In 2007, Jonathan Trenn of the US bought a diamond ring from Overstock.com so as to propose to his girlfriend in a few months’ time on New Year’s Eve. Within hours of buying the ring, Trenn received a ‘shocking call’ from a friend saying congratulations for getting engaged. He said:

“Imagine my horror when I learned Overstock.com had published the details of my purchase including a link to the item and its price to all my (Facebook) friends ... including my girlfriend and all of her friends.”

Such was the technical ability of Beacon that enabled Facebook publisher partners to reveal their customers’ purchases to Facebook networks to drive engagement and sales.

While Beacon was shut down in 2009 due to user complaints about privacy violations, the gathering and commercialisation of user data on the internet has only intensified such that the phrase ‘surveillance capitalism’ was coined by US academic Shoshana Zuboff in her book of 2019 to describe the practice. The term represents how private companies, sometimes with questionable user consent, collect as much data as they can on their users with an objective to maximise profits. Controversially, they have enjoyed the ability to employ technology that can track users across the internet. Once they have enough data, the data harvesters then sell their ability to match these profiles against the type of people whom advertisers would like to reach.

The success of online ads

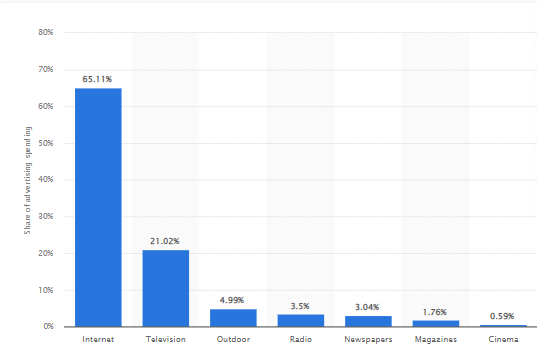

Targeted online advertising is among the world’s most successful business models such that online advertising is expected to reach 65% of global advertising spending by 2024.

Online advertising’s dominance

Distribution of advertising spending worldwide expected in 2024, by medium

Source: Statista. Published 17 February 2022

The sobering news, however, for companies that turn data into behavioural information is that the business model is coming under regulatory scrutiny and changing in ways that dent the money-making ability of the platforms that rely on off-site (or ‘third-party’) data for targeting, while strengthening the position of those platforms with significant on-site (or ‘first-party’) data.

The impact of regulators and Apple

The biggest challenge for the online-ad business model is the elevation of online privacy as a social concern. This has two strands.

The first strand is that EU policymakers are imposing tougher laws to restrict data use and make more transparent how data is used. The most worrying consequence for Big Tech? Such regulations spread worldwide, most worryingly for them to the US.

The second strand to the elevation of privacy concerns is that Big Tech companies – especially Apple – are offering privacy protections because, as Apple CEO Tim Cook says, the online privacy ‘emergency’ is making society ‘less human’. An Apple update in 2021 installed a change whereby users must agree to being tracked across apps. The result is that Facebook and other platforms have suffered as their ad targeting has become less effective.

The second challenge to the online-ad business model is greater scrutiny of the unregulated ad exchanges on which prices for online ads are set in an auction. Texas and other US states have filed a lawsuit of collusion against Google that accuses the company of taking steps to prevent publishers from using ‘header bidding’.

The term refers to when publishers insert code in the header of web pages to increase competition among online ad exchanges. The Texas filing said that when publishers used header bidding, they received up to 70% more for their ads than when using Google’s ad exchange without header bidding.

The header-bidding revelations have aroused other policymakers. In the US, bipartisan-sponsored legislation is before Congress that aims to stop companies from playing more than one role in digital advertising. If enacted in its current form the legislation would force Google to spin off parts of its online-ad business.

A third challenge for the online-ad business model is the political question of the dominance of internet platforms in society; specifically, whether their data gathering and use of certain algorithm-promoted content to maximise engagement threaten democracy. Some demand that the ability of companies to collect data be restricted to the point of being abolished.

Hurdles to displaying ads, exposés on online-ad exchanges, industry restrictions on competitor data-gathering, and incremental government regulation might accelerate the decline in the effectiveness of display ads. But people will still see plenty of them. Businesses know that online advertising is a generally superior way to promote sales and brands thanks to its micro-targeting and measurement abilities. A mild rise in ad misfires won’t matter much to them.

Advertising budgets still directed online

Governments and bad actors have the capabilities to abuse online privacy to a much greater extent. Irrespective of the harshness of laws preventing ad targeting, the personal information of device users will remain traceable. Privacy only flickers as a political problem because most people seem untroubled that Big Platforms and others track them online.

But enough care and more might, especially as TikTok is gathering data globally that many allege heads to China. While a drive is underway to ensure online privacy more matches offline privacy, nothing is likely to happen that stops advertisers from directing most of their budgets to online. But at least enough of a privacy push is underway that it’s safer to buy an engagement ring before proposing.

Michael Collins is an Investment Specialist at Magellan Asset Management, a sponsor of Firstlinks. This article is for general information purposes only, not investment advice.

For more articles and papers from Magellan, please click here.