Australia’s Banking and Finance Oath (BFO) should be a big deal. Its purpose is:

“The Banking and Finance Oath contains a set of commitments that individuals working in the banking and finance industry might agree to adopt and apply as personal principles in their work.”

Source: www.thebfo.org

It is in the interests of every banker, wealth manager, fund administrator, financial planner and stockbroker to improve public trust in the finance industry. At its heart, banking and finance rely fundamentally on confidence and trust in looking after another’s money.

Although the wording was finalised in February 2011 and it has been possible to take the Oath since October 2011, it was given its formal launch only recently, at a dinner for a large group of senior executives. Everyone agreed it was a fine initiative and there was much satisfaction at reaching this milestone, and then in one conversation around my table, it was driven home to me the types of problem the industry faces. More on that later.

I am a big fan of the aims of the Oath. I put my cards and my career on the table in 2001 when my book, Naked Among Cannibals, What Really Happens Inside Australian Banks, was published. It revealed some of the less savoury practices I had experienced in two decades in banking, although I believe the industry has improved significantly since then. If we had thousands of bankers taking the BFO seriously, then change would be manifest.

The BFO has a heavyweight Board, including the heads of AMP Capital, Morgan Stanley, MLC, ASFA and ANZ in Australia. The Oath’s wording is laudable:

- Trust is the foundation of my profession.

- I will serve all interests in good faith.

- I will compete with honour.

- I will pursue my ends with ethical restraint.

- I will create a sustainable future.

- I will help create a more just society.

- I will speak out against wrongdoing and support others who do the same.

- I will accept responsibility for my actions.

- In these and all other matters;

- My word is my bond.

It is finance’s equivalent of medicine’s Hippocratic Oath. It should address what the BFO website calls the “trenchant criticism of the recent performance of the global financial system.” One of the Board members, former MLC CEO Steve Tucker, told an audience in September 2012 (as reported in Investor Daily, 21 September 2012), “Our industry cops a lot of flak. Financial services, globally, has not done so well in the last four or five years. A lot of people have challenged the fact that we actually act in our clients’ interest. We have to change that … At the moment it’s brand new and we don’t know how we’ll go.”

Current public perception of banking and finance

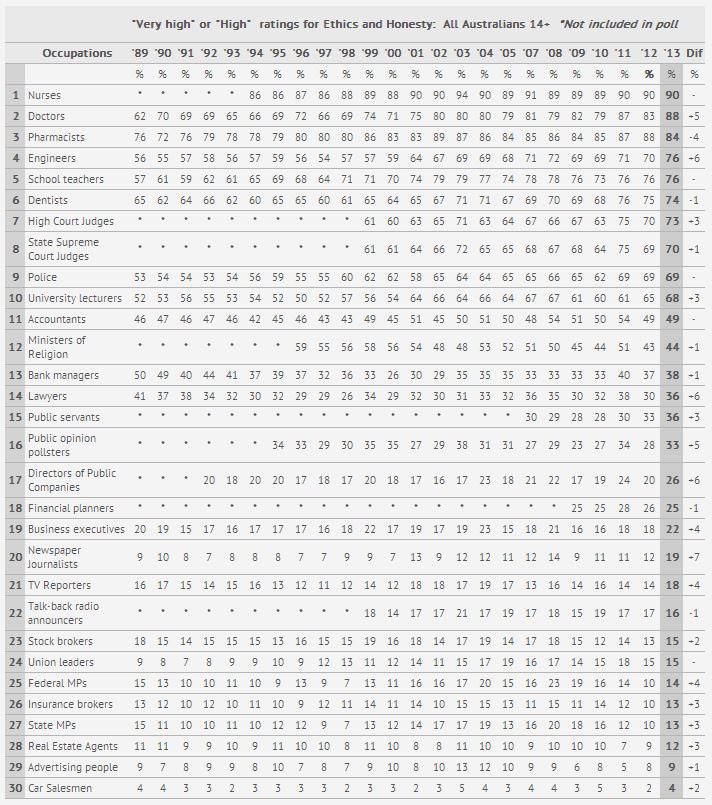

With so much to gain in improving the public image of the finance industry, why have barely 100 people signed up to it? The four major Australian banks alone have 175,000 employees. The BFO website has a ‘News’ section with only three items. Every senior executive in the country must want the industry’s image improved. The latest Roy Morgan Research ‘Image of Professions Survey’ for 2013 is summarised in the table at the end and does not make pretty reading for ‘ethics and honesty’ in finance. While members of the medical profession such as nurses and doctors are rated around 90% ‘very high’ or ‘high’, the ratings of various finance professions are:

- Accountants, 49%

- Bank managers, 38%.

- Financial planners, 25%

- Stock brokers, 15%

- Insurance brokers, 13%.

The respected Edelman Trust Barometer 2013 Annual Global Study shows Banks and Financial Services are the least trusted industries globally, behind even Media, Chemicals and Brewing & Spirits. Equally disturbing, while financial services in many countries improved their ‘trust score’ in the last year, Australia fell heavily from 46% to 38% (a score of one means ‘do not trust them at all’ and a score of nine means ‘trust them a great deal’, so 38% is not good).

Impact of existing legislation

Ideally, the undertakings in the Oath should be taken as given. Even if it were not a matter of honour and ethics, for large sections of the industry, it is also a matter of law. For example, the Life Insurance Act says that a director of a life company, “... in the event of conflict ... gives priority to the interests of owners and prospective owners of those policies over the interests of shareholders.”

Similarly, under the Managed Investments Act, when acting on behalf of an investment fund, a Responsible Entity must:

“(a) act honestly; and

(b) exercise the degree of care and diligence that a reasonable person would exercise if they were in the responsible entity's position; and

(c) act in the best interests of the members and, if there is a conflict between the members' interests and its own interests, give priority to the members' interests; and

(d) treat the members who hold interests of the same class equally and members who hold interests of different classes fairly.”

It is notable, however, that there is no legal equivalent for banks. Deposit money in a bank at 4% and the bank’s obligation is to give you 4%, not somehow to act in your best interests.

But my 'ethical restraint' is your 'standard business'

How is it possible, then, that public perception of the finance industry is so poor? Obviously, scandals such as Storm Financial and Opes Prime were major setbacks, but there are day-to-day practices which customers find both perplexing and untrustworthy.

Back to my conversation at the Oath’s launch. Four of us were making small talk when I said something like, “An oath is a big thing. I know there have been times in my banking career when I could not have stayed in the room if I’d signed the Oath.”

Sitting opposite was the high profile CEO of a major financial institution, and he frowned at me. “What do you mean?” he said.

“Well decisions are made in banks every day which would struggle to pass the tests imposed by the Oath,” I replied.

“I don’t have any problems,” he said.

“Okay. Let me be more specific with an example. You’re sitting on a bank pricing committee, and you are willing to pay 4% for a new term deposit. But at the same time, you set the rate for rollovers of existing term deposits for a similar term at 2.5%, in the hope that inertia or complacency will mean that your clients don’t notice. It’s worth millions to your bank, so nobody says anything, although you agree to offer the higher rate to anyone who complains. How is that ethical?”

Again he frowned at me. These dinners are supposed to be friendly affairs. “I think that’s fine. We write to our customers, we tell them the rollover rate, and if we don’t hear from them, it rolls over. Acceptance and offer, that’s how we do business.”

“So let me understand this. If a 90-year-old widow struggling to look after her own finances receives a letter from you offering 2.5%, and she does nothing, that’s fine. Whereas if she picked up the phone and asked for a better rate, you’d pay her 4%. Or you offer a bonus rate on a new account for the first 3 months, which anyone can continue to receive if they ring back each quarter, but you don’t tell anyone. And the difference goes into the billions of dollars of profits the industry makes, from which we reward ourselves. And we still charge credit card rates at 21% when the cash rate is 3%.” At this stage, we agreed to disagree, and I focussed instead on my steak.

And so I’m waiting for the Oath to become popular, to reach a critical mass, where individuals stand up in meetings in banks and finance houses across Australia and say, “I’ve signed the Banking and Finance Oath, my name is on the public record, and I’m obliged to help create a more just society, to create a sustainable future, to compete with honour and serve all interests in good faith. I think we should contact every person over the age of 60 who holds their life savings in a savings account earning zero interest and check if it’s really in their best interests.” And see how much support they receive.

Steve Tucker also said in his talk, “What we're trying to do is create a movement of people who operate in this industry to stand up and say personally, 'I'm accountable for how I operate'."

Bring it on.

Roy Morgan Research ‘Image of Professions Survey’ for 2013