Much was made of the fall in the prices of well-known tech stocks in September 2020, but they are well ahead this year, outperforming the overall market, and they have recovered ground in October to date. Many have benefited from changes in consumer spending patterns brought about (or accelerated) by the virus lockdowns.

In addition, share prices of tech stocks across the board have benefited from new first-time speculative traders – in Australia and around the world – buying shares simply because stocks have gone up in price.

Performance of tech over 2020

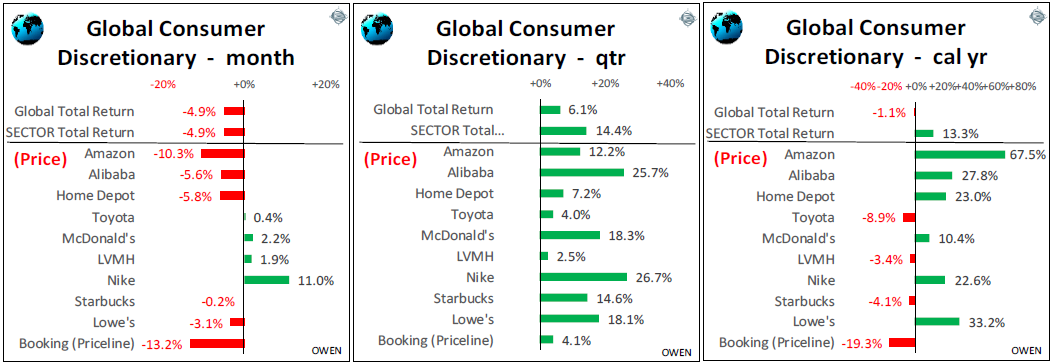

Globally, the big tech stocks are classified in different sectors. For example, Amazon (US) and Alibaba (China) are ‘Consumer Discretionary’ (data to end September 2020).

Also in this sector, it is notable that the big US home renovation/hardware chains Home Depot and Lowe’s have benefited from changing spending patterns during the lockdowns. Likewise with Bunnings (Wesfarmers) in Australia.

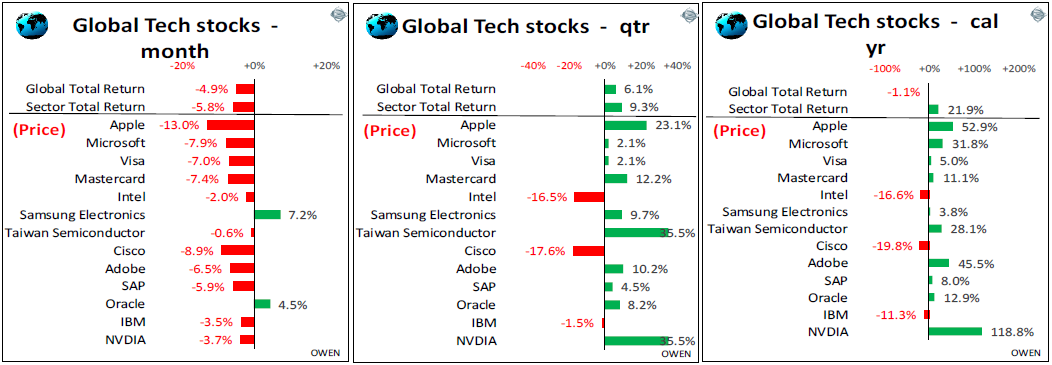

Apple and Microsoft are classified in the ‘Tech’ sector:

In this sector, we also see Nvidia (gaming software) and Adobe (office software) benefiting greatly from the lockdowns.

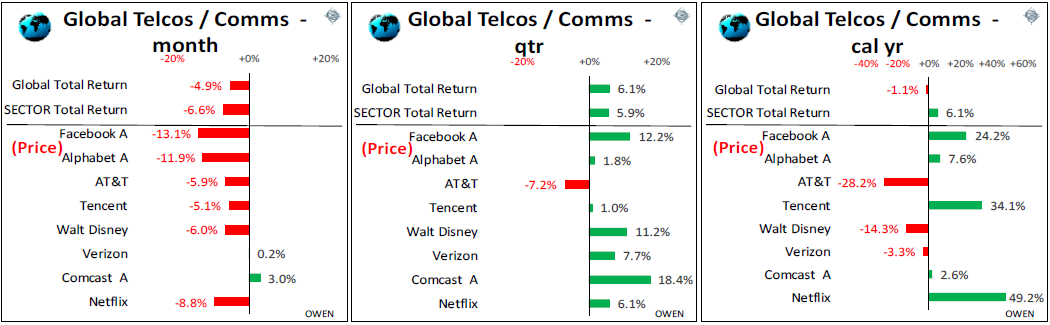

Facebook and Google (Alphabet), Netflix and Tencent (China) are in the old ‘Telco’ sector:

Tesla’s share price was also down 14% in September but is up more than 400% in 2020 to the end of September. The share price jumped on its 5:1 share split in August in anticipation of being included in S&P indexes (when a company is added to an index, every index fund in the world that tracks the index must buy shares in the new company to keep up with the index). But the share price fell back in September when index inclusion did not materialise.

Even though Tesla is profitable (just), it is impossible to value. It is trading on Amazon-like multiples at 1,000 times profits. Amazon’s price/earnings multiple is a relatively ‘conservative’ 115 times earnings!

Snowflake’s chance?

The rise of tech stocks this year has led to a flood of new tech floats to cash in on the boom. The highlight of the US tech IPO boom has been a company called Snowflake (SNOW). It is yet another cloud-based data storage firm. Unusually, its CEO Frank Slootman is not the founder, but a hired gun brought in by investors to ramp up the IPO, fresh from rescuing two other similar outfits in recent years (Data Domain and ServiceNow.) Snowflake’s accounts show 100%+ revenue growth and big losses to match. The bigger the losses, the better for a tech IPO!

The company raised US$3.4 billion at $120 per share, listed on 16 September, more than doubled to $253 on the first day, but since then it has drifted sideways. Snowflake is the first time Warren Buffett’s Berkshire Hathaway has jumped into a tech IPO. Berkshire bought $250 million of shares at the IPO price and is sitting on a 100% gain in a couple of weeks.

Buffett has made some very expensive mistakes in recent years, and all have been big departures from his long-held investment philosophies. The Kraft-Heinz deal (mistakenly assuming US brand loyalty extended to non-US markets); the Occidental–Anadarko oil take-over, right before oil prices crashed (having promised for decades never to invest in commodities companies); and big losses on four US airlines (having promised for decades never to invest in airlines). He also spent the 1990s vowing never to invest in tech IPOs (he was right at the time), but he’s doing it now.

Another tech highlight of the month was video conferencing outfit Zoom. Its share price has zoomed up more than 600% this year.

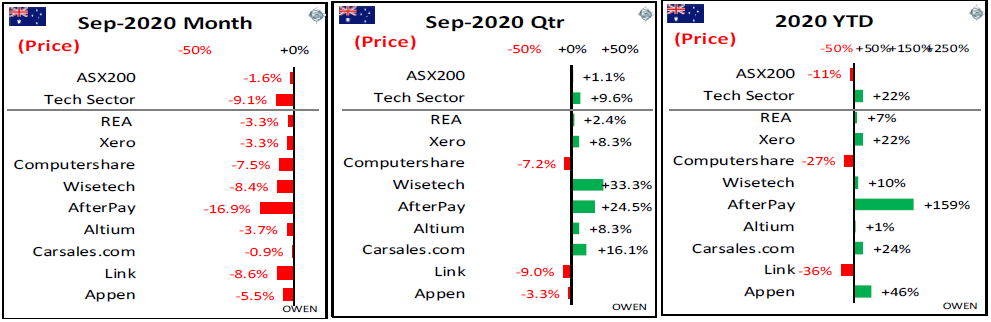

Australia's tech sector

In Australia, the main speculative ‘tech’ stocks were also down in September in the global mini correction, but all were still ahead for the September quarter and ahead for the year to date. (The exceptions are the two share registries Computershare and Link, which are classified as tech stocks for some reason).

Realestate.com (REA) and Carsales.com are not ‘tech’ stocks. Both have risen with hopes of a recovery in consumer spending.

This is not to suggest that the local tech stars are good investments (most are speculative bets, not investments) but shareholders have still done well this year, especially if they bought them in the coronavirus sell-off.

When will it end?

Hundreds of thousands of mostly young first-time speculative traders opened brokerage accounts since the virus sell-off to buy into the hot tech stocks du jour because most of the sporting events on which they usually gamble have been closed. The mini-correction in tech stocks in September was the first time they experienced prices actually going down. They bought purely because share prices were rising (“Hey, I doubled my money in a month – I’m a genius! Defs”).

The current boom will end the same way as every other speculative frenzy that was driven by the mass hysteria creating momentum from rising prices rather than actual profits.

When will it end? It will end when global confidence in the prospect of endless monetary and fiscal stimulus runs out of steam, but confidence seems to be holding up thus far.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual.