On 23 November 2016, the Government’s superannuation reforms announced in the 2016/2017 Budget finally passed the Parliament. The changes are designed to “improve the fairness, sustainability, flexibility and integrity of the superannuation system”, according to Treasury. The Government also intends to enshrine the objective of superannuation in legislation, “to provide income in retirement to substitute or supplement the Age Pension.”

How the new rules will lead to less in super

Without debating the merits of the changes, the new regulations target wealthier Australians who use the upper limits of the contribution caps to place large amounts in the tax-advantaged system. The argument is that well-off Australians are exploiting generous tax breaks in super to accumulate more wealth than they need for retirement, often with a view to transferring it to the next generation.

The major changes that will reduce super balances when implemented from 1 July 2017, are:

- The $1.6 million cap on the amount of super which can be transferred into a tax-free retirement account (previously no limit)

- The annual concessional (before tax) contribution limits of $25,000 (previously up to $35,000)

- The annual non-concessional contribution cap of $100,000 (previously $180,000)

- The threshold where an extra 15% tax (total of 30%) is paid on concessional contributions applies to anyone earning $250,000 or more of ‘income for surcharge purposes’ (previously $300,000).

Potential for further changes

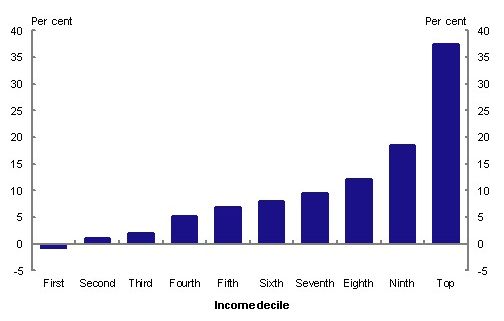

The Labor Party has other versions of how superannuation and contributions should be legislated, called its ‘Fairer Super Plan’. Criticism from politicians and social equity groups such as ACOSS on the ongoing generosity of super will continue. The most commonly used table from the Murray Report (below), shows that about 38% of the tax advantages of super go to the top 10% of income earners. This will change under the new rules but not significantly for a long time.

Share of total superannuation tax concessions by decile

Source: Financial System Inquiry, Final Report, page 138

Investors seeking certainty and flexibility in a tax-effective environment will increasingly consider alternatives outside of super. There are various options which may assist in minimising or deferring tax, including creating a private company to hold investments, or forming a family trust, but for high income earners, one of the more tax-effective, flexible and cost-effective options may be an investment bond.

Tax and flexibility of an investment bond

Investment bonds are technically life-insurance policies with a nominated life insured, and a beneficiary. In investment terms, they operate like a tax-paid managed fund. Investors choose from a range of investment options, depending on their goals. These range from growth portfolios (higher risk) which typically include more equities, to defensive portfolios (lower risk) which usually invest in cash and fixed interest.

An investment bond is tax-paid, because the earnings from the underlying investment portfolio are taxed at the company rate of 30% within the bond structure. Investors do not receive distributions as they are re-invested, and do not therefore need to declare the earnings from the bond in their personal tax returns. In the case of investment portfolios which contain equities, the tax rate may be further reduced by franking credits.

If an individual’s personal taxable income is at least $37,001 p.a. the tax paid on any additional personal income will be greater than on investment bond earnings rate. At this threshold, the marginal tax rate increases from 21% to 34.5%, higher than the 30% on investment bonds.

There is no limit to the amount which can be placed in an investment bond in the first year, and additional contributions can be made each year, at up to 125% of the previous year’s contribution.

Funds can be withdrawn at any time, however, if they are left in the investment bond structure for 10 years, the entire proceeds of the bond (original investment, additional contributions and earnings) are tax paid. The investor does not need to include them in their tax return, and they can be distributed as a lump sum, or as a tax-paid income over time. And because an investment bond is in fact an insurance policy, with a life insured (this can be the same person as the bond owner), on the death of the life insured, the beneficiary of the bond will receive all proceeds of the bond tax free, regardless of how long the bond has been held.

The proceeds fall outside of the bond owner’s estate, and pass directly to the beneficiary. This makes investment bonds ideal estate planning tools, or an effective way to transfer wealth from one generation to another.

Super remains the most tax-effective long-term investment structure for most Australians, but access to super money is restricted until a ‘condition of release’ is met. This generally means the investor can’t withdraw the money until they have reached a ‘preservation age’ and retired. Preservation age is 55 for an investor born before 1 July 1960 but increases up to age 60 for those born after this date. Earlier access may be allowed in exceptional circumstances, such as permanent disability.

Saving for education or estate planning purposes

By contrast, investment bonds can be used as savings for children or family members to fund education expenses or the cost of raising a child, and are often used by grandparents to finance the future needs of their grandchildren. The bonds bring simplicity in managing the tax that applies to a child’s income, and may be assigned to a child in the future (subject to parental or guardian consent) without tax or legal complications. The child has the option to continue holding the investment bond without affecting the original 10-year tax period start date.

An investment bond’s life insurance component enables tax-effective estate planning and simple wealth transfers external to a will. It gives the life insured significant flexibility and control in determining beneficiaries of any ‘death maturity’ payments.

In superannuation, death benefit tax concessions apply only to dependents of the life insured. However, an investment bond’s death benefits can be directed tax-free to any nominated beneficiary, including adult family members, or the estate. How long the bond has been held does not impact the tax-free status. This flexibility may reduce the risk of disputes over estates and enable benefits to be paid more quickly.

Neil Rogan is General Manager of Centuria Life’s Investment Bond Division. Suitability of investment bonds will depend on a person’s circumstances, financial objectives and needs, none of which have been taken into consideration in this article, and potential investors should seek financial advice.