Reducing inflation to an acceptable rate is an important policy priority. Although much progress has been made over the past couple of years, the goal has not yet been achieved. We are close and the trend is in the right direction, but some of the hysterical headlines that followed the May monthly CPI release would have us believe that inflation is re-accelerating and requires higher interest rates.

To be sure there’s a chance that the Reserve Bank of Australia (RBA) will see it that way, especially if the June monthly and quarterly CPI data don’t unwind some of the recent increases seen in the monthly series. They may consider progress to be too slow and elect to tighten a little further. Personally, I suspect that we will see an easing back because I believe there’s some seasonality to the monthly CPI series in which prices rise above-trend in summer then fall back again through autumn. Not many people realise that the May CPI print – the index, not the rate of change – was actually lower than the April level, which is a bit of a pattern at this time of year since the monthly series kicked off 7 years ago. Plug in monthly increases of 0.3% (equals 3.6% per annum) over the coming months and the year-to rate will be back down at 3% by September. (That’s not a forecast, by the way, merely a projection to illustrate my point.)

My concern in the discussion of the inflation trend is that a key piece of information is being ignored. This data was widely ignored ahead of the outbreak of inflation in 2021 and continues to be absent from almost every commentary on inflation and monetary policy. This key piece of information is the money supply.

All of us who learned our economics in the 1970s knew the aphorism that “inflation is always and everywhere a monetary phenomenon.” That phrase, uttered by the famous Chicago economist Milton Friedman almost 70 years ago, has been discarded in recent decades, which I think is a shame. Although there are some good reasons for the move away from simplistic monetarism, the fact that the link between money supply growth and inflation has been largely forgotten goes a long way towards explaining the mess we’ve been in for the past few years.

Let me explain what I mean. It starts with an economic identity that may or may not be familiar to you.

MV = PT

You don't have to be a Friedmanite quantity theorist to find analytical usefulness in the identity that states that the nominal value of goods and services produced in the economy (P, for prices, times T for real value of transactions) is equal to the amount of money (M) in circulation and how rapidly it circulates (V, for velocity).

Nor do you have to believe in a simplistic causal relationship between money supply growth (M) and inflation (P) to accept that there is, nonetheless, a key relationship between the two. And, therefore, that if the growth of M changes markedly then there is a likelihood that the growth rate of P will change in the same direction.

A related saying is that inflation results from “too much money chasing too few goods”. When we have just the right amount of steady money supply growth in the context of steady real output growth, then we’ll have steady inflation. When there’s excessive money supply growth, beyond the capacity of the real economy to keep up, then the macroeconomic outlet is rapidly rising prices for goods and services – aka inflation. And when money supply growth is too tightly restricted, then inflation is driven down by recessionary tendencies in the real economy.

Monetary policy, therefore, has a great deal to say about the inflation rate that the economy will experience. That’s why much of the task of preventing excessive inflation and bringing it back under control if it gets away, falls to the RBA.

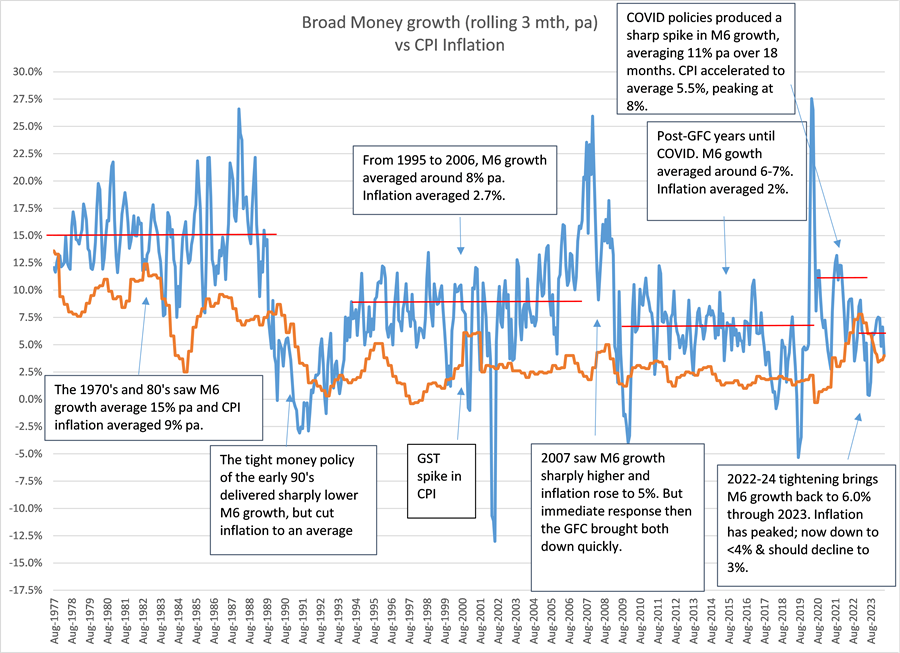

The following chart shows the relationship between money growth (M) and inflation (P) over time in Australia. Here, I take the broadest definition of money that the statistics can give me, which in Australia is called ‘broad money’. The chart (sourced from the RBA and ABS) shows how its growth has behaved over the years and how inflation has behaved at the same time.

The notes within the chart address the various phases of the last 45 years, but basically the relationship is that broad money growth equals inflation plus a margin, with the margin holding quite steady for prolonged periods of time. Much of that margin is the growth of T in the MV = PT identity, that is the rate of real economic growth, which has varied between around 2-3% in different periods. The rest (another 1-2%) captures a range of factors, including a trend decline in the velocity of money and a factor that monetary economists call ‘financialisation’ or the growth in the ratio of financial wealth to national income as the asset base of the economy grows in value.

In my opinion, the sharp increase in Australia’s inflation rate in 2022 was both caused by and was predictable because of the surge in money supply growth during 2020. Readers of Firstlinks were warned of this as early as April 2020 in an article by Prof Tim Congdon, Magic money printing and the reality of inflation. Soon after, broad money growth in Australia accelerated to almost 20%, so it came as no surprise to me that inflation rose to 8% soon after.

But it did surprise most analysts. Then when the inflationary outbreak was finally recognised, the majority rushed to lay the blame at the feet of a host of individual issues, in particular supply constraints in some markets because of the pandemic and the impact on oil prices of the Russian invasion of Ukraine. Those factors were definitely at work – they contributed to the ‘too few goods’ part of the story – but in my view can only become widespread inflation if allowed to by ‘too much money’ chasing the goods and services being produced and supplied.

In any case, the focus on supply-side issues led to a widespread questioning of the RBA’s policy response of increasing the cash rate to tighten monetary conditions. My view, however, is that they were too slow to do this. The time to respond to bring the growth in the economy and the money supply back to more acceptable levels was in early 2021. They had the monetary evidence in front of them by then but ignored it.

That’s history now and to their credit the RBA eventually defied much opposition, lifting the cash rate rapidly from near zero to 4.1% by early 2023, then took it a bit higher in November 2023 to 4.35%. As a result, inflation has fallen from that 8% peak 2 years ago to the 3-4% region now.

What’s the current story with money supply growth? After the 2020 spike, things have settled very well in response to tighter policy. Broad money grew in the 3 months to May at an annualised rate of just under 4%, bringing the year-to May growth rate in at 4.76%. That's the ninth month in the last 12 where the year-to rate of growth has had a 4 in front of it and it now looks more like the trend rate of broad money growth is slowing to less than 6%.

That being the case, the chances of inflation falling back into the RBA's 2-3% medium-term target band are improving – whatever the latest monthly CPI might say! And this in turn means that the current interest rate settings for monetary policy are, to use an old RBA word, 'appropriate'.

There may yet be some bumps along the way as Australia is navigated towards a lower and more stable inflation rate once again. I’m pleased that this outcome is universally regarded as a desirable one. Inflation is also always and everywhere a pernicious outcome that has negative consequences for both the efficiency and fairness of the way our economy performs. The RBA was right to begin focusing on it 30 years ago and, whatever they choose to do with interest rates at their next few meetings, they’ll be right to continue to focus on it now.

From an investor’s point of view, I believe this means that the building blocks of asset pricing calculations can now start with an inflation rate assumption of 2.5-3.0%; a neutral cash rate of 3.75-4.0%; and a long bond rate of 4 – 4.5%. As I said, those levels might not be achieved immediately, but at this stage that’s where things seem to me to be trending.

Warren Bird has over 40 years’ experience in public service, business leadership and investment management. He is currently a Director of the WA Government Employees Super Board (GESB) and Chair GESB’s Investment Committee. He is also Chair of the independent Audit and Risk Committee of the Illawarra Shoalhaven Local Health District. This article reflects the personal views of the author.