When looking to purchase an investment property, there are many important questions. While most investors consider location, purchase price and tenanting ability, depreciation is often overlooked. Depreciation can help unlock the cash flow potential within an investment property, often resulting in thousands of additional dollars for the investor each financial year.

What is depreciation?

As a building gets older, items wear out – they depreciate. The Australian Taxation Office (ATO) allows property owners to claim this depreciation as a tax deduction. Depreciation can be claimed by any property owner who obtains income from their property.

Claiming building structure as a deduction

Capital works allowance deductions are based on the historical cost of the building excluding the cost of all ‘plant’ and non-eligible items. As a general rule, residential buildings which commenced construction after 15 September 1987 and commercial properties which commenced construction after 20 July 1982 are eligible for the capital works allowance.

Although these restrictions apply, often older properties have undergone renovations. Renovations completed within the legislated dates can also entitle the owner of the investment property to deductions, even if the deductions were completed by a previous owner of the property.

Common depreciable items in an investment property

Plant and equipment items, commonly known as removable assets, are also eligible for depreciation deductions. Each plant and equipment item has an effective life set by the ATO. The depreciation deduction available on each item is calculated using the effective life. Some plant and equipment depreciable items commonly found within a property include:

- Hot water systems

- Ceiling fans

- Dishwashers

- Carpets

- Blinds and curtains

- Exhaust fans

- Light shades

- Ovens

- Furniture

- Range hoods

- Smoke alarms

- Garbage bins

- Cook tops

- Door closer

Case study

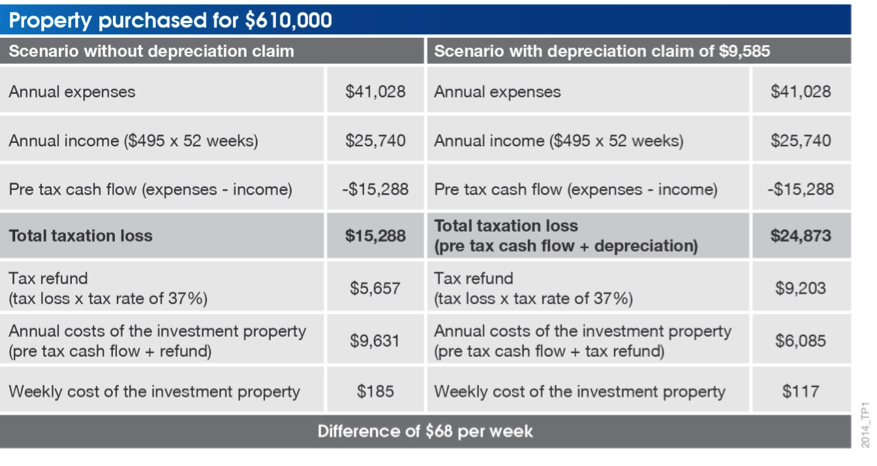

Amy purchased a nine-year-old three-bedroom house for $610,000 one year ago. Prior to making her depreciation claim, Amy’s investment property was earning a rental income of $495 per week or a total income of $25,740 per annum, while her yearly expenses (including loan interest) totalled $41,028. Towards the end of her first year owning the property, Amy’s annual after-tax outlay amounted to $9,631 or $185 per week, based on her 37% marginal tax rate. Of course, the reductions in taxable income are even more valuable to people in a higher tax bracket.

A thorough site inspection led to a detailed tax depreciation schedule showing the deductions available for her property for the next 40 years, including $9,585 in the first year. The following table provides a summary of Amy’s scenario for the first full year, both before and after depreciation was claimed.

The depreciation deductions in this case study were calculated using the diminishing value method of depreciation. The BMT Tax Depreciation Schedule reduced Amy’s annual outlay for the property to $6,085 per annum or $117 per week, a difference of $68 per week or $3,536 per year.

To claim depreciation, investors should obtain a comprehensive tax depreciation schedule from a Quantity Surveyor. They are qualified under the tax ruling 97/25 to estimate construction costs for depreciation purposes and are one of a few select professionals who specialise in providing depreciation schedules. They are affiliated with industry-regulating bodies and gain access to the latest information and resources through their accreditations.

Claiming depreciation during renovation

Existing assets within a property can be worth thousands of dollars. When old assets (like carpet or hot water systems) are replaced during a renovation, the owners may be entitled to claim any residual depreciation as a tax deduction. Property owners should consider a pre-renovation depreciation schedule if they are considering making any renovations to an investment property. They should also update an existing tax depreciation schedule after work is completed to ensure they capture deductions for any new items added to the property during the renovation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Chief Executive Officer of BMT Tax Depreciation, a leading provider of tax depreciation schedules for investors. This article is general information and individuals should seek their own tax advice.