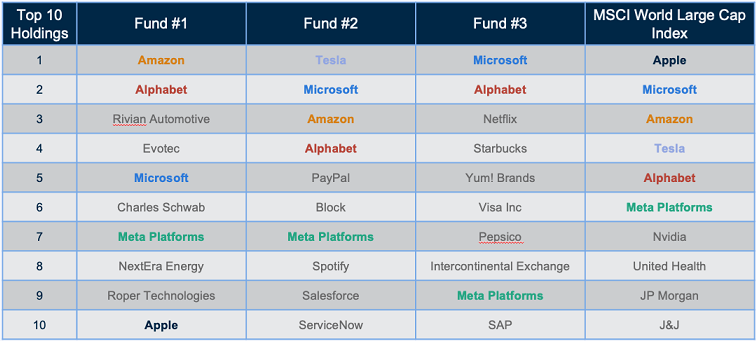

Furthermore, in the funds management industry here in Australia, the concentration persists. Here I have compared three popular Australian actively-managed global equities funds. We see many crowded trades and much homogeneity.

Source: MSCI, Morningstar. As at 31 December 2021

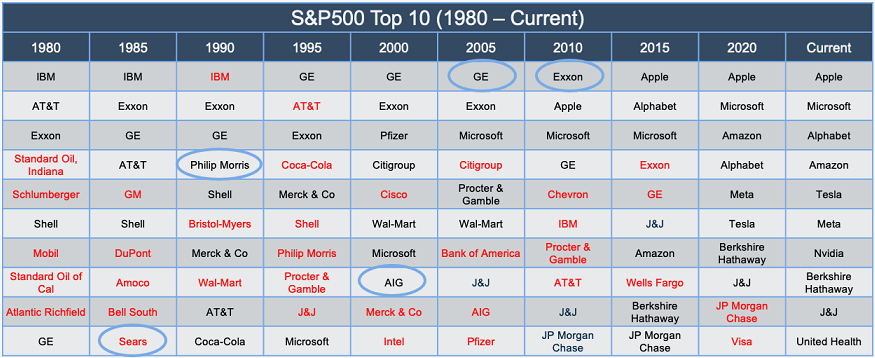

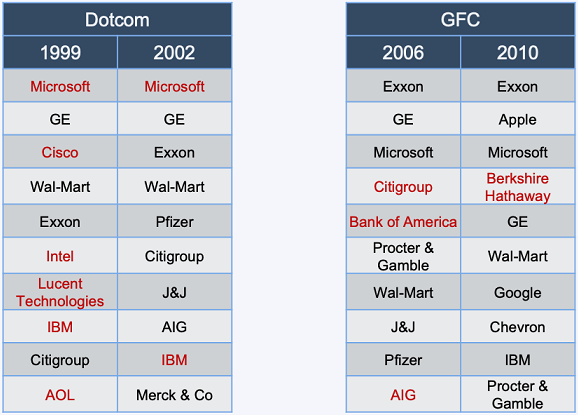

Many of these companies are exceptional businesses but the perception that large caps are too large to fail must be challenged. Take a look at the S&P 500s Top 10 over time. It needs little explanation. History shows it’s not easy to stay at the top of the pile.

Source: S&P Dow Jones, Spheria

Where to invest as the cycle turns?

Checking some well-known recent market turning points, the table below shows at the dot-com peak, the market was overweight tech. At the GFC, it was financials.

Source: S&P Dow Jones

The question is what are investors overweight today as the cycle turns?

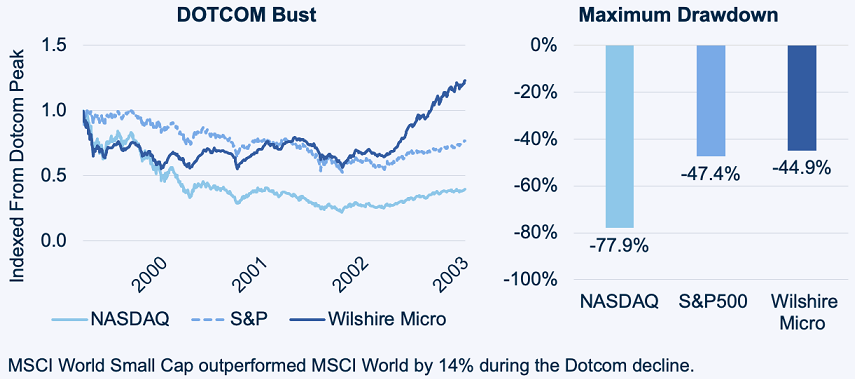

There’s strong historical evidence that allocating to stocks outside of the big end of town can strengthen portfolios at this time. The MSCI World Small Cap Index outperformed the larger MSCI World by 14% on the way down during the dot-com bust. While the MSCI World Microcap Index does not extend that far back, if the GFC and COVID are a guide, it would have outperformed by a similar magnitude.

Working with the available microcap data, the dot-com decline (below) shows the Wilshire US Microcap Index (the only microcap index at the time) outperformed both the NASDAQ and the S&P 500.

Source: Bloomberg, Spheria. NASDAQ Total Return Index unavailable during period examined. S&P and Wilshire Micro are Total Return Indices.

Microcaps were initially caught up in the risk-off before a plateau then a burst of strong outperformance as the global economy began to recover.

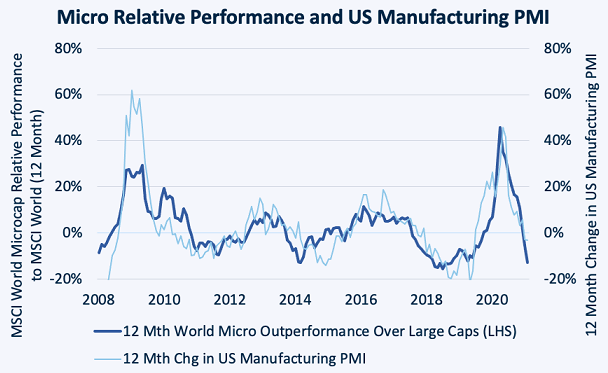

To highlight this further, below we have plotted the performance of global microcap relative to global large caps (dark blue line) against the 12-month change in US Purchasing Managers' Index (PMI), a measure of economic activity. In simple terms, as the economy accelerates, microcaps outperform and as the economy decelerates, microcaps underperform. While the asset class led markets out of the dotcom era, the GFC and COVID-19, there was only marginal underperformance on the way down.

Source: MSCI, Bloomberg, Spheria

This asymmetry during large market events provides investors a powerful asset allocation enhancement.

Demystifying global microcaps

Finally, global microcaps are a relatively underexplored and misunderstood asset class, being developed market securities with market caps of under US$1 billion (more akin to what we know as small cap Australian companies).

It’s the ‘little end of town’, you might say. But in this universe, there are over 18,000 securities globally and the US is only 24% of the index. And there are many misconceptions about this asset class, particularly when it comes to risk.

As bottom-up stock pickers, we believe investors are best served favouring growing and innovative businesses with strong cash flow conversion. In global microcaps, it’s a philosophy that enables a broad set of opportunity, and we also focus on capital preservation, with valuation discipline being a critical component in protecting capital.

A portfolio of global microcaps constructed against this disciplined framework of active management is why we don’t believe size matters, and how we believe investors can better navigate this current turning point in the market cycle.

Gino Rossi is Portfolio Manager at Spheria Asset Management, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.