Thanks to the hundreds of readers who shared their experiences in Australia's current inflationary environment. Here is a summary of the results and extracts from your comments.

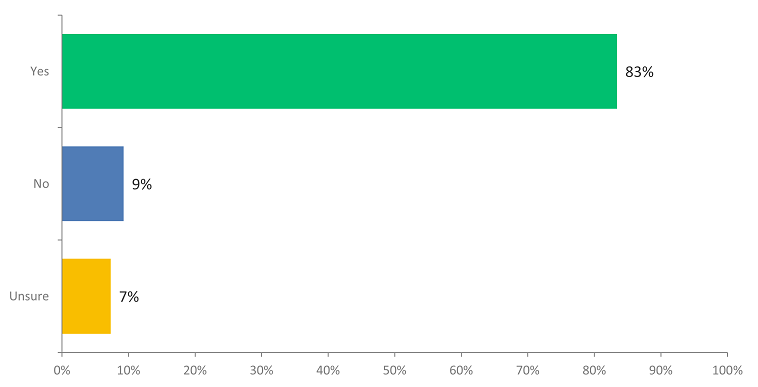

Rising living costs are keenly felt with 83% of people believing that costs are rising more than the officially-reported inflation rate.

Do you feel inflation has been higher than the official trimmed mean average of 5.75% in the last two years?

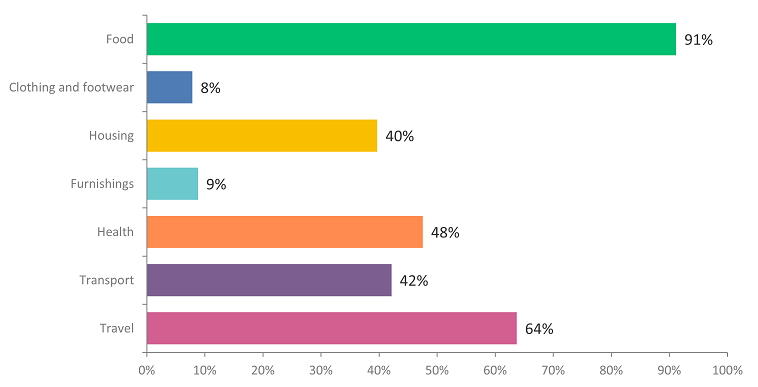

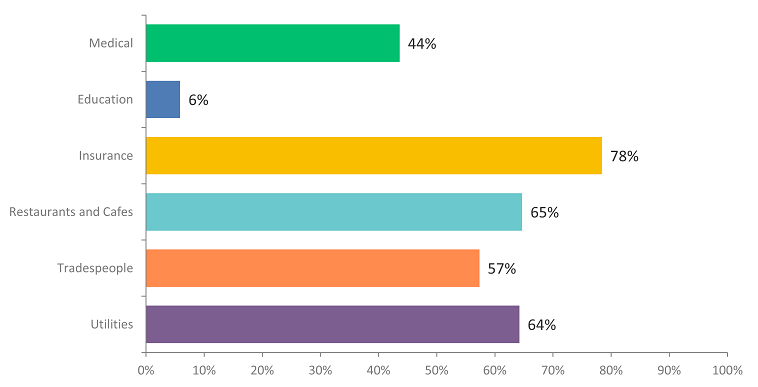

On which goods and services seem to have increased in price the most, the standout answers (selected by more than half of our respondents) were food (91%), travel (64%), insurance (78%), dining out (65%), tradies (57%), and utilities (64%).

What goods in particular seem more expensive? (multiple selections allowed)

What services in particular seem more expensive? (multiple selections allowed)

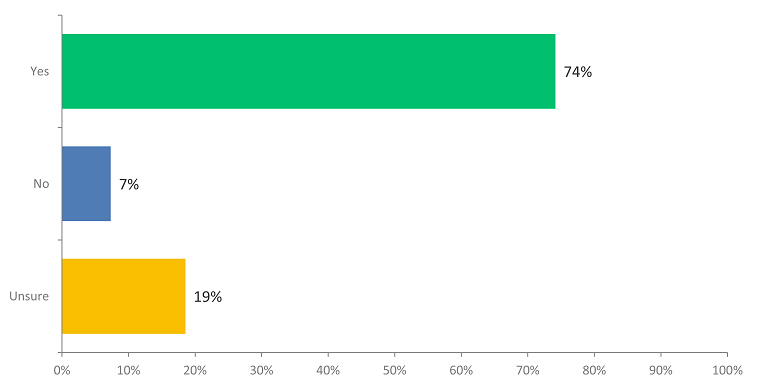

Almost three-quarters of respondents believe companies are taking advantage of the high-inflation environment.

Do you feel companies are taking advantage of the inflationary conditions?

The final question asked readers to share their more quirky and unusual anecdotes and examples of rising costs and inflation. While most comments are included in the longer report linked below, here is a sample:

- We started the backyard vege plot and it's going gangbusters! We scour the neighbourhood for produce and share our abundance of navel oranges with anyone who comes near our front door.

- Restaurant wine increases out of proportion.

- An example last week, at the Grand Central shopping centre car park in Toowoomba Qld. The first 3 hours are free, however, my total time was 3 hours & 30 minutes. They charged me $2.00 for the additional 30 minutes & there was no provision to pay by cash. When I received my credit card statement I was charged $2.10. That was a 5% fee!!!!

- Lower your standard of living. Shop around & consume less.

- It is becoming increasingly expensive to use the convenience of digital payments as more and more outlets (service industry, hospitality, medical and so on) charge a credit card surcharge - and without prior warning.

- I'm not one to scout about to save 6 cents a litre, but there are noticeable mark-ups of 50-60 cents a litre at some service stations. I ask you, why?

- Fuel surcharge on transport costs.

- Restaurants adding weekend surcharges, also on holidays.

- My doctor bulked billed and then changed to no bulk billing. There was no notification. You found out after the consultation. Now the medical practice is empty but you can easily get an appointment which was not the case with bulk billing.

- Car insurance. My car is 1 year older so insured value is lower. No accidents but premium increased by over 20%.

- Restaurants adding service fees on top of menu price rises (are we now becoming the US??) and pass through of credit card charges.

Full results and comments can be downloaded here.