The Weekend Edition includes a market update plus Morningstar adds links to popular stock articles from the week.

Weekend market update

From AAP Netdesk: On Friday, shares had their biggest loss in more than a week as the US technology crash spilled over into the Australian market. The ASX lost more than 1% and technology shares fell by almost 4%. The biggest technology company on the ASX, Afterpay, fell 9.2% to $69.03. Online furniture trader Temple and Webster plunged by about the same measure to $8.98.

Elsewhere, global investment manager Pendal revealed a disappointing December quarter. UK institutional clients were responsible for outflows of $5.1 billion, mostly in Pendal's global opportunities strategy. Pendal was down 15.8% to $5.00.

Almost all ASX categories were down. There were losses of 1% or more for shares in healthcare, financials, consumer categories and energy. Utilities were the only shares to prosper and rose 0.4%. The benchmark S&P/ASX200 index closed down 80 points, or 1.1% to 7393.9 points. For the week, the market lost 0.8%.

From Shane Oliver, AMP Capital: Global share markets remained under pressure over the past week from concerns about rising US inflation and faster US interest rate hikes. Omicron-related disruptions and tensions with Russia over Ukraine are not helping although markets don’t appear to be too concerned about Omicron. For the week US shares fell 0.3%, Eurozone shares fell 0.9%, Japanese shares lost 1.2% and Chinese shares fell 2%. Oil, metal, gold and iron ore prices rose as did the $A, as the $US fell. The relative strength of commodity prices, resources stocks and the $A are a positive sign from a cyclical perspective.

US inflation rose to near a 40-year high in December of 7% and putting more pressure on the Fed. The Fed already took a hawkish turn late last year and this has been reinforced by recent comments from various Fed officials including Chair Powell. We expect inflation to ease a bit this year as production increases and spending rotates from goods back to services but the Omicron wave and associated further supply setbacks risks delaying this. And with a tight labour market and accelerating wages growth in the US there is a rising risk that high inflation will become entrenched.

As a result, we now see the Fed raising rates in March, hiking four or five times this year and starting quantitative tightening in the second half. However, while this will contribute to a more volatile ride for US and hence global shares its unlikely to be enough to end the economic recovery and cyclical bull market as monetary policy will still be relatively easy and other major central banks including the RBA will lag the US, with China’s central bank actually easing monetary policy this year.

On Friday in the US, the S&P500 was flat and NASDAQ recovered 0.6%.

***

Every person is predisposed towards some combination of gullible and sceptical across many aspects of their lives. We might be sceptical about information we read on social media but gullible in accepting opinions in a favourite newspaper. In investing, one person may think 'it's too good to be true' while another sees a great opportunity. Scientist and author, Carl Sagan, wrote in an essay called 'The Burden of Skepticism' (yes, English versus US spelling):

"It seems to me what is called for is an exquisite balance between two conflicting needs: the most skeptical scrutiny of all hypotheses that are served up to us and at the same time a great openness to new ideas. If you are only skeptical, then no new ideas make it through to you. You never learn anything new. You become a crotchety old person convinced that nonsense is ruling the world. (There is, of course, much data to support you.)

On the other hand, if you are open to the point of gullibility and have not an ounce of skeptical sense in you, then you cannot distinguish useful ideas from the worthless ones. If all ideas have equal validity then you are lost, because then, it seems to me, no ideas have any validity at all."

My summer reading about the psychology of persuasion and influence showed how clever sales techniques take advantage of our gullibility. We might be surprised that the techniques work but we can't resist them. This week, supported by comments from leading journalists Ross Gittins and Geoff Kitney that we need "traditional hard-bitten, no-bullshit Australian scepticism", we explore our gullibility and hope it's not quite as bad as in the US. We can't even agree how to spell 'sceptical'!

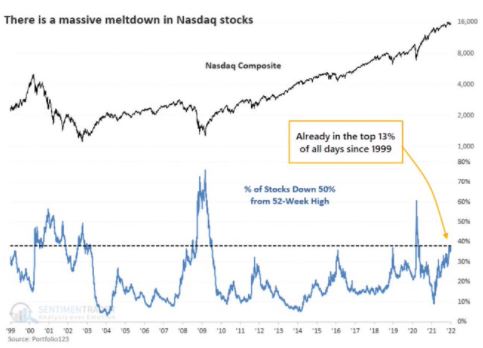

Which is a good segue to what's happening in the sell off of technology stocks, where many dreams of unlimited growth backed by a good story are souring (for the moment, at least). Disguised by the success of a few big stocks in the US, according to Bloomberg, 40% of stocks on the NASDAQ are down 50%+ from their 52-week high, as shown below.

The most spectacular rise and fall in tech funds is Cathie Wood's ARK Innovation ETF. It generated inflows of over US$15 billion and in 2020, gained a stellar 150% by investing in disruptors such as Tesla, Zoom and Roku. But senior executives in the companies held by the fund in the six months to 31 December 2021 sold US$3.5 billion of stocks (excluding Elon Musk selling US$10.7 billion) and bought only US$11 million. That's not only a lot of wealthy executives riding the tech boom but suggests they have little conviction in the future of their own share prices. The ARK fund has lost 50% of its value since its peak in February 2021.

These tech losses are not quite as bad in Australia but there's plenty of blood on the streets. According to the Morningstar Australia Tech Index, eight of the 22 stocks in the index are more than 40% off their 52-week high, with Afterpay over 50% off its high.

(As a reminder not to make too much of short-term movements, the NASDAQ tech index was off 2.7% at one stage on Monday but ended the day flat, then rose 1.4% Tuesday. That 4.1% turnaround represents billions of dollars and turned talk of a 'sell off' into 'buy the dip'. Only history will tell the full story).

We deep dive into the Morningstar database to show market performance to the end of 2021 across a wide range of assets and time periods, including the risk and drawdowns tolerated to generate those returns. Which asset class wins over the long term?

One part of Australia's culture that Americans have not supplanted is the love of cricket, and this summer has been dominated by the Ashes. I must admit, I find watching the live betting as entertaining as the cricket itself. One online bookie, Betfair, matched $75 million of bets on this single category of bet - the outcome of the fourth Ashes test - and it's remarkable how volatile the prices are. For example, at one stage on day 5, as Ben Stokes and Johnny Bairstow delivered a rearguard recovery, the price for an Australian victory rose to over $10 (for a $1 investment), as shown below. The instant Stokes was dismissed, the market fell to around $2. If this looks like an inefficient market, there's lots of money to be made backing your judgement. Betfair also translates the odds into an implied % chance of victory, with the 'x' showing after the Stokes dismissal.

A great diversity of subjects as we motor into 2022 ...

Brendan Ryan presents his Retiree Checklist of 25 items anyone in or heading for retirement should know. With a bit of effort contacting service providers, significant savings are available for eligible people.

And judging by the global research conducted by MFS International and reported on by Marian Poirier, Australians could do with a little help because they feel less confident about retirement than peers in other countries.

Then Di Johnson attacks the problem of whether it is better to pay off a mortgage or put more into super. Ultimately, you should be guided by your long-term plans and expected relative returns, but at least in the short term, you know how much you save in interest costs by paying off your mortgage, and you don't know your future super returns.

Warren Buffett's mate, Charlie Munger, reached the age of 98 at the turn of the year, and he is one of the few investors who does not care if he offends anyone with his forthright views. He's not the type of person anyone wants to confront. We have extracted some classic Mungerisms from a recent compilation video.

And Rob Prugue takes a swipe at the preoccupation of investors, and now regulators with their 'heat maps', on fund manager past performance, saying it's likely to be a poor guide to investment timing given the potential for mean reversion.

One thing we know for sure about the coming months of 2022 is that every government decision will be made with one eye on the election, now likely in May. Later, budget repair and addressing $1.2 trillion of debt will come into focus. An example is the third stage of the planned cuts to personal tax rates due from 2024-25. They will only benefit a minority of wealthier taxpayers with an income over $120,000, many of which have experienced a wonderful rise in their wealth in 2021, but the tax cuts come with an annual cost of $17 billion. Surely, the current COVID crisis has confirmed we need to invest more in essential services such as the health system.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Australia's largest miner was briefly the fourth most-shorted stock on the ASX this week. Hedge funds are on the hunt for arbitrage opportunities ahead of BHP's proposed unification of its UK and Australian listings, writes Lewis Jackson. And Morningstar analysts share 11 stock ideas for 2022.

This week's White Paper from Martin Currie, part of the Franklin Templeton group, looks at the prospects in 2022 for equity markets. Spoiler alert: they are optimistic overall.

Many thanks for the emails, comments and tweets to mark the start of our 10th year, and as these say, it's hard to believe it's been a decade.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website