Initial selling during a heavy share market fall has nothing to do with valuations, and that is why it is always difficult to judge the extent of any short-term correction. With a bit of space from the immediate ructions of last week, what did it tell us about the long-term position of debt and equity markets?

Finally, a reaction to rising rates

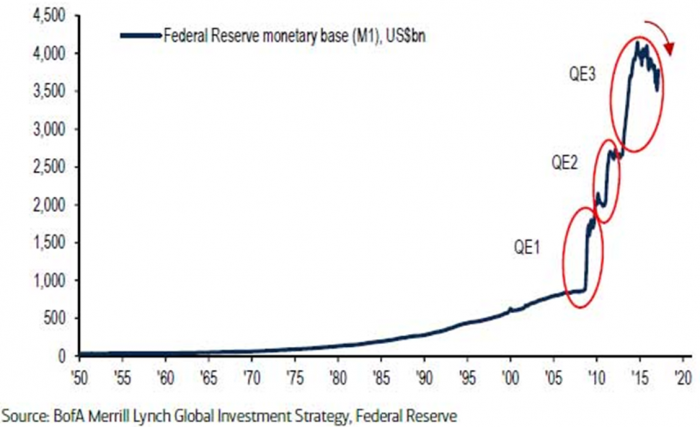

Having watched this sort of thing far more than I’d like, my summary is this: it was an interesting but not unexpected week with a technical adjustment in markets. It was investors finally reacting to the fact that interest rates are adjusting to the reality of stronger economic growth and a US central bank that has begun the process of removing excess liquidity from the system.

Eighteen months ago, I thought that we had turned a corner not yet recognised by the broader market. Interest rates had inflected. Few people thought the same, particularly given the lack of wages growth in the US and the fact that interest rates were still negative in parts of Europe.

Scaling the wall of Fed money

The Federal Reserve monetary base since 1950

In September 2016, I expressed a view in our quarterly report that investors should note how abnormally low rates are (and remain so now) and not to allow the gyrations of the market to hide the fact that the tide may be changing. We thought the inflection point had occurred in July 2016 and there would be a different set of long-term opportunities in future.

Our expectation was that economic growth and earnings would be better than expected and the short-term price action risk would now more likely come from inflation scares and subsequent upward moves in interest rates.

Between then and now, we have invested based on our belief that markets were underestimating how tight labour markets were, with the most common complaint from CEOs in the US being the inability to find workers. Coupled with the passage of Trump’s tax cuts late last year, which in theory will create significant pent up demand, interest rate markets have noticed that the inflection point had already been reached.

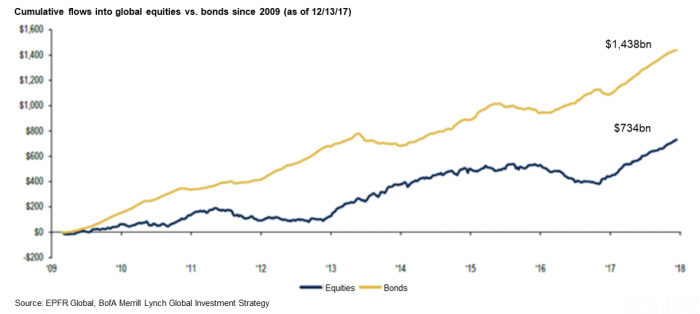

Flow into bonds at the expense of equities

However, investors (particularly passive ones) have been still piling into bonds at the expense of equities.

Until recently, the lack of wage growth was still a popular theme. This was looking in the rear-view mirror. Then we saw the strongest year-on-year increase in US wages for some time and market sentiment turned on its head and interest rates appeared to trigger a technical reaction in equity markets.

I suspect it is simply further confirmation that excess liquidity is starting to leave the system, the most high-profile examples being through VIX funds and even Bitcoin. Investment opportunities will now be in those companies that can grow their earnings, as opposed to those that historically benefited from a re-rating on the back of lower interest rates.

Investment opportunities, but with some cash caution

Many forecast valuation multiples seem reasonable. As examples, home builders are trading at less than 10x forecast earnings, banks and alternative asset managers at 10-12x and Pfizer is 11x. Over 50% of our global portfolio is on an average price to earnings (P/E) ratio of approximately 11. Other large sectors and stocks, as monopolistic and high growth businesses like the financial exchanges, Mastercard, Visa and Google range in P/E ratios from 18-24x, which seem reasonable for the nature of their businesses. We believe these types of businesses will give a satisfactory return in a general market environment of lower returns and choppier price action.

With last week’s pullback in the market, we marginally reduced some of our futures hedges, closed out short REIT positions and will, in all likelihood, marginally increase some of our existing positions. This will be done within an overall framework that interest rates have inflected, markets have done well, and an invested position of approximately 85-90% is prudent.

Paul Moore is Chief Investment Officer at PM Capital. This article is general information and does not consider the circumstances of any investor.