The Russia-Ukraine conflict looks set to splinter the world into two distinct trading and financial systems that are aligned across the US and Chinese axis, triggering a long bout of sustained inflation that will impact commodity and food prices over this decade. This inflation will come in three waves: rising energy prices, repositioning commodity supply chains and the birth of a new reserve currency.

Before we get into it, we’d like to make it explicitly clear to readers that we do not in any way support military conflict. War is horrible and the wrong action regardless of who is involved. Our role as investment analysts is to remain as neutral as possible. This position allows us to correctly assess the contribution of parties directly involved in the lead-up to this conflict, as well as assess the long-term consequences that are likely to evolve.

1st wave: Rising energy prices

The cause of the first layer of inflation starts from an imbalance between the supply and demand of energy in the form of oil and natural gas. The last sustained global inflationary period occurred as a direct result of the 1973 Arab-Israeli Yom Kippur War and the 1979 Iranian revolution, which led to a 13-fold oil price increase from US$2.70 in 1973 to US$36 in 1980. Then US Federal Reserve chairman Paul Volker was forced to raise US interest rates to 19% in 1981.

Fast forward to the 21st century, and we see rising demand from the developing world, which is expected to grow its share of global oil demand from 40% in 1990 to 70% in 2030. However, with many of the largest oil fields reaching maturity, and with US-led sanctions on major oil reserve nations like Iran, Venezuela, Iraq and now Russia, the rising oil price volatility witnessed over the past 20 years is likely to worsen.

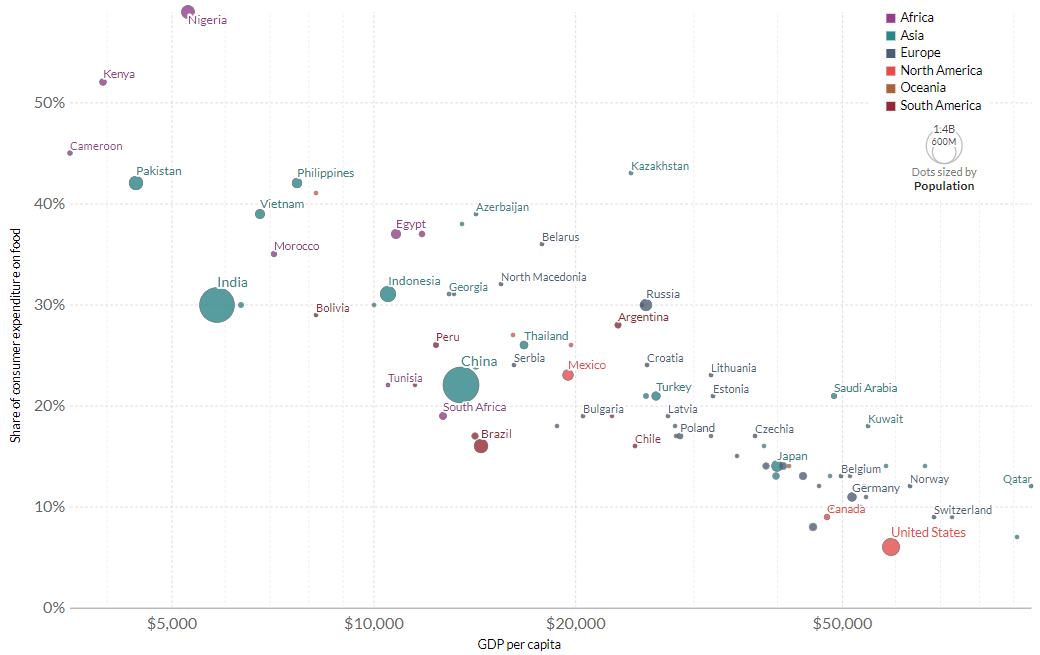

The consequence of higher sustained energy prices over the past two decades has led to higher prices across the entire supply chain for goods and services. Higher food prices, which depend upon stable oil and gas prices to manufacture fertilizers, plant and harvest crops, fuel logistics networks, refrigerate supermarkets and for cooking, impact consumers in the developing world the hardest. Food prices have doubled since 2017, likely driving food costs above 50% of income across most developing countries.

Percentage of GDP per capita spent on food, 2017 ($USD)

Source: Our World in Data

The recent war in Ukraine has triggered a big jump in food prices. Together, Russia and Ukraine’s share of global exports is 32% for wheat, 19% for corn and 80% for sunflower oil. Russia and Belarus together supply 40% of potash while China and Russia supply over 50% of global phosphate, both critical to the production of fertilizer that is used to lift crop yields in agriculture. Further complicating supply constraints is the recent introduction of food export bans from Argentina (Soybean and meal), Algeria (all food products), Indonesia (palm oil), Ukraine (barley, sugar, wheat), Serbia (grains and oils) and China (fertilizer).

Lower global food supply risks further increase in grain and livestock prices, with wheat and corn up 50% and 20% respectively since February 1st. Higher energy prices are also expected to raise the cost of logistics and manufacturing globally, raising the cost of almost all goods and services for the consumer.

All this data almost certainly means that inflation is here to stay.

2nd wave: Repositioning commodity supply chains

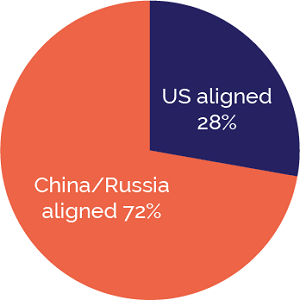

The 2nd inflationary force will be driven by the massive costs associated with shifting commodities production away from Russia, as well as other countries that appear to be aligning against the US. This group includes the 39 countries that voted either against or abstained from voting in the recent United Nations efforts to sanction Russia following its actions in Ukraine. Also included are Saudi Arabia, the UAE and Brazil, who have each made public statements against direct sanctions on Russia.

Political alignment of global oil reserves, March 2022

This should set off massive alarm bells for US aligned nations, including Australia and most of Europe. With 72% of global oil reserves located in countries that are aligned with China and Russia, the ability of Western nations to shift their oil resources towards friendlier nations is severely limited. Over one third of US aligned resources are the Canadian tar sands, which produces three times more global warming pollution than conventional crude oil, while another one-quarter of these resources are found in Kuwait, which is surrounded by China/Russia aligned partners Iraq, Iran, and Saudi Arabia.

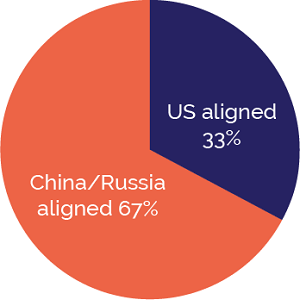

Political alignment of global gas reserves, March 2022

Global natural gas reserves are also heavily aligned with China and Russia supporting countries, which together control 67% of global reserves. Almost 40% of US-aligned gas reserves are in the South Pars field of Qatar, which is split 50/50 with Russia-aligned Iran. Efforts to shift Europe’s natural gas reliance away from Russia towards US shale gas is also unlikely a long-term solution given the US only holds 5% of global gas reserves.

The location of oil and gas reserves in countries aligned with China and Russia will require a massive increase in investment, measured in the trillions of dollars, to identify and develop new commodity resources. Besides exploration and production costs, substantial infrastructure investment will also be required for pipelines, mine site development, roads, ports, and shipping. While the shift to renewable energy sources will alleviate some of these concerns over the next few decades, building them will require substantial fossil fuels to mine the necessary resources and manufacturing.

Massive long-term investment also needs to be undertaken for many other commodities including fertilizer (potash and phosphorous), copper, aluminum as well as food production and water. Unless Europe and the US can find common ground and alleviate their multi-decade fight with Russia and now China, the cost of developing replacement resources will drive substantially higher resource prices and inflation for consumers over the long term (>10 years).

3rd wave: A new reserve currency is born

The third and largest force that is likely to trigger long-term inflation is the acceleration in the shift away from the US dollar as the reserve currency of the world towards an alternate China-aligned reserve currency.

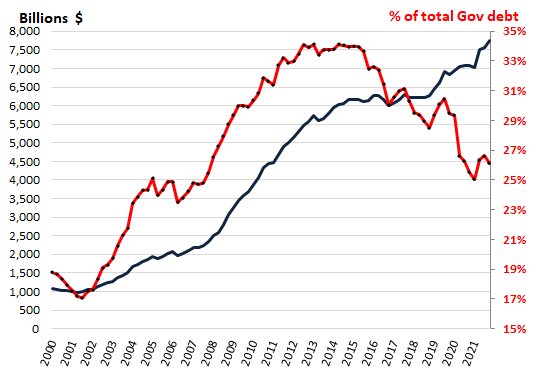

This shift away from the US dollar picked up in 2014 when traditional buyers of US Treasury bonds, led by China and Japan began to reduce their exposure to US government bonds. Foreign holders’ share of US government debt fell to 26% in 2021, a 16-year low.

US Gov’t debt held by foreign holders, quarterly ($USD)

Source: Wolf Street

Efforts by the US Federal Reserve to artificially hold US treasury interest rates below 2%, while accelerating artificial money creation through its 13-year ‘temporary’ Quantitative Easing support program, led to the high inflation and the loss of purchasing power on capital invested in these bonds.

Rather than raise interest rates or lower government spending, the US Federal Reserve Bank instead chose to purchase US debt on its own balance sheet which has grown from US$800 billion in 2008 to almost US$9 trillion in 2022. In addition, removing the requirement for US commercial banks to include their exposure to US treasury bonds when calculating Basel III leverage ratio limits, has allowed the banks to increase their holdings by US$1.8 trillion since April 2020, reaching a record US$4.8 trillion in March 2022.

The massive accumulation of US debt can be traced back to the US Federal Reserve’s decision to maintain a low-interest rate policy through Quantitative Easing. China first raised its concerns over the US dollar in 2009, when then People’s Bank of China governor Zhou Xiaochuan called for a new reserve currency “disconnected from individual nations and able to remain stable in the long-run”.

Tensions have risen substantially following recent moves by the US, Japan, and Europe to prevent Russia from accessing more than US$300 billion of its foreign exchange (FX) reserves1 following its actions in Ukraine. Such a strong move has never been undertaken against a single country before and sets a dangerous precedent that any country unwilling to support the US can have its FX reserves confiscated. For the many regions of the world that have been directly impacted by military action from US-aligned countries across South-East Asia, India, Africa and the Middle East over the past 50 years, the lack of alignment in the consequences of military action looks to be the proverbial straw that broke the camel’s back.

Over US$12 trillion is held in FX reserves by the top 20 reserve holders in the world, with 53% of this value held by counties aligned with China or Russia. These countries, particularly China with US$3 trillion reserves, will almost certainly shift more assets like gold bullion, while Bitcoin may also begin to attract some sovereign interest, given the current commodity supply concerns and high prices through much of the next decade, it’s also likely that these countries will use these reserves to stockpile essential commodity resources like oil, copper, nickel, and possibly rare earth elements.

Last month Russia and China formally announced plans to launch an alternate reserve currency backed by a basket of currencies and commodities including gold. Most of the work on this Stable Depository Right (SDR) basket has already been completed, with a first draft of the policy expected within the next few weeks. This SDR basket will initially include the other four members of the Eurasian Economic Union (EAEU), Armenia, Belarus, Kazakhstan, and Kyrgyzstan. Its success could see it quickly extend further to include the additional 14 members of the Shanghai Co-operative Organization (SCO) that would bring the large and rapidly growing economies of India, Pakistan, Turkey, Qatar, and Saudi Arabia on board.

Finally, it is also reasonable to expect that the 145 countries participating in China’s One-Belt-One-Road (OBOR) will also look to settle their trade in a stable and neutral currency that an SDR would provide, without the threat of confiscation from a single country.

The shift to a multipolar world now looks to be a certainty, with the world splitting along a US vs China axis. Important elements to consider in this discussion are the distribution of populations, global debt, and major commodity resources across each axis.

If we begin with population distribution, we see that countries that aligned with Russia or abstained in the recent Ukraine vote at the UN, plus those who publicly refused to enact sanctions on Russia (Saudi Arabia, UAE, Mexico, and Brazil), accounted for 60% of the world’s population in 2020. If we add the SCO nations to the mix, we surpass 70% of the world, while the addition of OBOR takes us closer to 90%.

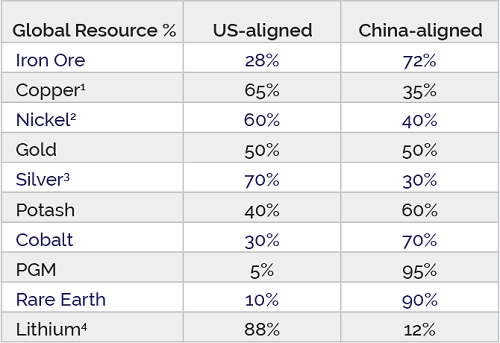

Next, looking across the location of key commodities, we see that dominance between each axis rests slightly with the China axis, which has more resources in iron ore, potash, cobalt, platinum group metals (PGM) and rare earths.

Political alignment of global resources, March 2022

1 – Chile 23% global copper reserves, 2 – Indonesia 19% nickel, 3 – Peru 19% gold, 4 – Chile – 52% Lithium

Worth noting is that while the US currently has dominance across 4 of the 10 key resources listed above, in each case its lead rests on a single country that is also a member of the OBOR trade union. If a China-axis reserve currency was more widely adopted by the OBOR members, we would see all the ten global resource reserves aligned with the China axis. The fall of the US dollar as the sole reserve currency will likely lead to an accelerated loss of its purchasing power, especially priced against hard assets like gold, silver and other commodities. Bitcoin should also benefit from the same US dollar devaluation.

Finally, if we next look at global external debt, we see that the top 20 countries hold a combined liability of US$80 trillion. Remarkably, just 4.7% of this external debt value is held by countries aligned with the China axis (China, India, Brazil, and Russia), which makes them at less risk from rising inflation and the eventual need to raise interest rates. With 95% of this debt held by the heavily indebted countries across Europe as well as the US, global investors will eventually demand higher interest rates to compensate for the risk of default, or alternatively shift their assets towards safer investment opportunities.

Investors take notice

The world is at an enormous crossroads that needs to be carefully considered by investors to ensure their assets are best positioned to manage what will certainly be a volatile period over the next decade. While the military conflict between Russia and Ukraine is unacceptable, the heavy-handed response from US-aligned central banks has forced the hand of government’s representing almost 60% of the world’s population to accelerate the shift away from the US dollar acting the only reserve currency. Unfortunately, the genie is now out of the bottle and cannot be put back in.

Hard commodities like gold, silver, energy, and other resources should be primary beneficiaries from the three waves of inflation outlined above. Bitcoin also stands to benefit greatly from the decline in the purchasing power of the US dollar.

1 Foreign exchange reserves are the financial assets of country held offshore in the form of currencies, bonds, equities, and/or commodities to facilitate international trading and used support the value of their own currency during financial crises.

Tim Davies is Director of Research at Holon Global Investments. This article contains only general financial information and has not taken into account your personal circumstances.