Over 30 years since 1992, both Liberal and Labor Governments have encouraged Australians to save large amounts in super with generous tax concessions as compensation for forgoing present-day consumption. In 1995, for example, the Labor Budget of Treasurer Ralph Willis announced the intention to lift the superannuation guarantee (SG) from 9% to 15% by 2002. In 2007, Liberal Peter Costello encouraged people to add up to $1 million to their super. As recently as 2017, a couple could put up to $1.08 million into super in one year using the bring-forward rule.

As Treasurer in 1991, Paul Keating was the main architect of Australia's compulsory superannuation system. He said recently:

“I wanted a system where the individual retained the capital and didn’t give it to the government. It was an account with your name on it. The capital is yours and it doesn’t belong to the government.”

Savers with enough money followed the rules - "the capital is yours" - over decades and watched their investments grow with compounding and good returns. No government should now demand they spend it all during their retirement. That was not the deal. Defining the purpose of super as only for providing income in retirement is rewriting history.

Whatever the future, that was not the past

Last week, at the annual Superannuation Lending Roundtable, Treasurer Jim Chalmers gave the old hobby horse another run around the track, when many thought the nag had gone to the knacker's yard. At the event, hosted by The Australian Financial Review and industrialist Anthony Pratt, Chalmers said:

“We see the lack of a legislated objective of super as a source of ambiguity which left the gate open for early access, and so we will legislate one.”

Way back in 2015, the previous Government announced it would enshrine the objective of superannuation in legislation, as recommended by the Financial System Inquiry (FSI). The Government even released a discussion paper entitled ‘Objective of Superannuation’ with background and questions, and received 118 submissions. The intention was to adopt the following:

"The objective of the superannuation system is to provide income in retirement to substitute or supplement the Age Pension."

Now, some seven years later, the Treasurer has made defining an objective a priority for his office. Already, a recommendation of the FSI that was adopted from 1 July 2022 requires all super funds to have a Retirement Income Covenant that includes a strategy that balances:

• maximising retirement income

• managing risks to the sustainability and stability of retirement income

• having some flexible access to savings during retirement.

But however the proposed objective is drafted, a large cohort of investors will have no problem funding their retirement and they have no intention of spending their superannuation.

Evidence of intention not to spend super

Like it or not, hundreds of thousands of Australians use their superannuation as more of a tax-advantaged savings vehicle than a source of retirement income.

At a 2015 CSIRO and Monash University Superannuation Research Cluster, a study reported that 90% of the amount an average retiree enters retirement with (including the family home and non-super) remains unspent upon their death.

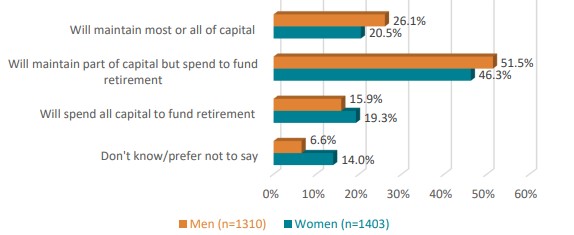

In a recent 2022 survey by National Seniors and Challenger of 3,345 members, more respondents reported they would 'maintain most or all of capital' than 'spend all capital to fund retirement', as shown below.

Intention to maintain capital in retirement (n=2713)

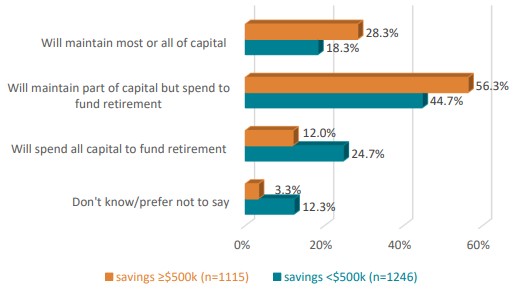

As expected, those with over $500,000 in retirement savings have a significantly higher intention of maintaining their capital.

Intention to maintain capital according to wealth (including super but not the home) (n=2361)

When asked why they are maintaining capital, 41% nominated 'for beneficiaries'. On whether retirement savings are a nest egg or income stream, the Report concludes:

"Super capital was not meant to accumulate and remain unused. In practice, however, many people only spend earnings from their super to preserve the capital or take the required minimum drawdown. This can reduce available spending money by as much as 30%. The results of this survey align with the observations made by the (Retirement Income) Review that many retirees do not want to consume their super as income. Only 1 in 3 people were intending to draw down their capital to generate income from super in retirement."

Is that first sentence correct? When in the first two decades of SG did Keating, Costello, other Treasurers and Treasury advocate that all super balances must be exhausted in retirement?

Diving deeper into SMSF and super balances

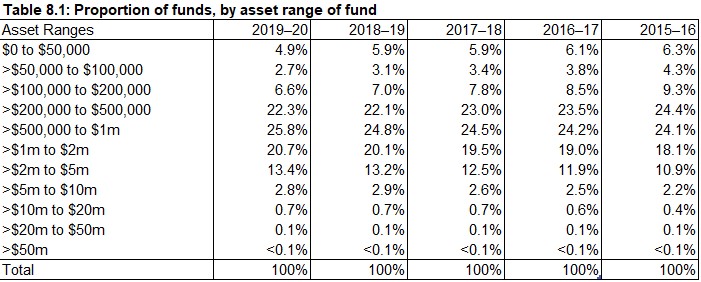

Consider the latest SMSF data, recently released by the Australian Taxation Office for June 2020. There is a significant lag due to delays in SMSF tax reporting, and the amount will be higher now. The ATO data reveals $854 billion (of the $3.3 trillion in super) was held in 605,000 SMSFs for 1.1 million members.

As shown below, 17.1% of funds held over $2 million in assets, equal to about 103,400 funds for 188,100 people. This data focusses only on SMSFs as they are likely to hold the largest super balances, but in addition, total super data from the ATO shows 575,000 people with annual incomes above $180,000 hold an average of $575,000 in super each.

As most people enter retirement as a member of a couple, and it's likely if one partner dies, the entire balance will pass to the other, the data indicates there are at least 200,000 Australians with access to super balances of $2 million or more and far more with $1 million plus.

Any way these numbers are cut, an enormous number of Australians have more money than they will use to finance their retirement. In the National Seniors data, 81% owned their homes outright with a further 11% owning with a mortgage. It is likely that their homes are worth more than their super, as well as owning considerable other assets. Given the tax efficiency of super, it is prudent to use non-super assets (other than the family home) before drawing on super.

Large balances can still accumulate

The caps imposed on contributing to super will go some way to eliminating the mega balances of $5 million or more, but they still allow significant wealth to be stored in super. For example, current rules allow:

- $1.7 million in a pension account ($3.4 million for a couple) subject to no tax on income and withdrawals

- No limit to the size of accumulation accounts taxed at 15%

- Non-concessional contribution cap of $110,000 a year

- Concessional contribution cap of $27,500 a year

Plus various schemes such as carry forward concessions and downsizer payments (of $600,000 a couple) which do not count towards the contribution caps.

Well-paid executives using these amounts over a long career will accumulate multi-million superannuation accounts long into the future. For example, invest $100,000 at the start and add $120,000 a year for 20 years compounded at 5% gives a balance over $4 million.

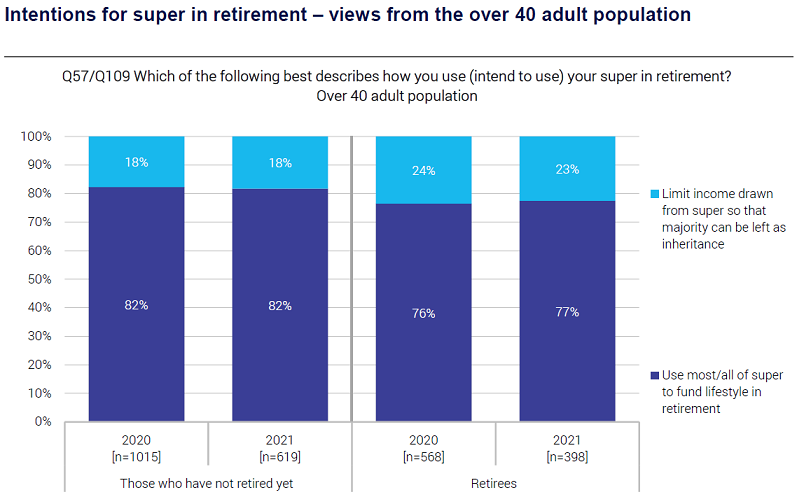

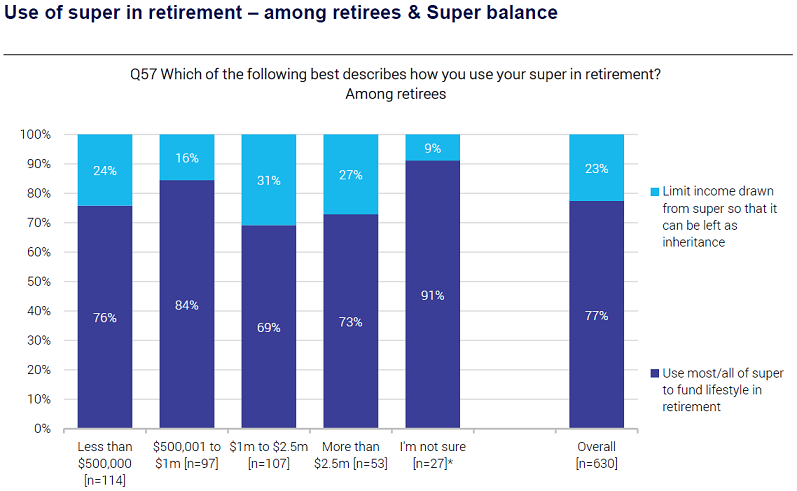

In research from Investment Trends, 18% of people over 40 who have not yet retired expect to limit drawdowns for income to ensure most super can be left as an inheritance. Fully one quarter of retirees are already doing this.

Copyright 2021 Investment Trends. November 2021 Retirement Income Report: Industry Analysis.

Cutting the data by super balances, even among retirees with less than $500,000 in super, 24% plan to leave most money as an inheritance. At larger balances, the proportion rises as high as 31%.

*Small sample, indicative only. Copyright 2021 Investment Trends. November 2021 Retirement Income Report: Industry Analysis.

Superannuation specifically acknowledges bequests

Superannuation legislation has specific features designed for appropriate bequeathing. Binding Death Nominations (BDNs) ensure superannuation is distributed according to the wishes of the deceased member, not at the whim of another trustee of the fund or executor of the estate. Superannuation is not an asset of the estate and a trustee is not obliged to follow directions in a will, even if super is specifically mentioned in the will. The instructions in the BDN define the money flow.

The superannuation rules facilitate bequests to non-dependants. There is no restriction on withdrawing money from superannuation for anyone who has reached preservation age and satisfied a condition of release (including retiring). However, on death, if it is given to anyone other than a spouse or a dependent child, there is a tax (on the taxable component) of 15% plus the Medicare levy (currently 2% for most people). The obvious approach is to gift it before death, if possible.

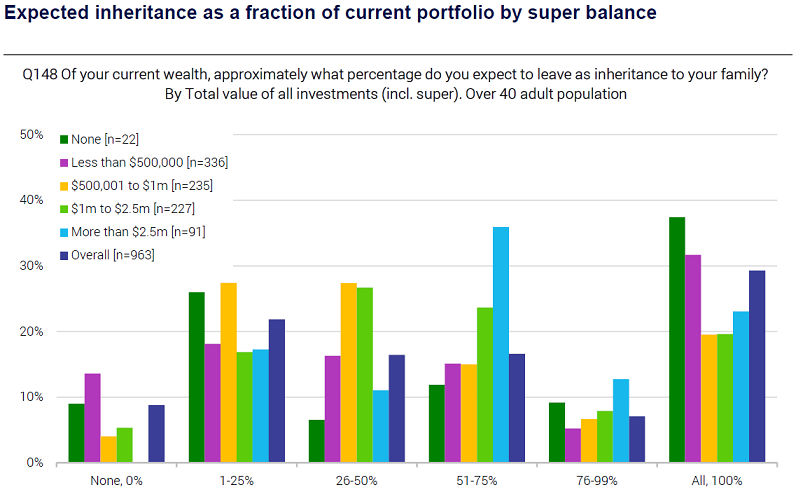

Again using Investment Trends research, large proportions of people in every wealth bracket intend to leave substantial parts of their estate to beneficiaries, and in some cases, the total value of all investments.

Copyright 2021 Investment Trends. November 2021 Retirement Income Report: Industry Analysis.

The system was designed to allow large balances

Treasurer Chalmers will define the objective of superannuation as 'providing income in retirement' or similar, ignoring the fact that both Labor and Liberal Governments designed a system which allowed people to accumulate more than they need. As stated above, the current chair of the Future Fund allowed $1 million into super in only one year, and more recently, a couple could put up to $1.08 million into super in only one year.

Unless some much stricter legislation is passed such as requiring all balances over a certain amount to be removed from super, hundreds of thousands of Australians have no intention of running down their super to one dollar on the day they die. As Keating said, "I wanted a system where the individual retained the capital."

Labor badly misjudged the opposition to its policy on restricting franking credit refunds but would be on safer ground with most voters if superannuation were capped at a high amount, say $5 million per person. There is no knowing, however, how much extra tax this would generate as the very wealthy have other tax minimisation techniques.

Go ahead, clarify the objective of superannuation, but don't expect those with large balances accumulated by the completely legitimate (and government sponsored) use of the system to change their plans. Their spending intentions extend beyond their lives and beyond their graves. For many, the objective will be flogging a dead horse.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any person.