Most individual investors are facing the same dilemma at the moment. They don’t want to sit in cash or deposits earning little in real returns (the cash rate and inflation are about the same), share markets look fully valued (the All Ords closed at its highest level since May 2015 on the day of writing, and the Dow has seen many all-time highs this year) and even that darling, residential property, is looking skittish. Yet to build retirement savings at a decent long-term target return of say 8%, risks need to be taken.

Unrealistic return expectations in current market

It’s one reason why recent research by AMP Capital into the investments of 800 SMSF trustees shows a disconnect between growth aspirations and actual asset allocations, and the difference is stark. The annual ‘Black Sky Report’ shows SMSF trustees expect a 10.9% return on their portfolio in 2017, made up of 6% capital growth and 4.9% income. Yet about 55% have moved to a more defensive asset allocation in the last year as they worry about market levels. Only 18% have increased their allocation to growth categories.

A typical balanced institutional portfolio will have an asset allocation of about 30% cash and fixed interest, 35% Australian shares, 20% global shares, 10% property and 5% others (such as infrastructure, hedge funds or private equity). However, although most SMSF trustees know they need a diversified portfolio, over half their fund balances are invested in only one investment type outside of managed funds.

How do SMSF trustees make decisions?

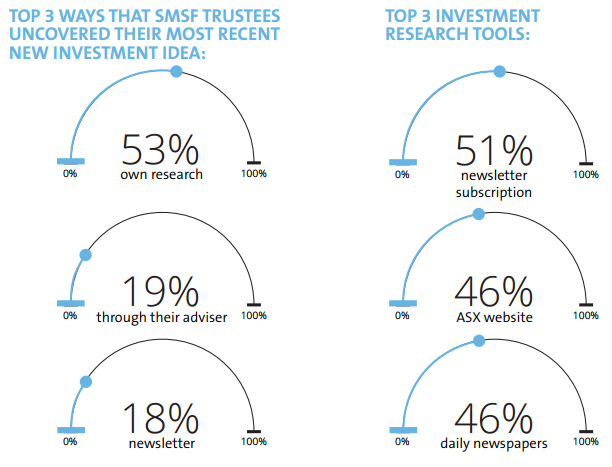

About three-quarters of trustees report they do not use any tools to assist with portfolio construction, which leaves plenty of scope for financial advice to assist with an investment strategy. Trustees also rely to a surprising amount on their own research to make their decisions (and another study shows Cuffelinks is prominent among investment newsletters).

Challenges facing SMSF trustees

The respondents identified three main areas of concern for the next 12 months:

- Market volatility (18%)

- Investment selection (11%)

- Regulatory changes (10%).

Although most trustees rely primarily on their own research, most want to learn more and nearly 60% are willing to use a financial adviser. About 37% of trustees nominated ‘retirement strategies’ as the area requiring most assistance.

There is an increasing recognition of new opportunities in active ETFs and unlisted managed funds which diversify away from the usual ASX index exposures. AMP Capital’s Tim Keegan noted:

“If trustees continue to be exposed to significant portfolio concentration risk and remain in more defensive assets without seeking financial advice, they may struggle to achieve their retirement goals. We can see through the report that their interest and understanding in ETFs have increased, but there is definitely a demand for more education ... I strongly believe that is going to be an ongoing theme because the Australian market is concentrated on banks, miners and telcos, so there’s a very limited range of industry sectors and markets to be exposed to.”

The SMSF trustees surveyed by AMP Capital are higher users of managed funds than most trustees, due to the more regular use of advisers, and they see the benefits of ETFs as:

- Ease of diversification 45%)

- Access to out-of-reach investments (41%)

- International diversification (36%).

Why SMSF trustees set up their own funds

The research also confirms the widely-held views on why SMSFs are being set up by the thousand each month:

- More control over investment (56%)

- Choose specific shares to invest in (32%)

- Save money on fees (31%)

On a positive note, the trustees are aiming for an average of about $2 million in investible assets before they retire, and 72% say they are on track to achieve this goal.

The 2017 Black Sky Report can be downloaded here. AMP Capital is a sponsor of Cuffelinks.