Smaller companies often have great potential and can offer investors bigger opportunities than those found in the broader market. Even over the past 12 months, as share markets have bounced back, small companies have outperformed. The S&P/ASX Small Ordinaries Accumulation Index returned 31% for the 12 months to the end of October 2021, compared with a return of 28% by the S&P/ASX 200 Accumulation Index.

Less-researched opportunities

The ability to generate this type of outperformance is driven by the information arbitrage opportunities available to smaller company investors. While large cap stocks are researched intensively, the small companies end is highly differentiated across a broad range of sectors and business models. These can often be unique and generally it is an area that is not particularly well researched across the market. This provides opportunity for the small-cap investor to sift through and find undiscovered gems.

However investing successfully in small companies requires a lot of leg work to understand industries, companies, and their respective management teams. Even in the initial stages of the investment process, an in-person visit is important to get a feel for a company and understand what drives it. There is also a need for rigour and discipline when processing company information.

ESG as a factor

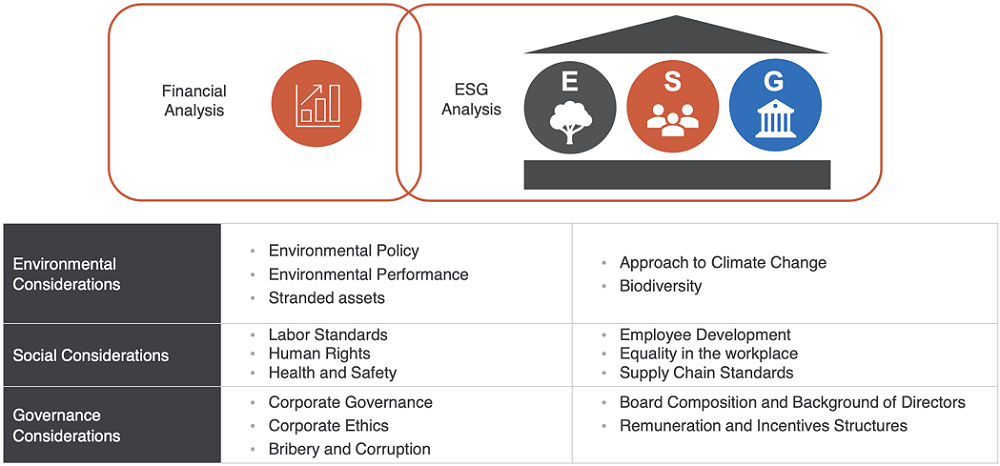

Any factor that may have a material impact on a company’s performance and the industry in which it operates should be looked at when considering investing in a company.

ESG involves assessing a company’s approach to issues such as climate change, employee development, community impact, supply chain standards, board remuneration and diversity. Ultimately, a company is unlikely to find lasting success unless it has a strong social license and employs sustainable practices.

Three small companies set for big things

Creative thinking

A great example of the rewards that can accrue from good research is location sharing and driving safety app Life360 Inc. Although based in San Francisco, Life360 founders Chris Hull and Alex Haro decided to look to the ASX to raise ‘clean’ funds that wouldn’t have as many strings attached as in a US listing.

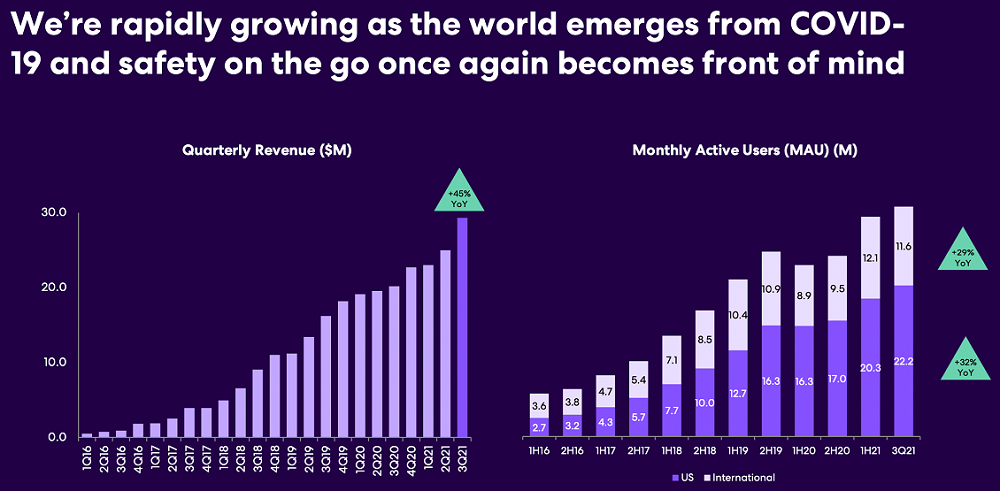

The company listed on the ASX in May 2019 but COVID-19 hit the share price hard. With nobody leaving the home, there was no need for parents to be worried about the safety of their family. The app was never particularly popular amongst the teenage children tracked for their whereabouts, although Life360 did introduce some clever social media marketing campaigns to combat this issue.

But we could see value in the company if they could make the transition to a paid membership strategy. Despite the impact of lockdowns, we could see early signs of success. Management was also looking to make strategic acquisitions to increase market penetration. Earlier this year, the company bought jiobit, a wearable tracker for pets and young children.

With the majority of Life360’s users in the US, impressive monthly user and subscriber growth is driving results. Management has capitalised on the economic reopening and the back-to-school period with marketing campaigns that are improving customer conversion rates.

More recently, Life360 announced a binding agreement to acquire Tile Inc and it is conducting an equity raising to raise $280 million. Tile Inc sells hardware devices that can be attached to items, such as wallets, keys etc, to help users find them. With Tile, Life360 can offer the whole suite of location services from ‘things’ to family and pets. We are heavily overweight Life360 in our portfolio.

Building momentum

While it has been around for a lot longer than Life360, Australian gas producer Senex Energy has been bucking sector trends in recent months after engaging with Korean steelmaker Posco International regarding a takeover proposal.

Senex management granted due diligence to Posco in an attempt to elicit a higher bid than the initial offer price of $4 per share. They also made public that the initial offer, and subsequent second and third offers, fell short of appropriate valuation levels. Senex holds a unique set of assets that should deliver attractive long-term cashflows and the board was right to wait for a fourth, and potentially final offer, of $4.60 per share.

Factors such as corporate culture and ESG can reveal a lot about how a company’s executives and management might act when they receive an approach like that of Posco. Senex’s calm but calculated response vindicated our view that Senex would eventually develop utility-like characteristics as energy users embraced gas as a ‘transition fuel’ in moving to net zero.

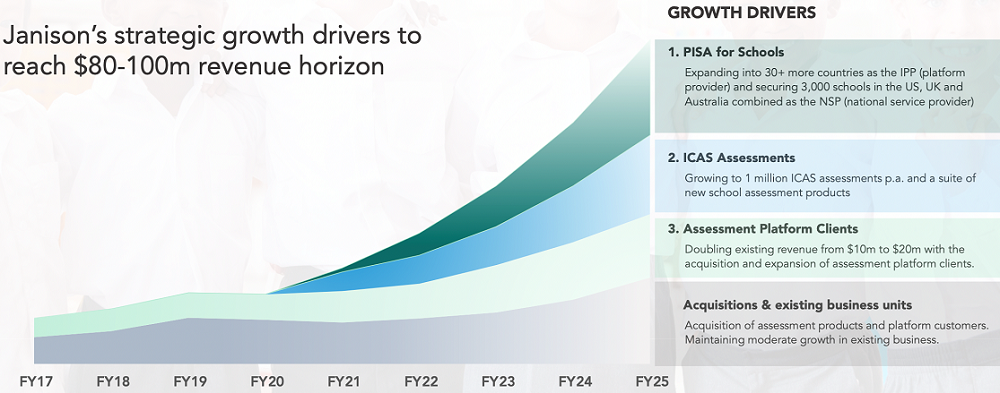

Edtech opportunity

We’ve also recently initiated a position in online assessment and digital learning business Janison Education. COVID-19 provided it with the opportunity to shine. The Edtech business pivoted its model from bespoke online environments to a more standardised platform, better enabling it to scale. The opportunity to digitise and rollout existing programmes while also making targeted acquisitions showed us a business trading at a material discount to emerging SaaS peers.

Small caps might require more work than large cap stocks but they are often worth it. After all, all large companies were small once, and there can be clear benefits of investing early.

Simon Brown is a Portfolio Manager at Tribeca Investment Partners. Tribeca is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. Tribeca may have holdings in the companies mentioned in this article. This information is general in nature and has been prepared without taking account of the objectives, financial situation or needs of individuals.

For more articles and papers from GSFM and partners, click here.