There’s no doubt that superannuation funds are moving their member communication and education into the digital world and the pace is increasing. But compared to the broader rate of technological change and uptake in other industries, funds still have much ground to gain.

Willis Towers Watson has been monitoring funds’ digital technology use since 2013. Last year, we went back to the industry to evaluate the overall trends and examine some key indicators, such as popular versus effective digital channels, potential roadblocks and what the future looks like.

Budget allocation to digital

All funds surveyed are increasing digital technology across a wide range of channels and, with it, their budgets. The current multi-channel take-up rate is 62% and funds are also using a wider spread of channels than previously.

In the past two years, 75% of funds have stepped up their spending on digital member communication by 10% or more. Around 35% of funds are spending $150,000 or more on digital communication (this excludes their fund website). Participants told us that the most significant investments to come will be made in improving mobile websites, their main website and webinars, as well as calculators.

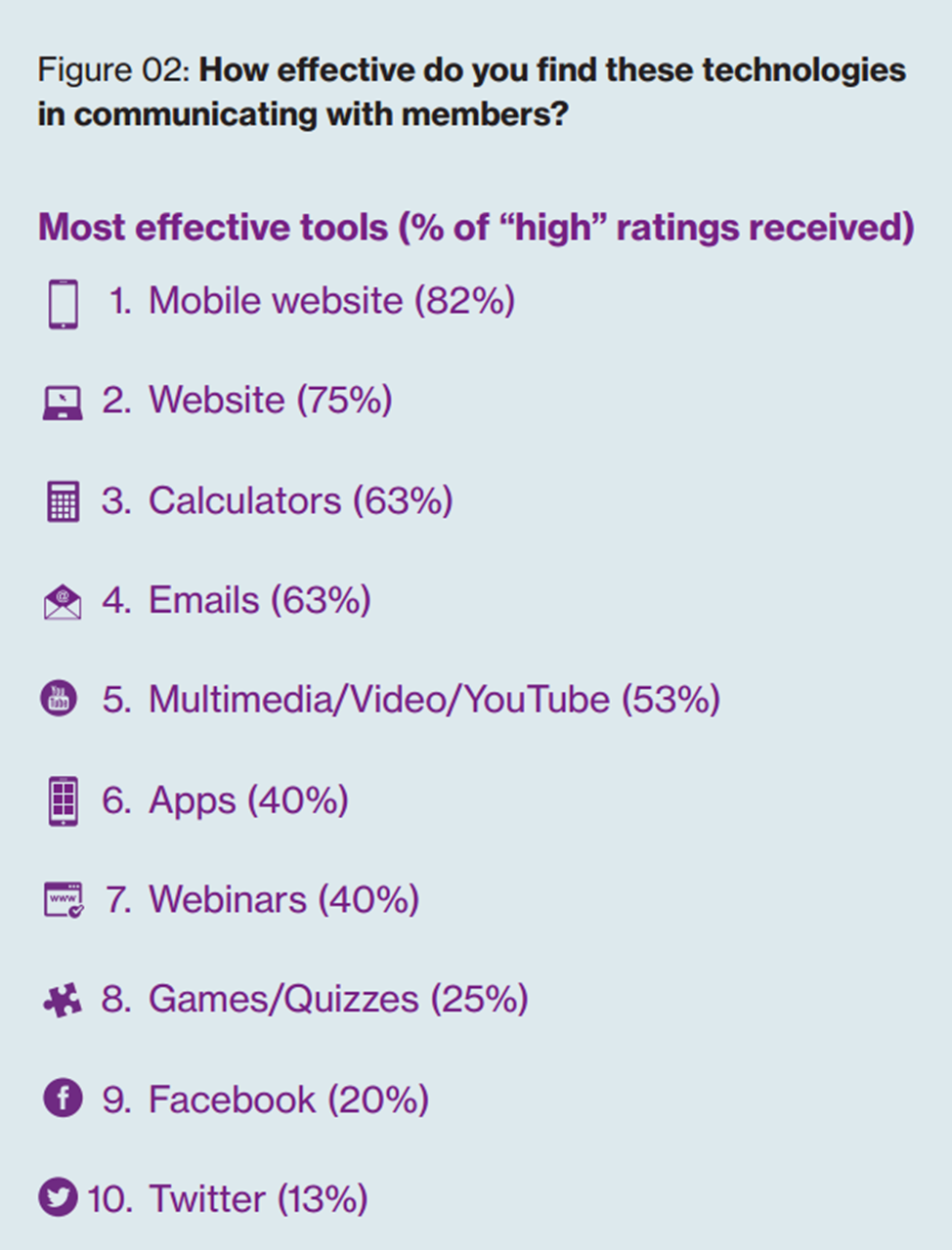

Mobile websites are now rated as the most effective technology for communicating with members while more standard tools such as traditional websites and emails continue to be widely-used. Looking ahead, though, funds are expected to shift their focus to the use of apps.

Although apps, games and quizzes are not currently rated as effective as mobile websites, their use has increased at least five-fold. Our original survey in 2013 found less than one in 10 funds used these channels to engage members but, by 2020, funds believe apps will be their most-used tool for member communication.

Although ranked low in terms of overall effectiveness, participants who use social media (such as Facebook and Twitter) agree that as a liaison tool, it plays a crucial role. While a low touch tool for member communication, it is used by most funds to monitor the industry and the media and deal directly with member concerns. In 2013, participants acknowledged a small role for social media but it appears that funds are still feeling the need to have a presence there, mainly as a channel for listening and reacting to members.

Webinars are an interesting item. Less than half of our 2015 survey participants use them, yet the same proportion rated them as highly-effective. The funds running them agree that they work extremely well.

Print still has a significant role to play in the overall strategy, but this is dropping, from 38% in 2013 to 32% in 2015. By 2020, this is expected to drop to 11%.

The benefits of digital

Funds told us a key benefit in using digital communication is that it is personal, targeted, immediate and interactive. Increasingly, members are only wanting information that is relevant to them. Funds say this trend will be a priority for them as they increasingly move towards using online benefit statements and other personalised communication.

A range of channels is in play and the mix is wider than ever before. Our 2013 report predicted the rate at which funds would take up a multi-channel approach would increase from 45% to 77% by 2017.

Perhaps this is no surprise. A study of 30 countries by We Are Social on how web traffic is shared across devices shows that although digital information is still largely accessed through laptops and desktops (approximately 60%), access via mobile devices already stands at 30% and growing fast. Ensuring fund information and tools can work across different platforms is therefore crucial.

Tools used to deliver education

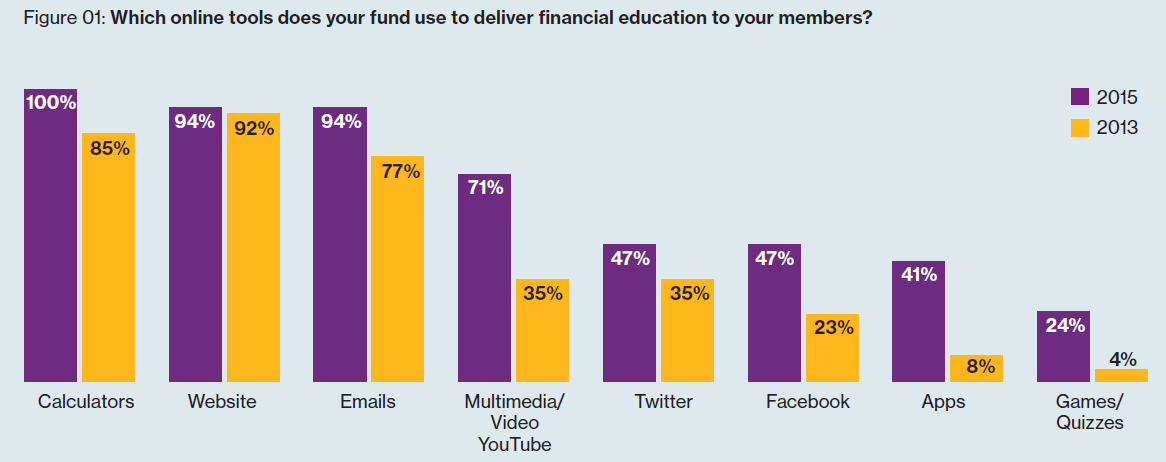

Funds continue to pick and choose from a wide range of digital media. More traditional digital channels such as calculators, websites and email remain top tools (see Figure 01). Although not surveyed in 2013, around three quarters of funds surveyed are now using mobile websites as part of their member education package.

Survey respondents cited mobile websites to be the most effective technology, unsurprising given the statistics around increasing mobile use, followed by non-mobile websites (see Figure 02). At the time of our 2013 report, over half of the Australian population was using smartphones, but it has now grown to almost three-quarters. This raises the bar for how funds must evolve to match member preferences and continue to create more sophisticated mobile-compatible tools.

In 2013, almost all funds predicted that they would still be using standard tools such as websites and emails in 2017, and this has played out as expected. However, the future sees big drops in the predicted use of websites (down from 96% to 65%) and emails (from 96% to 53%) by 2020. It is possible that in the case of websites, funds are switching their focus to mobile websites, however the reason for the expected drop in the use of email is less clear.

The use of calculators has increased, and was a feature in every fund surveyed in 2015, as compared to only 85% of funds in 2013. Looking ahead, four-fifths of funds intend to dedicate more resources to calculators.

The roadblocks

A key concern for funds continues to be around the security of member data, as well as practical issues such as resourcing and cost. Many participants felt that there was a skills and capabilities gap which might be restricting some funds from increasing the use of technology-based communication.

Since 2013, there has been little change to the perceived benefits of using technology to communicate with fund members. However, as members become used to regular updates, this breeds new challenges such as keeping up with continuous change.

Participants told us that learnings from the broader financial industry should drive much more sophisticated security and that superannuation needs to look at how banks have managed it.

Resourcing digital specialists who understand technology, digital and superannuation is incredibly difficult. Small to mid-sized organisations, in particular, would not find it viable to have one internal resource who has both the breadth and depth of skills needed in the digital space. As a result, super funds are partnering to help them grow their digital capabilities.

A full copy of our survey findings, with insights on current and future digital direction from UniSuper, Cbus, CareSuper, Kinetic Super, Maritime Super, HESTA and Australian Catholic Superannuation and Retirement Fund, can be found here.

Emma Longmore is the Communication Leader and Richard Body the Head of Digital Solutions for Willis Towers Watson Australia.