Three recent reports on asset allocation confirm a move by SMSFs and other investors into global equities at the expense of Australian companies. It is no doubt driven by the better performance of the S&P500 versus the S&P/ASX300, the surge in technology opportunities offshore and the struggles of previous favourites, the banks and Telstra.

The official statistics on the asset allocation of SMSFs as recorded by the Australian Taxation Office (ATO) from tax returns are flawed, as we have written about several times. Other data sources such as the Australian Bureau of Statistics (ABS) and market participants provide a more complete picture.

The managed fund industry

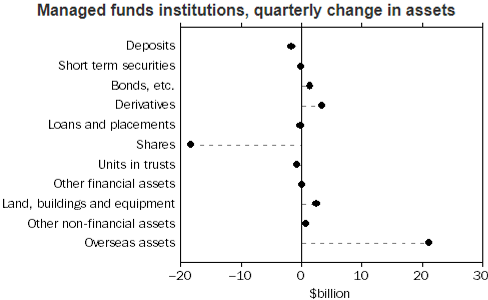

The latest ABS data for 31 March 2018 shows the Australian managed fund industry held $3.4 trillion, up $15 billion in the quarter. So much for the claims this is a struggling industry. The strongest increase by investment type was overseas assets, a rise of $21 billion, as shown below. Domestic shares fell by $18 billion.

Source: 5565.0 ABS Managed Funds, Australia, March 2018

SMSF investments move to managed funds

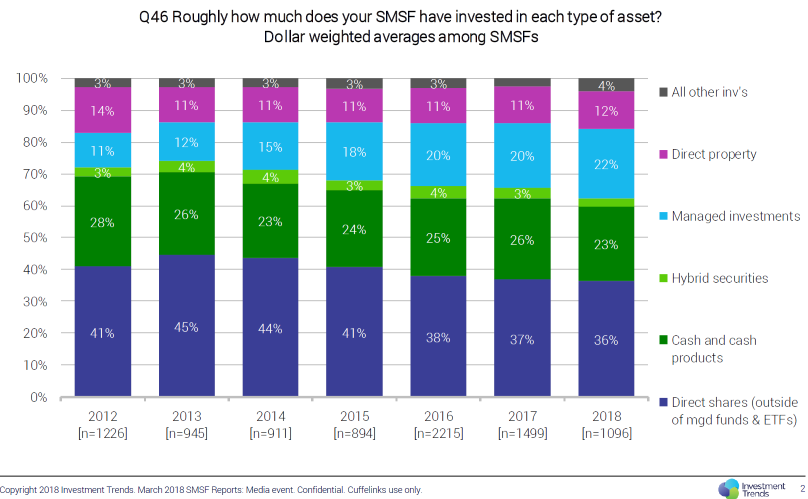

The just-released 2018 Vanguard/Investment Trends Self-Managed Super Fund Reports show a time series since 2012 in investment patterns. The most obvious movement is the growth of managed investments, which include ETFs and LICs, at the expense of direct shares. While SMSF trustees are making their own investment decisions, this should not be confused with making their own stock selections. The share of managed investments has doubled from 11% to 22% in six years. The latest BetaShares Australian ETF Review shows inflows into international equities of $273 million in May 2018, with this asset class first for inflows in every month of 2018 so far.

Source: Vanguard/Investment Trends Self-Managed Super Fund Reports, June 2018

SMSF asset allocation

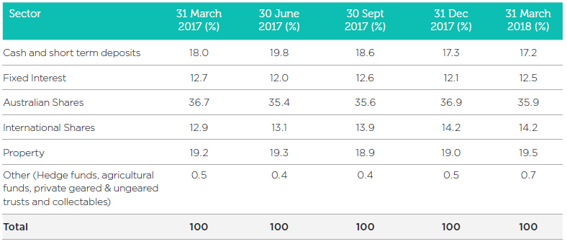

This week, SuperConcepts also released its latest Investment Patterns Survey for March 2018. This is far more up-to-date than the ATO data because it uses SMSF data from funds administered by SuperConcepts, rather than relying on the much-delayed lodgement of tax returns.

The data needs the qualification that SuperConcepts is part of AMP and has a higher proportion of advised clients than most SMSF administrators, and advisers tend to use the functionality of platforms and managed funds. Nevertheless, the change in asset allocation also shows a greater use of international equities over time, up from 12.9% to 14.2% in a year.

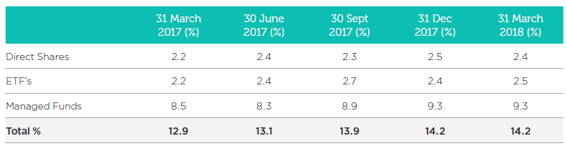

A further break-up of the international shares component over the last year shows the steady rise of ETFs and managed funds, and a small rise in SMSFs going directly into foreign stock exchanges.

SMSF international shares components

The balanced options of institutional superannuation funds have long allocated around 20% of their portfolios to global equities, and SMSFs have traditionally lagged far behind. In the last five years, SMSFs have started to catch up, and with the Australian index still dominated by some big companies without compelling growth prospects, it's a trend that will continue.

Graham Hand is Managing Editor of Cuffelinks.