Only a few days apart, I attended presentations from two global equity managers offering divergent perspectives. Both were realistically open to all possibilities and know about the market’s current optimism, but where Hexavest saw a bubble, Insight Investment Management justified the valuations. Both these fund managers do not market to retail investors and their views are normally restricted to institutional and wholesale investors.

It’s worth knowing that both managers are top-down, starting at macro conditions rather than bottom-up stock pickers. They forecast growth, currencies, financial conditions and prices before looking at which companies to invest in.

In its active asset allocation process, Insight makes frequent adjustments based on expected returns and risk. Its current listed equity allocation (excluding infrastructure) at around 38% is the highest for a couple of years, and cash holdings are at the bottom end of the range since 2009. However, most risk is carried in ‘total return strategies’ which are less prone to overall market directional influences and derive returns from relative value or absolute returns. For example, backing its general optimism, Insight states:

“Our pro-cyclical portfolio stance – based on the idea that a synchronised global recovery would continue – looks well supported. Purchasing managers’ indices (PMIs) from around the globe are at high levels and moving higher.”

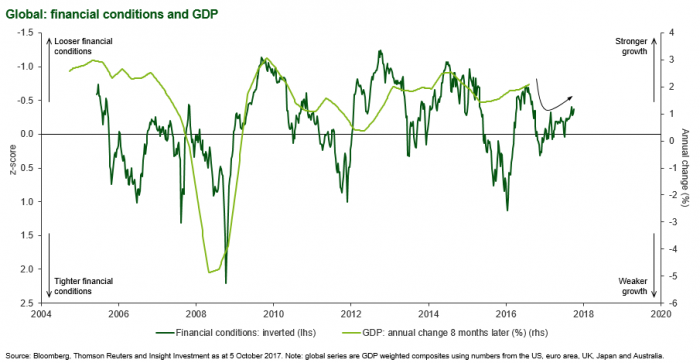

1. Better financial conditions and growth

Insight quotes many indices which show an improvement in global growth and lead indicators, with better global growth since the start of 2017 after slowing into 2016.

For example, the Institute of Supply Management (ISM) manufacturing index monitors employment, production, new orders and supplier activity based on over 300 major firms. The ISM Index has been rising since early 2016, and in the last few months has had a healthy uptick. Insight reported in early October:

“In the US, economic data continued to be strong. The ISM manufacturing index reached 60.8 in September, the highest since 2004. US service sector growth also reached its highest in 12 years in September. The US trade deficit dropped to an 11-month low and factory orders rebounded in August. Markets are expecting a non-farm payrolls figure around 90,000 today. The House of Representatives approved a $4.1trn budget, with markets optimistic that this could be a step towards tax reform.”

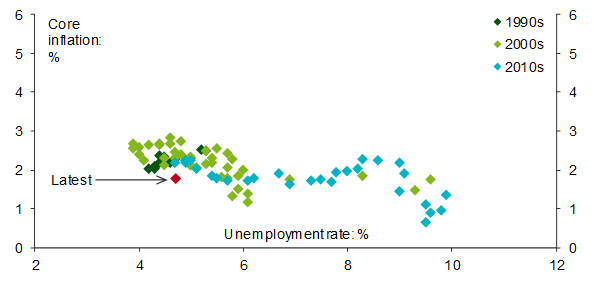

2. Inflation and unemployment under control

The US remains the most important economy for economic growth, and despite record low interest rates and low unemployment, core inflation does not seem to be rising. Wages growth remains subdued. The economic theory behind the so-called Phillips Curve, that low unemployment leads to high inflation and wages growth and vice versa, is not occurring.

Phillips Curve is flat in the US

In Germany, engine room of the European Union, unemployment is at its lowest for decades but there is also little sign of inflation.

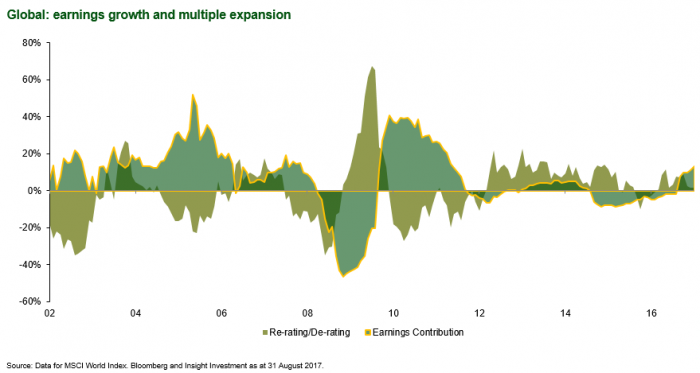

3. Improving corporate profitability

A rise in share prices might be driven by a re-rating, or earnings expansion, where investors are willing to pay higher prices for the same earnings. Low interest rates reduce the attractiveness of alternative assets such as bonds and encourage buying of equities if earnings do not expand. The other driver is increasing earnings contributions, and after flat conditions through 2015, there was an improvement in 2016 and into 2017, as shown below. Says Insight:

“After more than two years of contraction, global corporate earnings growth turned positive at the start of this year and the 15.8% year-on-year rise in August 2017 marked the highest reading since 2001.”

Conclusions

This combination of improving growth, low unemployment and corporate earnings growth leads Insight Investment Management to believe there is reason for optimism about the near-term performance of equities. The portfolio managers have shown a willingness to rapidly change portfolios from month to month, but at the moment, they are solving the equity conundrum with confidence in the market.

Graham Hand is Managing Editor of Cuffelinks. Insight Investment Management has AUD930 billion in assets under management with AUD33 billion for wholesale Australian clients (although its funds are found on many local wraps). It is part of the BNY Mellon group. This material is not investment advice and it does not consider the circumstances of any investor. It is based on material considered to be reliable but no assurances are given.

Bull or Bear? What is your opinion on the medium term outlook for markets? After reading this article as well as Graham’s other piece Five warnings about the most hated bull market in history, we invite you to voice your opinion in this short survey [survey now closed].