The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular articles from the week.

Weekend market update

From AAP Netdesk: A property giant on the brink of collapse has contributed to a third consecutive week of losses on the Australian market, but analysts say Evergrande will not become a full-scale disaster. Mining giants were largely responsibly for modest losses on Friday as the ASX bucked a positive US lead.

Banks recovered for a second straight day after slumping earlier this week on fears of Evergrande collapsing.

The market looks likely to end its 11 month run of gains. The S&P/ASX200 is lower by 2.5% in September with only four trading days remaining. Property trust Centuria Industrial dipped almost 6% after raising $300 million to buy eight properties. Elsewhere, APA said its offer to buy all shares in AusNet for $2.60 each would create the nation's largest energy distributor worth $35 billion.

APA's offer does not require foreign investment review, unlike rival suitor Brookfield's $2.50 per share offer.

From Shane Oliver, AMP Capital: Global shares fell sharply early in the past week but then rebounded as fears around China Evergrande receded and the Fed meeting was out of the way. This saw US shares gain 0.5% over the last week and Eurozone shares rise 0.4% but Japanese shares lost -0.8% and Chinese shares fell -0.1%. Both the S&P500 and NASDAQ were little changed on Friday.

Australian shares also fell -0.8% despite a mid-week rally as the weak iron price weighed on miners which along with falls in financial and property shares more than offset big gains in energy and utility stocks. Bond yields rose again on the back hawkishness from the Bank of England, a rate hike from Norway’s central bank and Fed signals for a faster reduction in bond buying.

We could still see more volatility over the next month or so: there could still be more bad news out of Evergrande before a restructuring occurs; the US debt ceiling is far from resolved; tax hikes are likely on the way in the US; supply constraints are continuing to weigh on growth and contribute to inflation; and seasonal share market weakness usually runs into mid-October.

***

Two conversations last week with people at opposite ends of their financial journeys confirmed that a vital part of the investment decision is often overlooked. Where should the assets be held? Placing money in a personal account, joint names, company, super fund or SMSF, family trust, spouse or child can have vastly different consequences for tax, capital gains, estate planning, social security and access.

There are tradeoffs. A young person starting an investment plan with regular contributions from a salary has a tax incentive to use super, but that will compromise access to money to buy a first home. An older person with accumulated wealth may be eligible for the age pension or a tax-free super pension if assets are held in the right places. It's better for each member of a couple to fill their own $1.7 million cap to create a generous $3.4 million tax-free pension but what if their ages are significantly different?

Much of the decision is driven by marginal tax rates. The income tax-free threshold is $18,200 and for low balances, it might be better holding investments outside super. And an inheritance paid from super to a non-dependant child is taxed at 17%, so what is the right time to get the money out ... the day before death!

When considering a financial plan, always check where the investment should be held for the long term. In my case, I am looking to sell an investment property held in my own name but the tax bill will be severe compared with if I had held it in my SMSF.

And then the rules may change, stuffing up the best-laid plans. The Transfer Balance Cap was introduced a few years ago, with some justification. Similarly, there's a strong argument to include the family home in the age pension assets test subject to a threshold, and as our survey results show, there's a lot of support for this change. Politically impossible? That's what they said about the GST.

Leisa Bell reports on the results of our survey last week. With over 2,000 responses and about 1,000 comments, the response was excellent and it's worth taking the time to read the comments. Lots of strong feelings on both sides but, among our readers, a clear winner.

Surging property prices are only one sign of the asset price inflation around the world. In Australia, the surprisingly strong statement from the RBA Governor, Philip Lowe, that the market is misunderstanding future interest rates and they will stay lower for longer, serves to drive debt and house prices even higher.

This statement from an RBA Governor is so clear on intentions for years ahead that it's worth quoting in detail. Speaking in an address to the Anika Foundation, Lowe said:

"In particular, the Board has said that it will not increase the cash rate until actual inflation is sustainably within the 2–3% target range. It won't be enough for inflation to just sneak across the 2% line for a quarter or two. We want to see inflation around the middle of the target range and have reasonable confidence that inflation will not fall below the 2–3% band again. Our judgement is that this condition for a lift in the cash rate will not be met before 2024." (my bolding)

"Meeting this condition will require a tighter labour market than we have now. Our assessment is that wages will need to be growing by at least 3%. We remain well short of this."

And then Lowe specifically tells the market they have it wrong:

"I find it difficult to understand why rate rises are being priced in next year or early 2023. While policy rates might be increased in other countries over this timeframe, our wage and inflation experience is quite different."

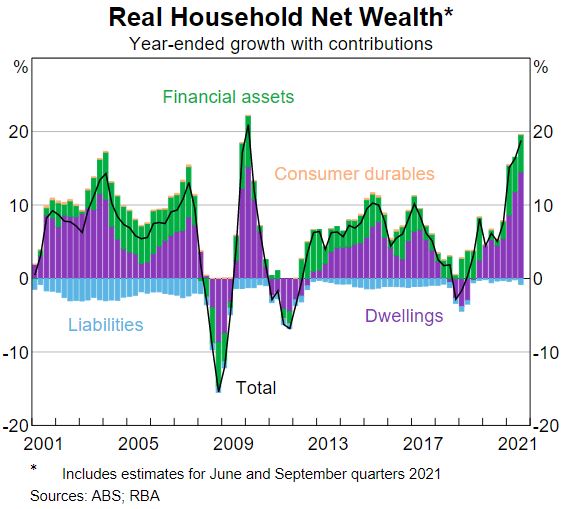

Furthermore, not only are rising house prices not the RBA's problem - despite a generation of families being unable to buy a house - but rising wealth due to home inflation will help the recovery:

"This lift in the net wealth of the household sector is one of the things that suggest that once the restrictions are eased, households will be well placed to start spending again.

While it is true that higher interest rates would, all else equal, see lower housing prices, they would also mean fewer jobs and lower wages growth. This is a poor trade-off in the current circumstances."

He provided this chart to illustrate his point about rising wealth.

But in a somewhat inconsistent message, Michele Bullock, Assistant Governor (Financial System) at the RBA, told Bloomberg Inside Track Online this week:

"However, while household debt to income in Australia hasn't increased much over recent years, it is at a high level, both historically and relative to other countries. So sustained strong growth in credit in excess of income growth may result in vulnerabilities building in bank and household balance sheets." (my bolding)

So while Lowe says higher house prices are "outside the domain of monetary policy and the central bank", Bullock says "developments in the housing market (including prices) provide information on the emergence of financial stability risks". Subtle difference?

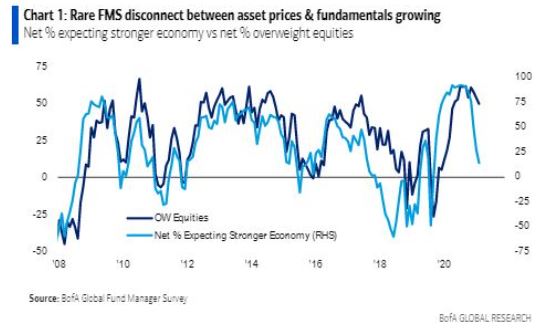

Globally, central banks are eager to raise the wealth of existing wealthy people, doing whatever is necessary to hold up markets. The latest Bank of America fund manager research shows a rare disconnect between the economy and a willingness to hold equities. Normally, the net % overweight equities and net % expecting a stronger economy are closely correlated but we now have a divergence.

Many investors would like the greater upside of equity exposure but cannot accept the downside, where every generation sees a 50% fall and plenty of drops of 10%. We have two articles showing the opportunities for buying LIC options or convertible notes. Rodney Lay explains the pluses and minuses of these options and why investors need to know about share price dilution.

Leading this week, it is difficult to think of a time in recent years when geopolitical tensions were as high on the agenda. The submarine deal has locked Australia into a military future with the US and the UK and alienated our largest trading partner in China and allies in France and Europe (maybe we should let the French into our deal and call it FAUKUS). It is opportune to read the perspective of Joe Hockey, former Treasurer and Australian Ambassador to the US, talking about investment implications over a wide range of geopolitical issues.

Then Roger Montgomery looks at an equally-pressing issue, the decarbonisation of the world and opportunities in power and transport. Roger identifies stocks that will benefit but says technological change does not mean every participant is a winner.

Long-term demographic trends can guide investment sections, and Aneta Wynimko outlines three factors which everyone should overlay in their decisions.

And Damien McIntyre observes that many people tend to think about bonds as low return and low risk, while equities are the opposite, high returns with high risk. There is an asset type in the middle.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Fears are mounting the collapse of one of China's real estate juggernauts could infect global markets and Australia's largest export. Lewis Jackson explains the Evergrande crisis. And in a special webinar, Peter Warnes joins Mark Lamonica to discuss results season and answer viewer questions.

This week's White Paper from MFS International called 'It's the Second Mouse that Gets the Cheese' says they expect high-priced financial assets to deliver underwhelming returns while some sectors will benefit from a scarcity premium.

Comment of the Week from Sean (among a thousand others) in response to our asset test survey.

"Geez, are we meant to be sympathetic for the pensioner with a $2 million dollar house that instead of receiving a full tax-payer funded pension has to use a portion of their equity to enjoy their retirement? Unfortunately their kids will inherit only maybe $1.5 million after repaying the pension loan scheme used to make up the difference. What a terrible situation to be in to help pay off the trillion dollars of government debt used to help protect our older citizens from covid."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website