We can survive longer without food than without sleep. The US Centre for Disease Control and Prevention says most people will show adverse signs of sleep deprivation within 24 hours. Three days without sleep has a profound impact on mood and cognition, and chronic sleep deprivation increases the risk of disease, obesity, and diabetes. Health is more important than wealth, and anyone who regularly loses sleep or wakes in a sweat worrying about the stockmarket must reassess their priorities. And asset allocations.

The dilemma is that over time, equity markets deliver the best returns of any major asset class. With the recent rise in interest rates, anyone who cannot tolerate even a small loss of capital can generate safe nominal returns of around 4%, but for most investors, some equity allocation is needed to achieve long-term goals.

What’s the right level? It’s personal. I have known someone for 40 years who is always 100% invested in equities and only cares about the income generated (and author Peter Thornhill makes the same arguments). But I know an older person with 95% allocated to term deposits and property and no tolerance for sharemarket volatility. Over many years, she has missed out on significant gains but she sleeps easy.

Why invest in equities?

Investors who can tolerate the volatility of share prices are eventually rewarded with a recovery of their capital as well as better returns. The All Ords Total Return Index (which includes dividends) has not experienced a period of negative returns over any eight-year rolling average on record in nominal terms. The average annual return over the last 100 years is 11%.

It’s a compelling result in the context not only of regular scary headlines about inflation, recession, and earnings downgrades, but genuine crises hitting the world such as wars and pandemics, as shown in this chart of the MSCI All Country World Index. While the long-term evidence favours equities (and in Australia, residential property), it requires an ability to think like Warren Buffett, who said:

"Charlie and I spend no time thinking or talking about what the stock market is going to do, because we don’t know. We are not operating on the basis of any kind of macro forecast about stocks. There’s always a list of reasons why the country will have problems tomorrow.”

Source: @QCompounding

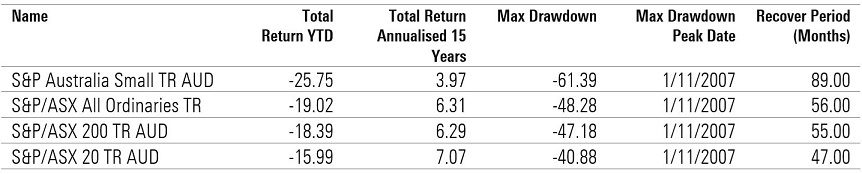

The maximum loss (drawdown) for the All Ords Total Return Index during this period was in November 2007, and the 48.3% would have frightened the hardiest of investors. And yet it had recovered to its previous high within 56 months, or less than five years, although the more volatile small company index took much longer.

Maximum drawdown for Australian broad market indexes

Period analysed: 01/01/2000 - 1/06/2023. Source: Morningstar Direct

Herein lies the challenge. Equities will deliver negative returns in about three years out of every 10, often by 20% or more. Investors should expect a 50% loss once every 25 years, which is the time horizon of 65-year-olds with a life expectancy until 90. For most, a 100% equity portfolio is simply too volatile, while a move to say 70% equities/30% cash would deliver 70% of the market volatility. Australian equity returns are also understated as indexes do not include the value of franking credits.

(This article focusses on investible assets, not the family home which comes with special tax and social security advantages and the pleasure of owning the place where you live, as explained here).

Why not invest 100% in equities?

Benjamin Graham taught and mentored Warren Buffett in the principles of fundamental value investing, and he has influenced generations of stock analysts through his two seminal books, Security Analysis and The Intelligent Investor. The following quotations are taken from the 2009 reprint which reproduces sections of the 1973 edition of the latter.

Graham describes most people as ‘defensive’ who:

“… will place his chief emphasis on the avoidance of serious mistakes or losses. His second aim will be freedom from effort, annoyance, and the need for making frequent decisions."

On this basis of avoiding large losses, Graham recommends an equal balance of 50% bonds and 50% stocks. He is open to allocations between 25%/75% and 75%/25% based on whether an investor perceives stocks are cheap (leaning towards 75% in equities) or expensive (moving back to 25%).

This is not very helpful, however, as he admits that investors attempting so-called Tactical Asset Allocation will struggle, because the usual human tendency is to buy when markets are riding high and sell when depressed and low:

“There is an implication here that the standard division should be an equal one, or 50–50, between the two major investment mediums. According to tradition, the sound reason for increasing the percentage in common stocks would be the appearance of the ‘bargain price’ levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgment of the investor the market level has become dangerously high. These copybook maxims have always been easy to enunciate and always difficult to follow, because they go against that very human nature which produces the excesses of bull and bear markets.”

He is unable to provide a reliable rule which applies to everyone, except that very few people should place more than 75% of their assets in stocks. But he is willing to identify the characteristics of “a tiny minority of investors” for whom holding a near-100% stock portfolio (with some cash) may make sense:

- Enough cash to support your family for at least one year

- Investing steadily for at least 20 years to come

- Did not sell stocks during the most recent bear market

- Bought more stocks during the most recent bear market

- Implement a formal plan to control your own investing behaviour.

He says:

“Unless you can honestly pass all these tests, you have no business putting all your money in stocks. Anyone who panicked in the last bear market is going to panic in the next one – and will regret having no cushion of cash and bonds.”

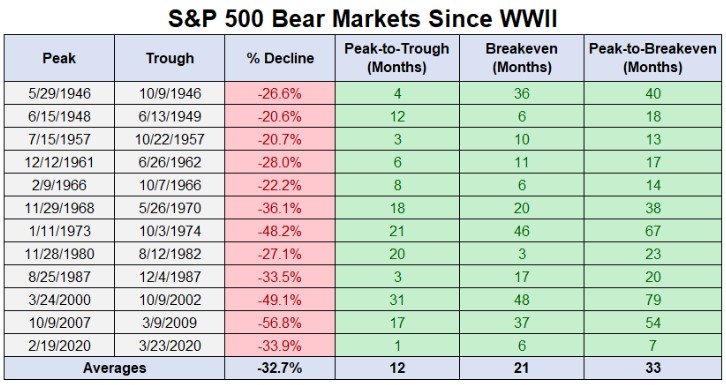

Here are the losses that anyone invested 100% in the US S&P500 would have experienced since World War II. The average bear market decline is 33% but there have been three falls of close to 50% in the last 50 years. The drops have taken as little as one month or up to 21 months of grinding down. It requires fortitude to watch losses accumulate for nearly two years.

Source: A Wealth of Common Sense

Source: A Wealth of Common Sense

Market conditions are less favourable

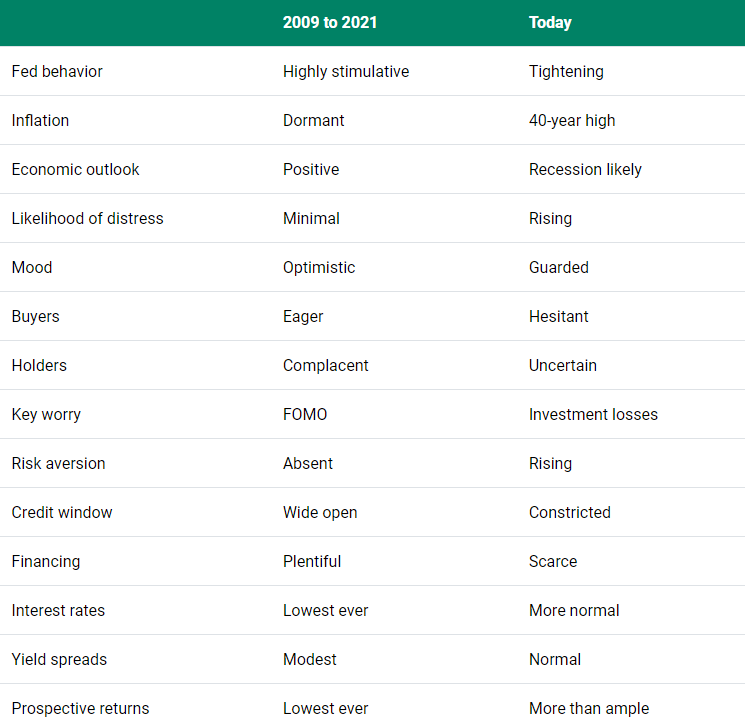

It is easy to list the threats in the current market, and they are higher than normal with the Ukraine war, withdrawal of monetary stimulus and inflation as serious dangers. Nobody holds up a red flag to signal a market top, although plenty of leading names in investing are issuing warnings. For example, Warren Buffett is also a great fan of Oaktree Capital’s Howard Marks, and Marks wrote in his client memo on 13 December 2022:

“In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today … What are the factors that gave rise to investors’ success over the last 40 years? We saw major contributions from (a) the economic growth and pre-eminence of the U.S.; (b) the incredible performance of our greatest companies; (c) gains in technology, productivity and management techniques; and (d) the benefits of globalization. However, I’d be surprised if 40 years of declining interest rates didn’t play the greatest role of all.” (his bolding)

Marks included this table showing how almost everything is worse for investing than it was in the period 2009 to 2021, which he looks back on as a golden age of favourable conditions driven by ever-falling rates.

So the risks are real, and it is legitimate for someone in retirement to prefer to protect their capital rather than make a bit more money when they already have enough to meet their goals. Future earnings from paid work will be limited, and there is less time to recover from a major stockmarket fall. Where a comfortable way of life may be compromised, the risk may be too great.

Retirees should not feel embarrassed by reducing equity exposure to a point which reduces anxiety, to the sleeping point. The personal big picture of age, assets and risk tolerance are all relevant.

Cost of staying out of the market

Notwithstanding these heightened risks, caution often comes at a cost. Using US data, Vanguard studied each 3-month period in which equities declined 10% or more from 1 January 1980 through to 31 December 2022. These are times when investors are tempted to move to cash. They then checked returns in the following periods of 3 months, 6 months and 12 months. For example, there was an 87% chance of underperforming a 60/40 portfolio by spending a year stuck in cash, with an average underperformance of a hefty 13.5%.

Determining your sleeping point

So what are the questions that retirees or people near retirement should ask themselves in deciding the maximum equity allocation?

A useful check is whether the value of a share portfolio dominates your mind when going to sleep or waking up. Checking the market and worrying whether you can finance a future lifestyle is no way to start each day. A good question is:

What is the equity exposure where you are indifferent whether the market rises or falls?

You want some skin in the game to enjoy the rewards from equity investment, but you are not worried if the market falls because it gives an opportunity to buy equities at a lower price. Another check of the absolute dollars:

How much money are you prepared to lose without worrying about it?

If you have $1 million invested with 70% in equities and the market falls 30%, are you fine ‘losing’ over $200,000 in a short period?

Stay committed in a heavy market fall

Benjamin Graham says that with all the planning in the world, you still need to control your investing behaviour. There is no point going all-in equities because you know the rewards are the greatest, and then dumping in a sell off.

Some investors believe they can catch a falling knife, but it doesn’t work like that. If the market falls 10% and that’s a trigger price to sell, it’s just as likely to recover quickly as it is to fall further. The worst outcome is to continuously switch as markets swing around.

Although the daily market noise commands attention, there is much to support a portfolio that invests in a broad index and is left untouched for decades. And allows the investor to sleep easy.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any investor.