Trust. It's at the heart of finance. Trust is that special property that bends time, allowing for the provision of a good, service or facility today on the strength of a belief that the other party will honour its financial obligation to make payment at or before some later date.

So central is trust to finance that the word ‘credit’ has its origin in the Latin crédere, which means to believe (and from which credo is also derived). The sudden collapse of trust in finance can be catastrophic, as demonstrated dramatically by the demise of the 158-year-old Lehman Brothers in the space of a few short months during 2008.

If the existence of trust lubricates the wheels of commerce and its absence acts as a retardant, then clearly being 'trusted' is economically advantageous. So just what makes one profession more trusted in the eyes of the public when compared to another?

Trust across professions - a survey approach

Unlike temperature or barometric pressure the measurement of trust resides not in the domain of physics but in sociology. Trust tends therefore to be measured by surveys that rank occupations across a scale from least trusted to most. One Australian example is the annual Roy Morgan Image of Professions Survey, run continuously since 1987 and expanding from an original 19 occupations to 30 now.

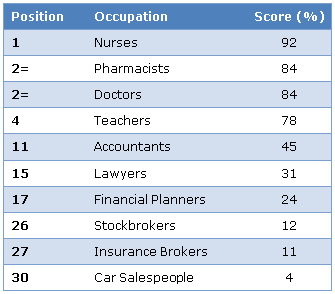

The Roy Morgan Survey respondents score people in various occupations for honesty and ethical standards using one of five possible responses; Very High, High, Average, Low or Very Low. A selection of these occupations appears in the table below, ranked highest to lowest for 2015.

The percentage of respondents rating each occupation as “Very High” or “High” for ethics and honesty for 2015 were:

Source: Roy Morgan Image of Professions Survey.

The results are unequivocal. Nursing is the most ethical and honest profession for the 21st year in a row. It's quite a gap to the next most trusted professions at 84%, jointly held by pharmacists and doctors, with teachers rounding out the top four.

And what of professions connected to finance, commerce and investing? Accountants fare relatively well, sitting in the top half in 11th spot. Lawyers sit mid-pack, holding 15th on 31%, whilst financial planners sit two below lawyers in 17th place on an ‘approval’ score of 24%.

Other professions are clearly perceived as being less trustworthy. Amongst these are stockbrokers (26th), insurance brokers (27th) and finally in last place, car salespeople at a score of 4, a position held for 28 years in succession.

Why are nurses so trusted?

Part of the answer might lie in the high standard of training and education required. Most states require a minimum three year tertiary qualification to become a registered nurse. Further, once qualified, trainee nurses are under strict supervision, gradually increasing the range of treatments and medication they are allowed to administer as their experience builds.

Nursing is also a profession with a rich history of compassion, empathy and service. From Florence Nightingale tending the wounded in the Crimean War to the volunteers who battled the recent Ebola outbreak, nursing is a profession emphatically linked to the service of others over the advancement of self.

Can financial planners bridge the gap to nurses?

It’s clearly a long haul from 24% to 92%. Financial planning’s cause hasn’t been helped by a series of advice scandals over the past several years, some involving Australia’s largest financial institutions. In the wake of these scandals, the laws governing the provision of advice have been strengthened. Yet these are only part of a greater shift that must occur if financial planning is to sit amongst the truly trusted professions.

If you’re in a profession struggling with trust and credibility, nursing is a model of professionalism worth aspiring to. Modern nursing has a clear and unbroken lineage to the pioneering work of The Lady with the Lamp, as Florence Nightingale came affectionately to be known.

Nightingale was not a nurse by training. How could she be when no such training existed in mid-1800s Britain? She was in equal parts social reformer and statistician. Among her many contributions was the development of the pie chart to illustrate numerical proportion. With this and other novel data visualisation techniques she conveyed information vital to both the Crimean War effort and public hygiene more generally, and for her efforts became the first female member of the esteemed Royal Statistical Society.

Nightingale is best remembered, however, for establishing the foundations of the nursing profession in 1860. The principles she espoused; of service, diligence and compassion, together with a body of knowledge based on scientific observation and measurement, still resonates in the Nightingale Pledge which, although modernised since its first incarnation in 1893, remains at the core of nursing’s code of ethics in most jurisdictions.

Earning trust, and keeping it

Professions who find themselves not as universally trusted as nursing might first seek to focus on finding their reason for being, a reason other than the accrual of monetary benefits and material possessions. Unlike financial planning, nursing suffers little in the way of principal/agent effects. These effects present themselves when a person tries to simultaneously serve two parties with opposing interests. It is fair to surmise that in any hospital the patient, loved one, doctor, nurse and hospital board are all pulling in the same direction – a speedy recovery and discharge.

Perhaps the last word on trust is best left to the father of modern economics, Adam Smith, who in his 1759 work The Theory of Moral Sentiments, suggested that one should seek not to be praised but instead first to be worthy of praise.

In a similar vein, if financial planners wish to emulate the trusted status of nurses they should seek first not to be trusted, but to be worthy of trust. The pie chart, a tool used by financial planners the world over to sell complex investment concepts to clients, was after all first perfected by the lady who wrote the book on trust.

Harry Chemay is a former Certified Financial Planner who previously practised as a specialist SMSF advisor and as a consultant to APRA-regulated superannuation funds. He is CEO and co-founder of the automated investment service at www.clover.com.au.