In recent years, the growth of Listed Investment Companies (LICs) and Exchange Traded Funds (ETFs) has captured the headlines, making unlisted managed funds appear old-fashioned and outdated. This is despite the fact that Australian retail managed funds hold about $750 billion (according to Plan for Life), compared with about $30 billion in LICs (according to the ASX, up from about $15 billion in 2012) and about $22 billion in ETFs (according to BetaShares, up from about $5 billion in 2012).

Clearly, LICs and ETFs are making inroads, boosted from 1 July 2013 by the banning of commissions paid to advisers (on new investments) by providers of managed funds, and the increasing use of ASX-listed products. ETF growth has been driven by low costs and interesting product diversification, while LICs have benefited from high-profile managers with attractive deals heavily promoted by brokers. But managed funds still dominate portfolios overall.

What is the evidence managed funds are recovering?

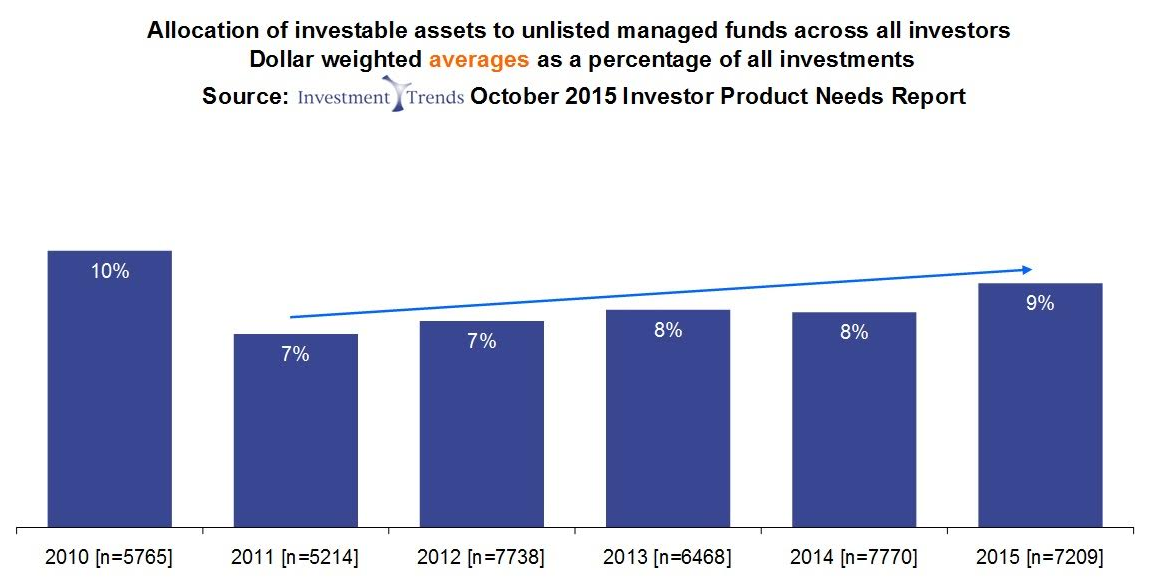

The Investment Trends 2015 Investor Product Needs Report surveyed almost 10,000 investors in October 2015. It showed investors are finding it more difficult to identify investment opportunities in shares, but unlike previous times when they switched to cash and term deposits, now they are hunting for alternative ways to generate income and capital growth. They are turning back to professional fund managers, with 15% of investors saying they intend to invest in unlisted managed funds, compared with 12% two years ago. The gradual recovery in investible assets in managed funds since 2011 is shown below.

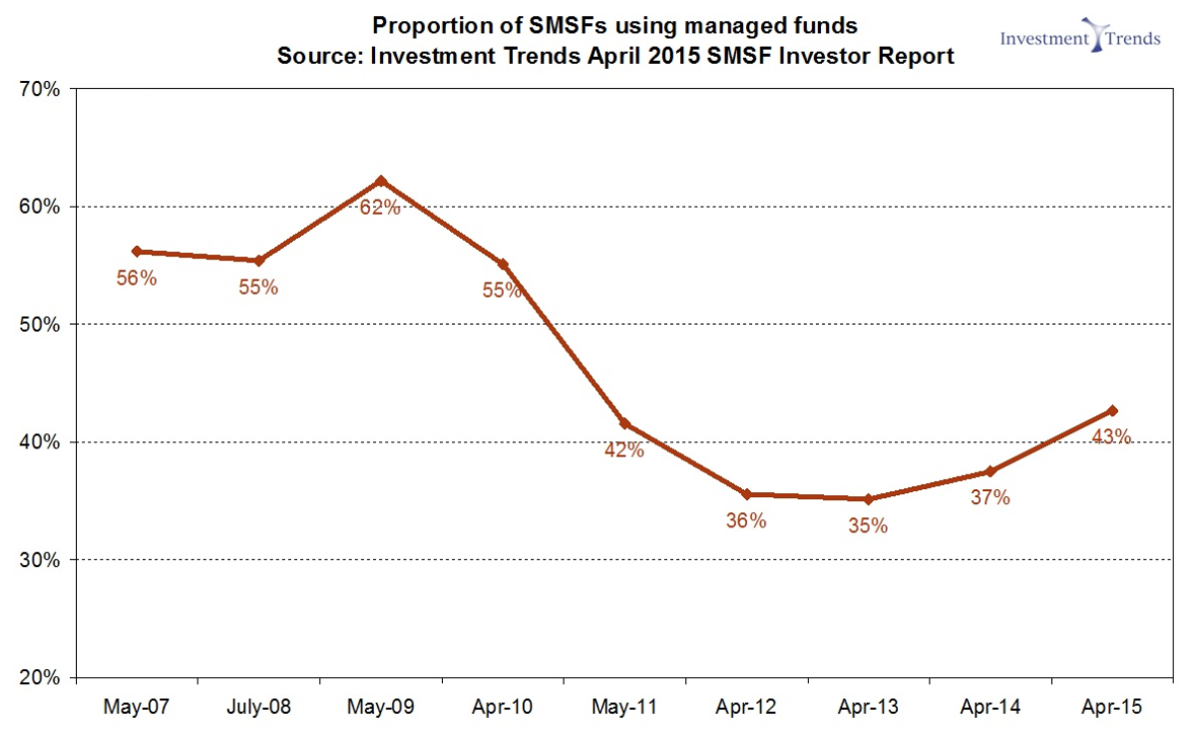

Investment Trends also reports an increase in self-directed activity, with ‘word-of-mouth’ and ‘online channels’ instigating investments into managed funds. This shows up in the increase in SMSFs using managed funds, shown below. Surprisingly, the share of people first learning about managed funds through ‘family and friends’ has risen from 14% to 27% since 2012, with 'advisers' falling from 42% to 27% over the same period.

According to Plan for Life, the leading five providers of managed funds are BT (18.5% of total FUM), AMP (17.4%), CBA/CFS (15.8%), NAB/MLC (14.2%) and Macquarie (8.1%).

As further evidence, OneVue reported in its recently released SMSF asset allocation survey for December 2015 that, among its clients, investments in managed funds rose by 5.1% to 28.2% of total assets compared to March 2015, with listed shares falling by a similar amount. Investments in cash and term deposits also fell. OneVue noted that its SMSFs are advised by accountants and financial planners, and these portfolios differ from self-directed.

What type of funds are being used?

The types of managed funds (as well as ETFs and LICs) attracting more attention are:

- international equities

- active Australian equities

- infrastructure

- property

- income funds, including bond funds and equity income.

Global funds have become more popular as investors realise the importance of diversifying beyond the ASX, which is dominated by a few banks, Telstra, BHP, Woolworths, Wesfarmers and Telstra. There was also a widespread expectation over 2015 that the Australian dollar would continue falling. While there remains a perception that active fees are too high, more SMSF trustees are turning to active managers because they are less familiar with stocks outside the ASX20.

Infrastructure, property and income funds are all benefitting from the low interest rates offered on cash and term deposits, and the perception of their defensive characteristics.

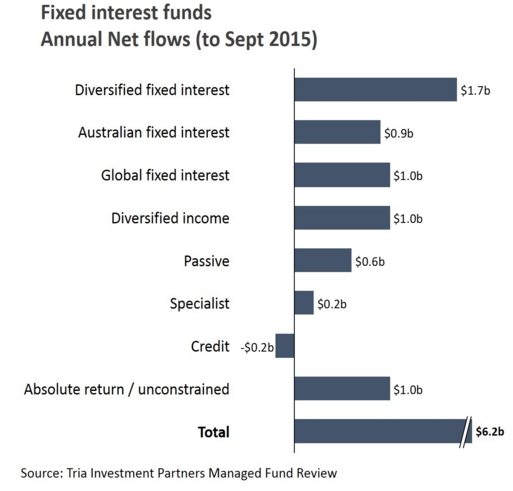

This final category was probably the year’s biggest surprise, especially in fixed interest. The global bond market is estimated at about USD100 trillion, far larger than the value of all listed companies on the world’s stock markets. Yet traditionally, fixed interest plays a minor role in most Australian self-directed allocations, including SMSFs. Tria Investment Partners reports all types of fixed interest did well in 2015, and “the data shows fixed income is continuing to receive healthy new flows, and more than any other single asset class.”

This is an asset category where managed funds have a much better range of alternatives than LICs (where fixed interest is negligible), although there are several bond and cash ETFs available.

What role is mFunds playing in the managed fund recovery?

The ASX offers a ‘settlement service’ in managed funds, which allows an easier investment process than the painful, time-consuming process of filling out the offer document of a fund manager. Like ETFs and LICs, certain managed funds can be accessed on market in the same way as shares.

The mFunds service can best be described as a ‘work-in-progress’. It has been boosted recently by the addition of new fund managers such as Fidelity and J.P. Morgan, and the first major bank online broker, nabtrade, and now offers a broad range of managers and fund styles. But it can only be accessed through a participating broker, and the two largest retail online brokers, CommSec and E*Trade, are not participating to protect their own businesses (and those of related companies in the CBA and ANZ groups). The total amount invested through mFunds, according to the ASX Funds Monthly Update February 2016, was only $102 million spread across 149 funds. About half that is in fixed income, a healthy percentage. Nevertheless, mFunds is not yet material in the overall picture.

Each product type will have its place

It’s difficult to see a future in wealth management without a strong role for all three structures: managed funds, LICs and ETFs. Both LICs and ETFs are on a rapid growth path, and ETFs in particular will be boosted by ongoing cost focus and the (albeit slow) trend towards roboadvice.

But those who have written off managed funds should recognise it is not only the reigning champion in terms of FUM, but with massive fund manager support, hundreds of millions of capital invested in major platforms, adviser and bank branch distribution and wide product range, it will not relinquish its crown anytime soon.

Graham Hand is Editor of Cuffelinks.