The Weekend Edition includes a market update plus highlights from Morningstar.

With some share prices down 80% and funds off 30% from their peak, there are plenty of investment professionals looking for ways to explain performance. All fund managers have their marketing patter, much of it similar to others. They describe their unique process of whittling down the investable universe by applying magic potions, they show their genius when selecting stock winners in their portfolio (what, no losers?) and then present the performance numbers of the best fund in their stable.

Then comes the part that every manager, for some misguided reason, considers mandatory. "We have skin in the game" and "We are coinvested with you". In some cases, the earnest vow is even stronger, with statements such as these taken from pitch documents in the last week:

"It is never pleasant to experience market falls or underperformance. We and the rest of the investment staff have 100% of our investable wealth in our funds. To fellow investors we say: we feel your pain."

"I am frankly dumbfounded by the events of the past 6 months; it feels like the rules of investing I have applied successfully for the past twenty years have been thrown out the window. Nonetheless, with my entire investable asset base in the fund and a substantial portion of the asset base of most friends and family also invested alongside us, I will continue to work hard to turn around the poor performance of the past half year." (my bolding)

Is that what we want from our fund managers? I prefer them to lead a balanced life with good relationships with family and friends, and to wake up refreshed and ready for another day of calm and rational analysis. Not sweating because their net worth is buried in their fund, mum and dad have mortgaged their family home and friends avoid the elephant in the room.

How does this complete lack of diversification accord with Investing 101? What if they are a bond manager, shouldn't they hold some equities? Every financial planner advises clients to run a diversified portfolio based on their future goals, yet here are the genius fund managers telling everyone that 100% of their investable assets sit in one fund. Why is that smart or desirable?

How does the conversation go at home with the spouse when the one-and-only investment is down 30%?

"Darling, you know how we're saving for a bigger house because we just had our third child and the first two are already sharing a room? How you want a decent garden? I'm sorry, I put all the money in one fund and it's collapsed, and we no longer have enough deposit. Oh, and since it's my own fund, my salary and bonus will also be hit."

Every fund manager has a professional and personal interest in their fund doing well. It determines their remuneration, their career progress and maybe the value of their business. They don't need to bet their house. The argument that 'alignment of interest' needs the fund manager to invest all their money in the fund is overdone. There is already a full alignment if a manager is trusted with the retirement savings of an investor. The "we're in this together" is redundant. Why should an investor care if the manager shares the pain? Does anyone think, "Oh, that's fine, thank goodness you're losing money as well as me"? Is it supposed to show greater commitment? Working 16 hours a day instead of 12 will not produce better results. Better to spend an afternoon with the family.

And with this 'all my investable wealth" claim, nobody reveals how much of their total wealth is so-called investable and the definition. If like many (younger) Australians, most of the wealth is tied up in the Great Australian Dream, then maybe "investable assets" makes up 10% of their wealth.

Cut it out, fund managers, it's meaningless. We know you want to win. Who doesn't? You're giving me enough pain without sharing yours.

Which takes us to performance fees. Are they part of this alignment of interest argument or just another way to charge a fee? Love them or hate them, there is no market standard but they should be designed to be fair to investors. Check these features and decide if the fee on your fund is fair, and surprisingly, there may be a fee holiday coming up.

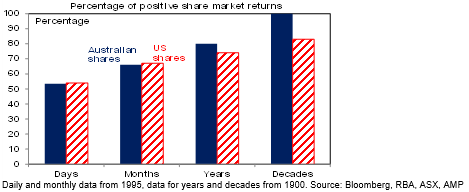

Among the many messages investors receive when markets fall is this useful reminder from Shane Oliver of AMP:

"If you look at the daily movements in the share market, they are down almost as much as they are up, with only just over 50% of days seeing positive gains. But if you only look monthly and allow for dividends, the historical experience tells us you will only get bad news around a third of the time. Looking only on a calendar year basis, data back to 1900 indicates the probability of a loss slides to just 20% in Australian shares and 26% for US shares. And if you go all the way out to once a decade, since 1900 positive returns have been seen 100% of the time for Australian shares and 82% for US shares."

Markets experiencing rapid rises and falls often trigger algorithmic, computerised responses and stop-loss orders, rather than a reflection of general market sentiment. For example, this week, City Index analyst Tony Sycamore said that 10,000 ASX200 futures contracts were sold close to the open of our trading day, possibly by an overseas hedge fund, quickly sending the market down. He said:

"About $1.75 billion worth of selling went through in a very short period of time. Typically that is representative of a get-me-out type order, I've seen it firsthand on trading desks. Just get the heck out, I can't take the pain anymore."

Other investors may panic and join the sale, especially when analysts start to justify the fall with all the usual excuses, and a bearish tone can take hold. Although there is a fear of catching a falling knife, it's at times of drawdowns that subsequent rewards are the best, but who knows where the bottom is.

And so to the election.

Today, let's visit a factory and wear a high viz vest and operate the equipment. Then a trip to my old school to announce funding for a swimming pool. A marginal electorate needs an updated road. How about $4.5 million to build a new distillery for a profitable, listed company? Hold a media conference where journalists scream gotcha quiz questions and concoct headlines of outrage.

The second leader debate was a feisty yelling match, and Nine's graphics and inadequate technology compromised the polling system:

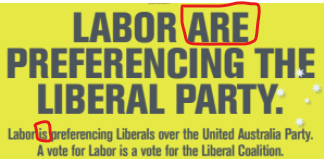

It would be easy to dismiss the United Australia Party as a distraction, with their policies to cap home loan rates at 3% for five years (and watch the banks withdraw from home loans) and bringing back $1 trillion of super from overseas (and deny access to 98% of companies). But money buys influence and votes, and the party has dealt itself into the outcome by directing preferences to the Liberal Party. Clive Palmer told The Saturday Paper:

“I write all the ads personally. Because I originally started in campaigning with the National Party years ago, I ended up becoming [campaign] director and state spokesman, so it’s easier for me to write the ads than it is for me to instruct someone to do it."

Clive, among the $50 million you're spending on ads, find a few thousand dollars for an editor. The grammar mistakes and style inconsistencies in your ads are doing my head in.

From AAP Netdesk: Australia's share market just suffered its fourth straight losing week, with tech stocks collectively erasing all their gains from the past two years. It's a selloff that's played out even more severely in other markets around the world - the NASDAQ is down 27 per cent so far this year - and some market watchers say there could be much more pain ahead.

"Essentially, the issue for markets is that all of the safeguards, all of the potential white knights for markets, have disappeared," said Michael McCarthy, chief strategy officer for Tiger Brokers Australia. "High inflation means that central banks are no longer in a position to support markets. The COVID expenditure and the expansion of government balance sheets means that governments are in no position to support markets."

Mr McCarthy said as central banks pull back on stimulus measures, there could be a major readjustment. "As a share market, we've been through the greatest boom ever recorded in modern times," Mr McCarthy said. "Unfortunately, what that could mean is that we're about to see the greatest bear market."

On Friday, Australian shares have clawed back Thursday's losses with across the board gains, closing out a volatile week with the local bourse's best single-day performance in 15 weeks. The benchmark S&P/ASX200 index finished Friday up 134.1 points, or 1.9 per cent, to 7,075.1. The broader All Ordinaries gained 141.1 points, or 1.97 per cent, to 7,307.7. The ASX200 still finished the week down 1.8 per cent, in its fourth straight of declines, and hit a three-month low on Thursday.

All 11 of the ASX's official sectors gained ground on Friday, with tech rising by 7.0 per cent after Thursday's 8.7 per cent selloff -- the sector's worst day since March 2020. Square - the worst performer on Thursday - was the best performer on Friday, rising , up 15 per cent to $114.88. Jack Dorsey's company is still down 19.6 per cent on the week, however. Xero rose 9.4 per cent, Wisetech Global gained 7.3 per cent and Altium rose 7.1 per cent.

The heavyweight mining sector was up 1.6 per cent, not quite recovering from Thursday's losses. BHP advanced 2.0 per cent to $45.84, Rio Tinto climbed 2.1 per cent to $105.59 and Fortescue Metals was up 2.0 per cent to $19.39. Goldminers Newcrest and Evolution both were down about half a per cent while Northern Star rose 0.4 per cent.

The big four banks lagged the rest of the financial sector, which was up 1.4 per cent as Macquire climbed 4.5 per cent. NAB rose 1.0 per cent to $31.14 while Westpac and ANZ both rose by 0.9 per cent, to $24 and $25.39, respectively. CBA was up 0.1 per cent to $102.28.

From Shane Oliver, AMP Capital: Share markets had another rough week with ongoing worries about monetary tightening to combat high inflation driving a possible recession, before a bounce from oversold levels at the end of the week. This left US shares down 2.4% for the week, Eurozone shares up 1.4%, Japanese shares down 2.1%, Chinese shares up 2% and Australian shares down 1.8%. Bond yields pulled back from their highs and metal and iron ore prices fell but oil prices rose. Worries about global growth also dragged the $A down as the $US rose.

Shares could have a further near-term bounce from oversold levels. But risks around inflation, monetary tightening, the war in Ukraine and Chinese growth remain high and still point to more downside in share markets before they bottom. The risks around inflation and rising bond yields are the main threat at present – but Chinese Covid lockdowns and the war in Ukraine are adding to supply disruptions.

US inflation came in stronger than expected again for April. While annual inflation fell slightly (from 8.5%yoy to 8.3% for the CPI and from 6.5%yoy to 6.2% for core inflation) as higher monthly inflation readings a year ago dropped out it was still higher than expected. While US inflation is still too high for comfort and may remain so for some months signs of peaking remain evident in our Pipeline Inflation Indicator reflecting lower freight costs and a slowing in commodity prices including oil and gas. This could enable central banks to slow the pace of tightening later this year – in time to avoid recession.

Graham Hand

In this week's articles ...

Ned Bell has been managing global equity portfolios for about 20 years, but he sees a generational step change underway. It feels like a moment in investing history when the rules are rewritten, with rising rates, an inflation spiral, record debts, wars and geopolitical conflicts. Is Ned correct when he says it's the best time in his career for active stock pickers?

In Meg Heffron's latest monthly column, she continues her deep dive into future-proofing your self-managed super fund, this time looking at the importance of preparing a power of attorney.

May's bank reporting season has wrapped up, and Hugh Dive delivers his take on the sector, awarding his gold stars to the top performers.

It is widely accepted that equal representation is the right thing to do. Dr Joanna Nash and Dr Ron Guido dig through the data on 2,500 large cap companies in 30 countries and find that more gender diverse leadership teams deliver better performance outcomes. We also feature Realindex's research report "Beyond lip service: tracking the impact of the gender diversity gap" as our white paper this week.

Andrew Canobi argues that the probability of central banks gently landing the plane looks to be shrinking by the day with global financialisation facing its biggest hurdle since the GFC. It is unlikely central banks will push rates up as far as markets are pricing in.

The pandemic has had profound implications for the way we use real estate. Steven Bennett and Sasanka Liyanage go beyond the headlines and explore the future of the office sector.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Things could finally be looking up for Magellan as the embattled fund manager reports steadying outflows across its funds and short-term outperformance at its flagship strategy, writes Lewis Jackson. And is it time to recession-proof your portfolio? Christine Benz joins Susan Dziubinski to discuss the 'R word' and how to protect your portfolio.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website