We have witnessed strong world earnings-per-share (EPS) growth since June 2016, extending the post-GFC run to nearly 10 years of expansion. Given the persistence of the economic cycle, 'Momentum' strategy performance has been exceptionally strong. A Momentum strategy seeks to invest in the continuance of an existing market trend, such as upward-rising prices.

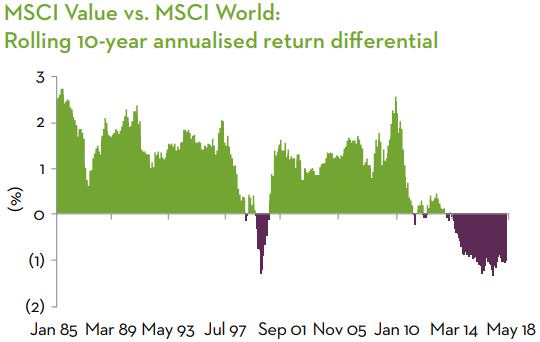

The strength of Momentum has also driven unprecedented underperformance of 'Value'-based strategies globally for the last few years. Unlike Momentum, Value-based strategies invest in undervalued companies trading at less than their estimated intrinsic value. The following chart shows how Value has suffered relative to the market in the last five years, whereas historically it has outperformed.

Source: Martin Currie Australia, Factset; as at 30 June 2018. Returns in US$.

EPS growth not the problem

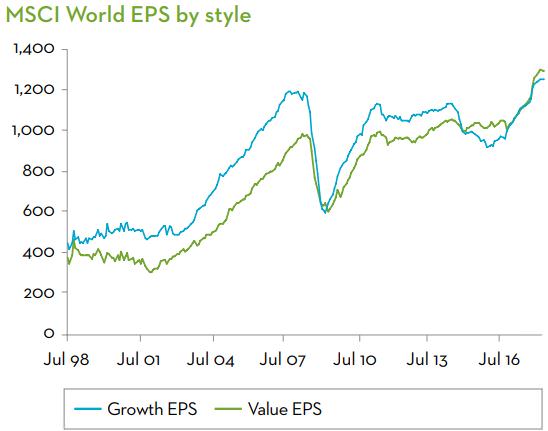

We had originally surmised that the main reason traditional Value indices had performed poorly was that Value stocks have not shown great earnings growth compared with 'Growth' or FANG (Facebook, Amazon, Netflix and Google's parent Alphabet) stocks. However, we were surprised to find that in the global market, since June 2016, earnings growth of Value (+14.8% p.a.) has in fact been stronger than that of Growth (+12.5% p.a.).

Source: Martin Currie Australia, Factset; as at 30 June 2018.

Is now the time for Value to recover?

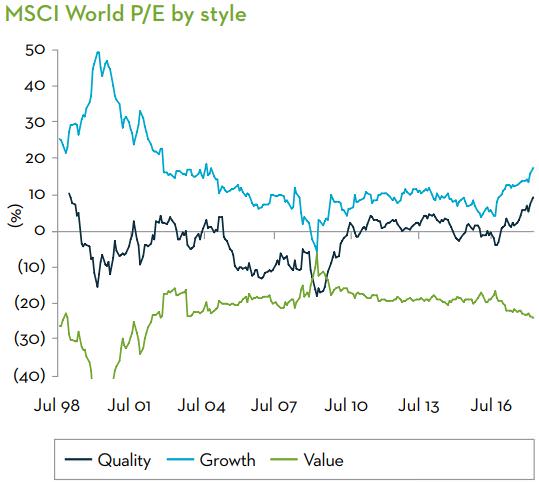

The recent strong returns of Growth strategies appear to have come not from earnings growth, but from a price-to-earnings (P/E) re-rating (18.7x to 20x) versus a de-rating of Value (from 14.3x to 13.1x), as shown in the chart below. The blue Growth line has recently risen while the green Value line has fallen.

Source: Martin Currie Australia, Factset; as at 30 June 2018.

So, it looks like Value stocks have been beaten up, despite their better EPS growth. Now may be the time to look for Value opportunities.

Is the growing valuation gap all it seems?

By some measures, there is evidence of a growing valuation spread – the gap between the cheapest and average-priced stocks in the market. Wide valuation spreads have historically preceded strong performance for Value strategies.

Most traditional Value indices (such as MSCI Value) are predominantly based on relatively naïve measures such as P/E or price to book (P/B). The divergence in P/E across investment styles has caused the valuation spread based on this measure to widen significantly. Dispersions of P/B, another common indicator of valuation opportunity, have also widened notably for the Australian market.

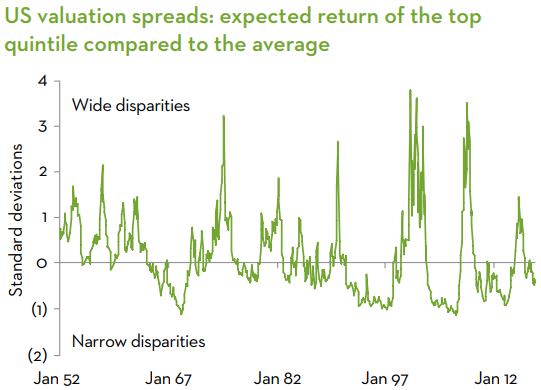

However, a note of caution: other measures, which use current earnings/cash flow-based metrics and rely less on a mean reversion assumption, are still showing far narrower dispersions. This is well described by the valuation analysis of Empirical Research Partners on the US market which uses cash flow methods. Their analysis in the next chart shows a much lower valuation spread, and as such, less Value opportunities available in the market than shown by P/E or P/B measures.

Source: Empirical Research Partners Analysis, National Bureau of Economic Research; as at 31 May 2018.

While Empirical Research Partners has a comprehensive quantitative valuation model, we believe all these measures miss a layer of fundamental insight required to truly understand the level of opportunity.

A deeper search for value

We conduct fundamental, forward-looking risk-adjusted analysis on the broad Australian market considering cashflow, quality, growth, cyclicality, and environmental, social and governance (ESG) risks. Our ongoing analysis reveals that immediately following the GFC, these Value spreads were much wider generally and also relative to each other. This was due to greater uncertainty about world growth drivers.

However, since 2009, these spreads narrowed significantly, and in February 2017 reached their lowest post-GFC levels. It is only recently that the spread for cheapest stocks has begun to really look cheap again.

Despite the better outcomes that P/E and P/B measures indicate, and the lower opportunities shown by quant measures, our analysis suggests valuation spreads have widened, but only at the extremes.

So, if Value spreads by our measures are in fact generally still low - and only in certain pockets - is the Value approach to investing compromised? In a word, no.

We believe the combination of a collective analysis of the market environment and a multi-lensed investment process (valuation, quality, direction and sustainable dividend) means it is still possible to assess the potential reward versus risk on offer of individual stocks, broad factors and the overall market regardless of the prevailing conditions.

This type of investment approach won’t deliver the same outcomes at all points in the cycle, but it certainly has helped us to navigate the choppy conditions we have seen for Value investors over the last three years.

Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Legg Mason affiliate. Legg Mason is a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any individual.

For more articles and papers from Legg Mason, please click here.