(Editor’s note: This article may be construed as anti-SMSF, but far from it. In fact, the author has one, as does the Editor. We both believe that in the right circumstances, SMSFs offer tangible benefits over institutional super funds. But they’re not for everyone …)

SMSFs have become the must-have financial fashion accessory for high-income earners and those seeking control over their superannuation investments. According to the ATO, there are 556,000 SMSFs in existence, comprising almost a third of the superannuation pie. For some, SMSFs offer a perfect mix of better control, inheritance planning and tax savings. For many, however, SMSFs are expensive, onerous and unnecessary. Too frequently, SMSFs are established by accountants and financial planners with an eye on revenue generation rather than with the best interests of the clients at heart. Despite their overwhelming popularity, here are eight reasons why you might pause before jumping on the SMSF bandwagon.

1. ‘Til death do us part

An SMSF is like a marriage – it takes a significant commitment and a lot of hard work to make it run smoothly. If you are the type who doesn’t like to commit for the long term, then an SMSF may not be for you. Even if you engage an army of advisers, accountants and auditors, you (as the trustee) are legally responsible for all the decisions made by the SMSF, for running the fund, completing the end of year tax return and audit, and for complying with superannuation laws. If this commitment is too much, then choose a retail or industry super fund as all the administrative, compliance and management responsibility is done for you.

2. Keeping up with the Joneses

Investment seminars, websites and ebooks on SMSFs are everywhere, and your golfing buddy has probably set one up. ‘Best thing ever,’ he says. Before calling your accountant demanding one, first determine what you want to do with an SMSF. If you see your current superannuation savings as readily accessible money to start trading today and making millions tomorrow, then you are most certainly going to end up disappointed.

3. Honey, trust me, I know what I’m doing

The ATO is quite clear about your responsibilities and the potential penalties.

‘As a trustee of an SMSF, you need to act according to your fund’s Trust Deed, the Superannuation Industry (Supervision) Act 1993 (SISA) – Superannuation Industry (Supervision) Regulations 1994 (SISR), the Income Tax Assessment Act 1997 (ITAA 1997), the Tax Administration Act 1953 (TAA 1953) and the Corporations Act 2001.’

Got that? The ATO continues rather more menacingly: ‘If you do not follow the rules, you risk one or more of the following: your fund being deemed non-compliant and losing its tax concessions, being disqualified as a trustee, prosecution and penalties.’

What does non-complying mean? ‘A complying fund that has been made non-complying will suffer serious tax consequences. Your fund’s total assets … are subject to tax at the highest marginal rate. Any income received in a financial year in which a fund is non-complying is taxed at the highest marginal rate.'

And the penalties? ‘If a trustee is prosecuted and is found guilty of either a civil and/or criminal offence under a civil penalty provision, the maximum penalties that may apply under Part 21 of the SISA are $340,000 (civil proceedings) and five years imprisonment (criminal proceedings).’

Engaging a financial adviser or an accountant to ensure you stick to the (highly complex) rules makes sense. But you are then up for another layer of fees. And what will you do if something should happen to you and you are no longer capable of running your SMSF? One-third of people aged 85 years and older have dementia. Will your partner know what to do in your place? Will they want to?

4. An SMSF! My kingdom for an SMSF!

In a report published in 2013, ASIC commissioned consultants Rice Warner to examine whether there was a minimum cost-effective fund balance for an SMSF. Rice Warner found that SMSFs with balances in excess of $250,000 were more competitive than the alternatives, provided the trustee was willing to undertake some of the fund administration. Those requiring a full administration service needed a balance of $500,000 to be more competitive.

As there are a range of fixed costs that an SMSF must incur (e.g. financial advice, administration, accounting, audit and actuarial costs) it is generally not cost effective for members with small balances to hold their superannuation through an SMSF. The cost of administering an SMSF and filing the tax return has fallen rapidly in recent years with the advent of better technology and you should not really be paying much more than $2,000 for this job (more if your SMSF has real complexity). Unless you are seeking advice about purchasing a property in your SMSF, planning to transfer in some business property or wish to gear up, there may be other more cost-effective options. Whilst there is no need to ransom your kingdom, for most, $250,000 should be the minimum.

5. Nothing is certain except death and taxes

You spend your whole life paying taxes. Wouldn’t it be great if you could recoup at least some when the curtain closes? An anti-detriment payment (ADP) is a refund of contributions tax you have paid during your working life. This is an additional payment that can be made to your spouse or children if they receive your death benefit as a lump sum. It can be substantial. For example, a retail super fund with a $1 million balance and 50% taxable component, will spit out an ADP of some $37,000. You are unlikely to receive this if you are still running your SMSF, as funding ADPs in an SMSF can be problematic. Having your super in a larger retail fund can be more advantageous (albeit for your spouse or children) as these funds will have sufficient reserves to pay the ADP in addition to your death benefits. Beware single member funds with large hidden ADPs. If you are unsure, ask your accountant or adviser. Note, however, that the government is considering abolishing ADPs.

6. All your eggs in one sliced basket

According to the ATO, cash accounts for 31% of SMSF assets, even those with $500,000 - $1 million balances, and 53% of the assets of those funds with less than $100,000. Australian shares appear to comprise another third of the asset base, though the figures are not too reliable. Multiport studies suggest that cash is more like 20%, but Aussie shares may be higher at 40%. Either way, most SMSFs comprise bank term deposits, bank hybrids and a whack of bank shares – akin to owning the senior, junior and mezzanine tranches of a single name Collateralised Debt Obligation (CDO).

7. You’ve got to call Australia ‘home’

An SMSF must have the ‘central management and control’ (CMC) in Australia and the member must meet the Active Member Test so that the SMSF remains compliant. Therefore, if you are offered a long term position overseas, Houston we may have a problem. If you plan to leave Australia indefinitely, the SMSF will often need to be wound up as the CMC test will not be met and you cannot make contributions into the fund or any investment decisions.

8. I can beat the market!

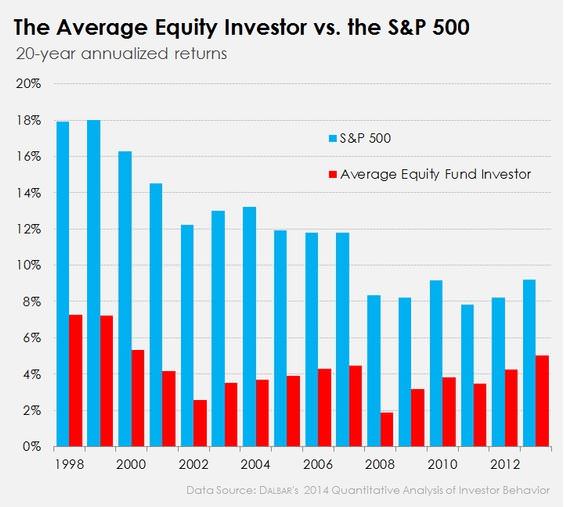

And we save the best for last. SMSF providers regularly promote the benefits of running your own investment portfolio. Wonderful if you have a thorough understanding of financial markets, diversification, correlation, behavioural economics, volatility and the patience of Job. Otherwise, you are suffering from the over-confidence bias, the most well-documented of all the financial behavioral heuristics. The chart below from The Motley Fool uses research from DALBAR which shows investors underperform the market due to poor timing of entry and exit points.

Recep Peker, a senior analyst with research firm Investment Trends, says that trustees of many new SMSFs are convinced they can outperform the big funds. Indeed, 28% of SMSFs surveyed told Investment Trends that one of the reasons they set up an SMSF is a belief that, ‘I can make better investments than the big fund managers’. And in Lake Wobegon, all the children are above average intelligence.

Make sure it’s suitable for you

In the right circumstances and for a well-informed trustee, SMSFs can offer significant benefits over traditional retail super funds. But remember Stanford Brown’s Golden Rule of Investing No. 8 – Don’t Copy Your Mates at the Golf Club. Just because it is right for them, doesn’t automatically make it right for you.

Jonathan Hoyle is CEO of the Stanford Brown Group. This article is for general purposes only and does not consider the specific needs of any individual.