I advocated - prematurely as it turned out - investing in small caps almost 12 months ago. Since then, the investment landscape has changed, prompting the narrative and, with it, many other investors to pivot towards smaller companies domestically and internationally.

Importantly, my belief in the benefits of small companies isn’t arbitrary but instead rooted in an analysis of historical investment performance and predicated on the relative underperformance of small caps. It's also based on the current macroeconomic climate, which appears uniquely poised to favour smaller enterprises over their larger counterparts.

Back in May last year, I argued that innovative companies with growth and pricing power would outperform. Given the small cap universe in Australia, which has about 1800 companies, is replete with such innovative growers, I made the tactical decision to back small caps.

While innovative growth companies with pricing power did indeed outperform, the outperformers in 2023 were confined to largely seven mega-cap tech companies that were labelled the ‘Magnificent Seven’.

As an aside, don’t ever fall for the trap inherent in those labels. Whether it’s the FAANG stocks of 2013, the MAMAA stocks that followed (Meta, Apple, Microsoft, Amazon, and Alphabet), the Nifty Fifty of the 1960s and 70s, or the Magnificent 7 of 2023, these labels denote the most popular stocks of the time. The trap is investing in them, usually in a late-to-the-party ETF - after they have been labelled. If you keep in mind the only thing common to each stock in the group is their popularity and, therefore, their share price performance, you will certainly be more discerning.

The reason for the outperformance of the largest innovative companies in 2023 probably has something to do with perceived safety. You’ll recall many people last year still feared a recession, and many others weren’t certain central banks had completed their rate-hiking exercises. With concerns about further rate hikes and a recession, it’s understandable investors loitered close to the most liquid companies that also displayed growth, innovation, and pricing power.

So why did I believe innovative growth companies would do well in 2023? The argument for my strategic portfolio pivot was anchored in seminal research conducted by Gavekal Research in the late 1970s. This body of work revealed the principle that innovative firms possessing robust pricing power—a trait abundantly present among smaller companies—tend to outperform in environments characterised by disinflation in conjunction with positive economic growth. This is precisely the scenario that dominated 2023. And it’s the scenario we find ourselves in today, making the case for investment in smaller companies compelling and timely.

However, today, the conjunction of disinflation and economic growth is not the sole premise for advocating an investment strategy favouring small companies. Recent developments have presented additional, compelling reasons that I trust will fortify my argument.

Other compelling reasons to own small caps

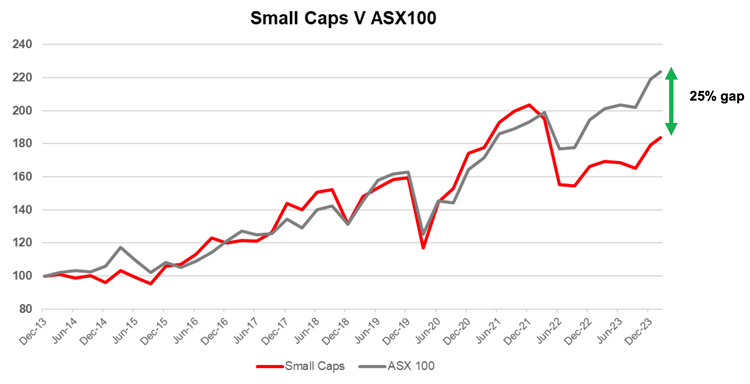

The first and perhaps key among these developments is that the underperformance of small caps against large caps, here in Australia, is perhaps the widest it has been since the GFC. That underperformance rarely persists because large caps eventually become relatively expensive and professional investors seeking higher returns with lower risk look for relative value lower down the market capitalisation spectrum. Their actions work to close the gap. It doesn’t mean large caps sell off, it may mean however large and small caps both rise, but small caps rise faster and therefore outperform.

The other development is a change in the narrative concerning interest rates, recession risks, and corporate earnings forecasts.

In 2022 and 2023, the investment community grappled with rapid interest rate hikes, a pace unparalleled for younger market participants. This environment has since shifted, with both investors and central banks now accepting interest rates have peaked, with cuts on the horizon possibly this year.

Moreover, the dominant narrative in 2023 of an impending recession, which steered investors towards defensive and highly liquid mega-cap technology firms, has gradually given way to a more nuanced expectation of a 'soft landing' and an associated reshaping of anticipations around monetary policy. As expectations of recession give way to a belief in soft landings, investors feel more comfortable moving out along the risk spectrum. That process, by the way, can take a couple of years, which may mean the equity market rallies up to 2026.

Amid fluctuating interest rates and the shadow of a recession, concerns regarding corporate earnings were understandable. Yet, these anxieties have largely been allayed, with earnings, especially from the higher-quality names we invest in, demonstrating resilience during the latest reporting season here in Australia and also in the U.S.

Investors are taking on more risk

Consequently, there is a discernible shift in portfolio allocation. Investors are moving from a cautious stance, characterised previously by high cash/liquidity levels, to a more assertive approach. Investors are now more inclined to engage in selective company investments, signalling a readiness to embrace measured risk, which in turn facilitates higher equity prices.

This newfound optimism is also partly predicated on historical analyses of equity index performances after the U.S. Federal Reserve begins cutting rates. Although the exact timing of the commencement of rate reduction cycles remains uncertain, prevailing expectations suggest that such a phase may begin in the latter half of this calendar year. A scenario of rate cuts would significantly bolster the argument for the superior performance of small caps, as evidenced by analysis from Wilson Advisory.

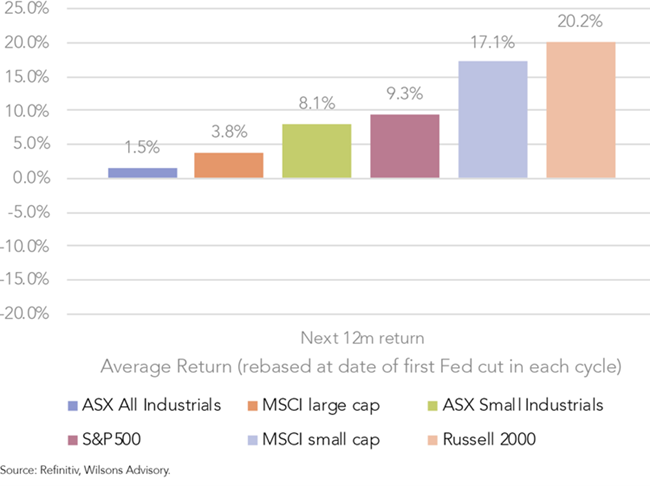

According to Wilsons Advisory, in the 12 months immediately following the Fed’s first rate cut, the ASX Small Ordinaries has, on average, gained 8.1%. This compares to the ASX All Industrial Index, which has, on average, risen just 1.5% in the twelve months after the Fed’s first rate cut. Globally, the story is even more compelling with the U.S. Russell 2000 small cap index, gaining, on average, 20.2% in the year following the first rate cut.

Global small caps typically perform well after Fed rate cuts

An intriguing additional aspect of this analysis is the comparison of the Small Ordinaries index against the S&P/ASX100 over the past decade. This comparison reveals a widening performance gap, suggesting a period of pronounced underperformance by small caps relative to large caps, the likes of which have not been seen in a decade. If we plot the Small Ordinaries against the S&P/ASX100 and zero the two indices back to a decade ago, we discover the gap between the performance of the large caps and small caps has widened to approximately 25%.

Source: IRESS, ASX 100 Accumulation index, ASX Small Ords accumulation index returns over last 10 years, Index data December 2013 to COB 29/02/24, Gap = Performance from 31/12/21

Earnings will be key

While this discrepancy is noteworthy, the rationale for its potential narrowing and the consequent outperformance of small caps likely hinges on the expectation of faster earnings growth among smaller companies.

According to FactSet data, at 15 February 2024, consensus expectations for ASX100 large cap compounded earnings per share growth over the next two years is just 3.1% per annum. For the small ordinaries, however, earnings are expected to grow 15.2% per annum over the same period.

The strategic case for investing in small companies is underpinned by a confluence of factors: small caps have underperformed, are relatively reasonably priced, are expected to generate substantially higher earnings growth over the next two years, and investors can access the opportunity through managed funds knowing that the median and top quartile small cap managers have delivered better returns than the market.

Roger Montgomery is the Chairman of Montgomery Investment Management and an author at www.RogerMontgomery.com. This article is for general information only and does not consider the circumstances of any individual.