Back in April this year, I wrote in this article:

“Electric vehicles, clean energy, and decarbonisation will take a more prominent role in the headlines than they already are ... Australia, of course, is rich in all the minerals required for the manufacture of lithium batteries, including lithium itself, and the ASX is rich with listed suppliers, developers and explorers.”

A prescient aphorism referring to the end of the oil age, and the declining power of oil producing nations, was offered by 1970s Saudi Oil Minister Sheikh Zaki Yamani, who quipped, “The stone age did not end for a lack of stone.”

It's no longer about running out of oil

Newer and superior bronze tools replaced stone, rendering the former redundant. Today, we are witnessing the same dynamic as electric power supersedes oil, at least as a fuel. Where once it was predicted the last barrel of oil would command an astronomical price, purchased by the wealthiest car or jet owner, it now appears we will leave oil in the ground with its extraction being uneconomic.

Throughout time, transformative technology has maintained its power to change the course of human history. And of course, as investors, it is easy to be lulled into believing new technology will also transform investment returns. And while it’s true steam engines, horseless carriages, television, the PC and commercial air travel have seen fortunes made, not everyone wins. Meanwhile fortunes are also lost when legacy technology is kept on life support by nostalgic but misguided management teams and shareholders.

Battery electric vehicles (BEV) momentum has built to a tipping point and underestimating the transformative impacts, failing to unearth the pan and cradle sellers of the coming BEV boom, or avoiding the space for fear of a bubble will, I believe, be an expensive mistake.

EV purchases have skyrocketed from just over 500,000 in 2015 to over two million vehicles in 2018 and three million in 2020. My confidence however stems from the support developers have received from governments globally. Already more than 14 countries and over 20 cities around the world have proposed banning the sale of fossil fuel-powered passenger vehicles (primarily cars and buses) in the near future. Denmark’s ban will be in force by 2030 – less than nine years away.

Meanwhile China, Japan, the UK, South Korea, Iceland, Sweden, Norway, Slovenia, Germany, France, the Netherlands, Spain, Portugal, Canada, Sri Lanka, Costa Rica and 12 U.S. states have proposed bans on the sale of internal combustion, or implementing 100% sales targets of zero-emissions vehicles.

More evidence of a tipping point

In response, and by necessity, global car and truck manufacturers have formed a conga-line announcing transitions from ICEs (Internal Combustion Engines) to BEVs.

Earlier this year Porsche, Audi, Skoda and VW owner, the Volkswagen Group announced a €25 billion capital expenditure program to develop a comprehensive range of EVs – from affordable to luxury and performance, as well as a network of tens of thousands of fast-charging stations across the world, and additional ‘gigafactories’ and battery recycling plants.

If VW’s announcement isn’t evidence of a tipping point, perhaps their tripling of EV deliveries in 2020 to over 212,000 and expectations of over a million EVs this year is.

So is General Motors’s plan to sell more than a million EVs annually by 2025, spending US$35 billion by 2025 on EV (electric vehicle) development. And Ford’s announcement back in June, to spend US$30 billion on EV development by 2030, sell 1.5 million EVs that year, while aiming for 40% of its global model range to be electric further strengthens the tipping point argument.

US President Biden’s proposed infrastructure bill has set aside US$174 billion to encourage EVs, with nearly US$18 billion for a national charging network.

This last development – a network of ubiquitous rapid charging stations - will feed EV adoption even more.

Rising demand for EVs amid mandates and decrees to reduce carbon emissions will inevitably lead to rising demand for ‘upstream’ inputs. And while quantifying EV demand precisely is a fool’s errand, there is no shortage of experts trying.

Ernst & Young believe EV sales in Europe, China and the US will outstrip internal combustion engine vehicles (ICEs) by 2033, which is five years earlier than previous projections. A plethora of predictions typically expect the global EV market to grow 10-fold by 2025, and forecasts of a 50-fold increase by 2030 are not uncommon.

EVs need batteries and the currently favoured Lithium-ion batteries also contain metals such as cobalt, nickel, graphite and manganese.

Meanwhile demand for batteries will also come from power utility projects, many increasingly adopting battery technologies, as are residential power consumers.

Evidence of a virtuous circle

A virtuous circle of declining battery prices, leading to increasing demand, in turn leading into increasing investment in battery technology, is well entrenched. In 2010, a 1KWh capacity lithium-ion battery pack cost more than $1,000. Two years ago, prices were $156, according to Bloomberg New Energy Finance. Cheap batteries will of course lower the cost of manufacturing cars as well as commercial and residential storage solutions, accelerating their adoption.

Demand is one side of the equation. Supply is the other. Currently global lithium (carbonate production) is roughly 500,000 tonnes per annum. If current predictions for the 2025 EV market alone are correct, demand will exceed 2.7 million tonnes per year. And if 2030 predictions are correct, expect demand to exceed 15 million tonnes.

Citi predicts 75% of all mined lithium will be consumed by EV batteries by 2025, while the IEA predicts a 40-fold increase in lithium demand by 2040.

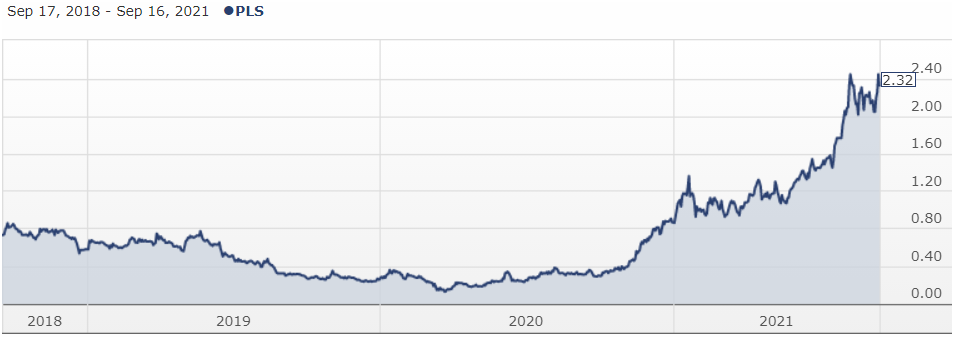

In investing in this theme, one of the lithium players we own in the Montgomery Small Companies Fund is Pilbara Minerals (ASX:PLS). PLS has risen almost 160% year-to-date and its share price is up approximately six-fold in the last 12 months.

Source: Morningstar.com.au

Back in March, Pilbara Minerals launched a sales and trading platform for its Pilgangoora project to provide “flexibility to transaction by auction, tender process or bilateral sale.”

In July, its inaugural battery materials online exchange (BMX) auction, received just over 60 online bids ranging from US$700/dry metric tonne (dmt) to US$1,250/dmt for a 10,000 dmt shipment of spodumene concentrate.

This week the company revealed the highest bid at its latest auction was almost double that of July’s inaugural auction, accepting a bid of US$2,240/dmt for an 8,000 dmt (5.5% spodumene concentrate shipment.

Lithium prices are skyrocketing but the evidence for growing demand and limited supply suggest prices are some way off a bubble. Decarbonisation is an investment theme that appears to have plenty of durability. With that in mind our small companies fund has been invested, for some time, in companies including Orocobre (ASX:ORE), Mineral Resources (ASX:MIN), Pilbara Minerals, Aeris (ASX:AIS) and IGO Ltd (ASX:IGO). Despite substantial gains, we believe there is yet more to this story.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.