The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular articles from the week including stock picks.

Weekend market update

From AAP Netdesk: Late in the week, Australian investors took money out of the ASX as they prepared for US inflation figures to hit a 31-year high with implications for interest rates. The market on Friday dropped 0.4% for a second consecutive day to end an otherwise good week for investors. The ASX improved 1.5% for the week. Healthcare and energy shares fell more than 1% on Friday but the heavyweight categories of financials and materials shed just 0.3%. BHP lost 0.6% to $39.96 while Rio Tinto was little changed at $95.83.

The $22 billion merger of Oil Search and Santos has taken effect after final approvals. Oil Search will disappear from the ASX and its shareholders will receive 0.6275 Santos shares per Oil Search share. Santos shares were down 2.1% to $6.48. Shopping Centres Australasia said more people shopping closer to home during the pandemic has helped the value of its properties.

From Shane Oliver, AMP Capital: Global share markets rebounded over the past week on indications Omicron may only result in mild cases and US inflation was not as high as feared. For the week US shares rose 3.8%, Eurozone shares rose 2.6%, Japanese shares rose 1.5% and Chinese shares gained 3.1%. Reflecting the 'risk-on' tone, bond yields, metal prices, oil prices and the $A all rose. On Friday, the NASDAQ rose 0.7% while the S&P500 was up 1%.

The 5% or so pull back in share markets on the back of Omicron and the Fed becoming more hawkish now just looks like it was a normal correction after markets had become overbought again. Of course, much will depend on Omicron. It is looking less threatening but more transmissible than Delta (possibly four times more) and it's likely to weaken the protection provided by existing vaccines.

***

As we come to the end of another year, predictions for next year will abound, especially when some financial metrics are difficult to reconcile, such as the US 10-year Treasury rate at 1.5% while annual US inflation (CPI) is above 6%. In Australia this week, the Reserve Bank seemed to finally step back from its King Canute stance that rates will not rise until 2024, with many economists now calling it in 2022.

Long-term investing should not depend on short-term predictions, so the challenge for most investors is to look well beyond 2022. As Nassim Nicholas Taleb wrote in his book referenced in this quote:

“When an investor focuses on short-term investments, he or she is observing the variability of the portfolio, not the returns – in short, being fooled by randomness."

In a recent meeting with Morningstar colleagues, after I mentioned I had started to reduce my personal equity exposure because I expect a decent market fall in 2022, I was asked to write my reasons. Forecasting is a set up for failure. While I anticipate changes in central bank policies to hit the market, I also reveal my long-term portfolio holds. Warren Buffett advises you should invest as if you are allowed only 20 investments in a lifetime.

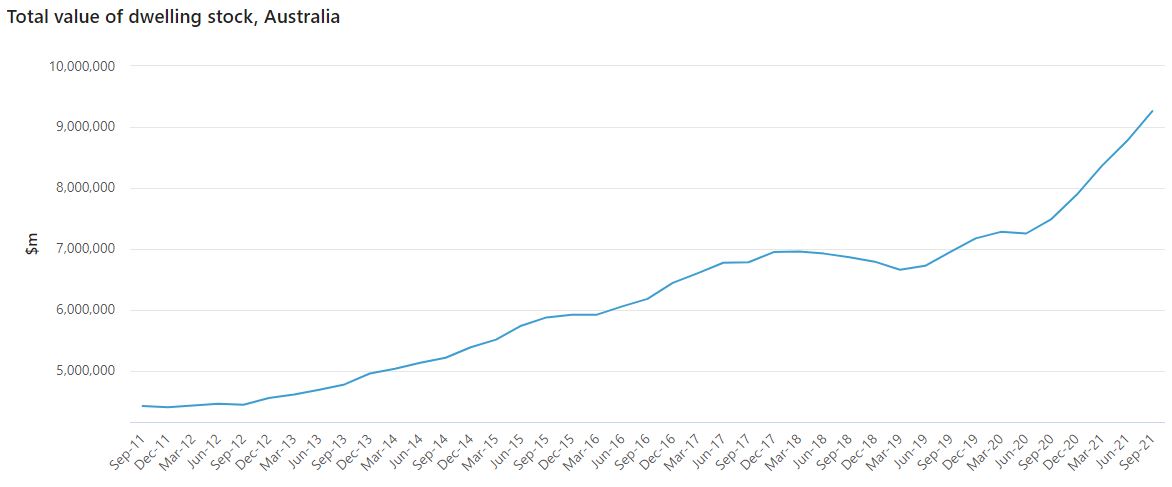

Before the punch bowl is pulled away, let me be the first to note the value of Australian dwellings at over $10 trillion now, before the ABS catches up. Head of Prices Statistics at the ABS, Michelle Marquardt, said this week of the September numbers:

"The value of Australia's dwelling stock has risen by nearly $1 trillion in the past six months. By comparison, the previous increase of just over $1 trillion took 15 months, rising from $7.2 trillion in the December quarter 2019 to $8.4 trillion in the March quarter 2021."

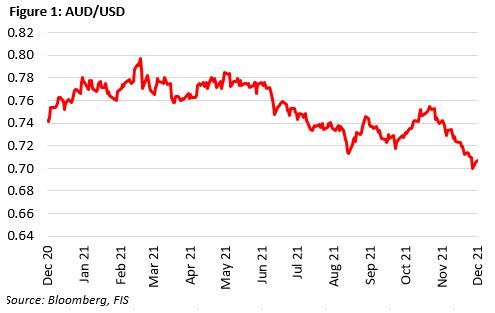

Elsewhere, an opportunity for investors holding USD bonds (or equities) lies in the fall of the AUD, down from close to 80 cents in February to 71 cents now. That's a 12% gain in AUD on bonds which shows fixed interest can do well despite low rates.

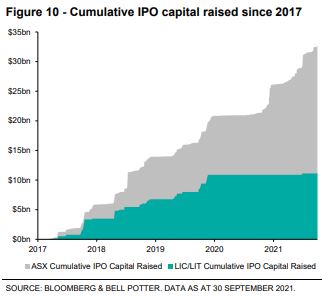

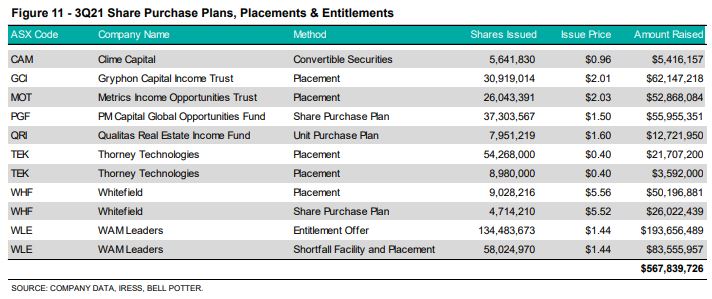

It is well documented that Listed Investment Companies (LICs) are now in the shadow of their listed rivals, ETFs. The first chart below shows that while ASX IPOs have experienced a spectacular year, LICs and LITs have done little. But under the radar, some managers have quietly gone about the business of adding to their funds in various ways, and the following table shows over half a billion issued in the September quarter. LICs live on!

Also this week ...

Low rates are forcing retirees to temper how much they can safely withdraw from their retirement savings, but Christine Benz offers some good news based on excellent returns of recent years. In fact, specifically in Australia, those who own their own house never totally run out of money. The age pension and benefits for a couple are worth almost $40,000 a year and while nothing to aspire to, many homeowner pensioners cope well. It's a different outcome for renters.

Simon Brown manages a small cap portfolio and sees opportunities in sectors less-researched than the big end of town. Here are three companies he likes, especially the quality of management.

Scientists have produced amazing results during COVID, and Laura Nelson Carney says it has cleared the way for innovations in biotech to continue as money floods into research. She identified five exciting trends which will create some great companies.

What has gold been doing, and why has it not been stronger with inflation rising, especially given its reputation of preserving purchasing power? Jordan Eliseo looks at the links.

Firstlinks has discussed in detail the potential to access home equity in retirement. Joshua Funder reports on an expert summit which argued for a united look at the three pillars of retirement - the age pension, compulsory super and voluntary savings (which includes the family home).

After suffering severe reputational damage during Kenneth Hayne's Financial Services Royal Commission, the banks have come through the pandemic relatively well. Brad Dunn admires the rebuilding of capital since the GFC, and he is confident that even with investments down the capital structure such as hybrids, banks are well-positioned to meet their obligations.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Rebalancing your portfolio is one of those beneficial habits that’s easy to let slide. But year-end is an ideal time to check how your portfolio is tracking against your target asset allocation, says Tim Murphy. And Brett Cairns' sudden resignation from Magellan is expected to have a limited impact on the investment manager's earnings outlook, writes Lewis Jackson.

This week's White Paper from Vanguard explores how bonds act as shock absorbers for portfolios when equity markets are under stress, which is fitting given the adjustment described in my article this week.

The Comment of the Week comes from Jack, who suggests how the family home may be included in the age pension asset test.

"What is suggested here is not a death duty. A death duty is a tax on all wealth not just housing. What is suggested here is a “claw-back” from the estate of some or all of the age pension paid during a person’s lifetime, precisely because the family home is exempt from the pension assets test and therefore recipients get a higher pension than they would otherwise. This payment by the next generation would be easy to avoid. Either downsize and release capital or borrow against the equity in the house. Either way you replace the age pension with your own income stream. If there was no pension received, there would be no “claw-back”. But it would mean that if you had the means, you would not rely on the welfare payment of the age pension."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website